UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | | |

Filed by the Registrant x☒ |

Filed by a Party other than the Registrant o☐ |

| Check the appropriate box: |

o☐ | Preliminary Proxy Statement |

o☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x☒ | Definitive Proxy Statement |

o☐ | Definitive Additional Materials |

o☐ | Soliciting Material under §240.14a-12 |

| | | | | | | | |

| Alexandria Real Estate Equities, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box)all boxes that apply): |

x☒ | No fee required. |

o☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o | Fee paid previously with preliminary materials. |

o☐ | Check box if any part of the fee is offset as providedFee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 0-11(a)(2)Rules 14a-6(i)1 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed:0-11 |

April 18, 20223, 2024

Dear Stockholder:

You are cordially invited to attend the 20222024 Annual Meeting of Stockholders of Alexandria Real Estate Equities, Inc., a Maryland corporation (the “Company”“Company,” ”Alexandria,” “our,” “we,” and “us”), to be held on Tuesday, May 17, 2022,14, 2024, at the Alexandria Center® for Life Science, 450 E. 29th Street, New York, NY 10016, at 11:00 a.m. EasternPacific Time, at 26 North Euclid Avenue, Pasadena, CA 91101 (the “2022“2024 Annual Meeting”).

At the 20222024 Annual Meeting, you will be asked to electconsider and vote upon: the election of eight directors; vote upon the amendment and restatement of the Company’s Amended and Restated 1997 Stock Award and Incentive Plan (the “1997(as proposed to be amended and restated, the “Amended 1997 Incentive Plan”); vote upon,a resolution to approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers; vote to approve an amendment of our charter to increase the number of shares of common stock that we are authorized to issue from 200,000,000 to 400,000,000 shares; and vote upon the ratification of the appointment by the Audit Committee of the Board of Directors of the Company (the “Board”) of Ernst & Young LLP as our independent registered public accountants for ourthe fiscal year ending December 31, 2022.2024. The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement (the “Proxy Statement”) describe these matters. We urge you to read this information carefully.

The Board unanimously believes that the election of its nominees as directors; approval of the amendment and restatement of theAmended 1997 Incentive Plan; approval, on a non-binding, advisory basis, of the compensation of the Company’s named executive officers; amendment of our charter to increase the number of shares of common stock that we are authorized to issue from 200,000,000 to 400,000,000 shares; and ratification of the appointment of our independent registered public accountants are in the best interests of the Company and accordingly recommends a vote FOR the election of all the nominees as directors; FOR the approval of the amendment and restatement of theAmended 1997 Incentive Plan; FOR the approval, on a non-binding, advisory basis, of the compensation of the Company’s named executive officers; FOR the amendment of our charter to increase the number of shares of common stock that we are authorized to issue from 200,000,000 to 400,000,000 shares; and FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accountants.

In addition to the formal business to be transacted at the meeting, management will report on the progress of our business and respond to comments and questions of general interest to stockholders. You will find a summary of some of the key performance indicators and more detailed information in the Proxy Statement.

We sincerely hope that you will be able to attend and participate in the meeting. Whether or not you plan to attend the meeting, it is important that your shares be represented and voted. You may authorize a proxy to vote your shares by completing the accompanying proxy card or voting instruction form or by giving your proxy authorization via telephone or the Internet in accordance with the instructions on the accompanying proxy card or voting instruction form that you should receive from the bank, broker or other nominee that is the record holder for your shares.

BY COMPLETING AND RETURNING THE ACCOMPANYING PROXY CARD OR VOTING INSTRUCTION FORM OR BY AUTHORIZING A PROXY VIA TELEPHONE OR THE INTERNET, YOU AUTHORIZE THE PROXY HOLDERS TO REPRESENT YOU AT THE 2024 ANNUAL MEETING OF STOCKHOLDERS AND VOTE YOUR SHARES ACCORDING TO YOUR INSTRUCTIONS. SUBMITTING YOUR PROXY NOW WILL NOT PREVENT YOU FROM VOTING IN PERSON AT THE 20222024 ANNUAL MEETING BUT WILL ENSURE THAT YOUR VOTE IS COUNTED IF YOUR PLANS CHANGE AND YOU ARE UNABLE TO ATTEND.

| | |

| Sincerely, |

|

| Joel S. Marcus |

| Executive Chairman and Founder |

| | | | | | | | |

20222024 Proxy Statement

| i | |

| | | | | | | | |

20222024 Proxy Statement

| ii | |

(1)Source: YCharts. Based on aggregate market capitalization for the life science industry, encompassing biotechnology companies, drug manufacturers, and diagnostics and research companies, as of November 10, 2023.

| | | | | | | | |

20222024 Proxy Statement

| iii | |

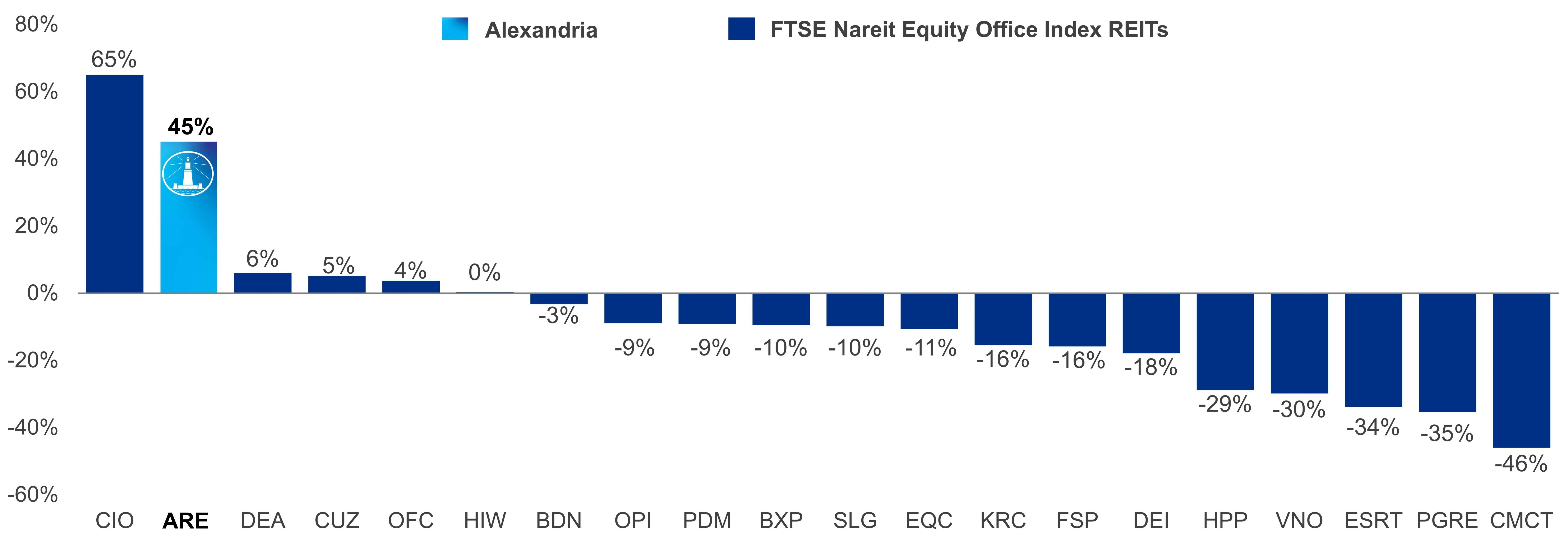

(1)Represents total equity capitalization for all publicly traded U.S. REITs, from Bloomberg Professional Services as of December 31, 2021. Alexandria’s total equity capitalization is calculated using shares outstanding and the closing stock price as of December 31, 2021.

| | | | | | | | |

20222024 Proxy Statement

| iv | |

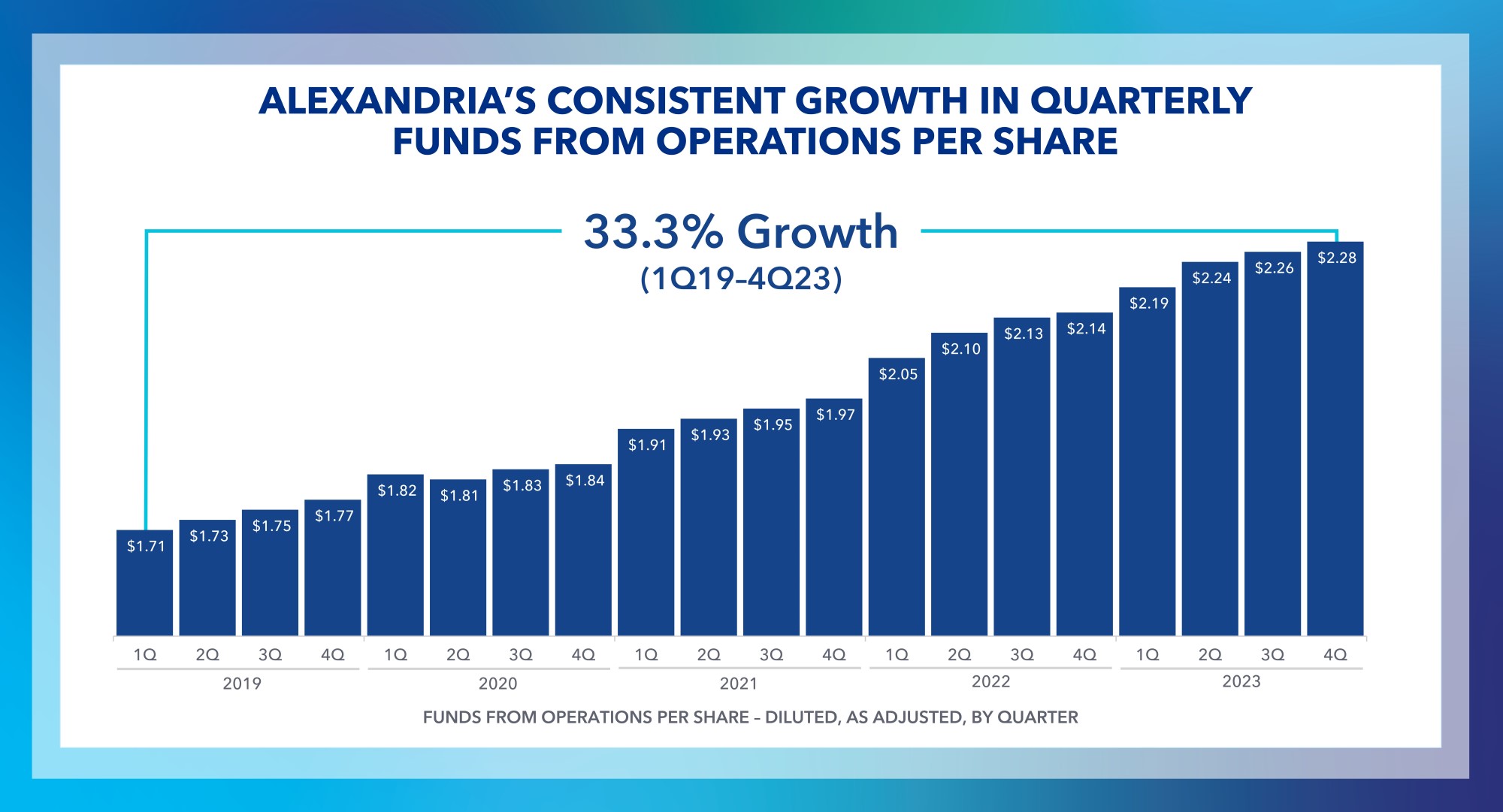

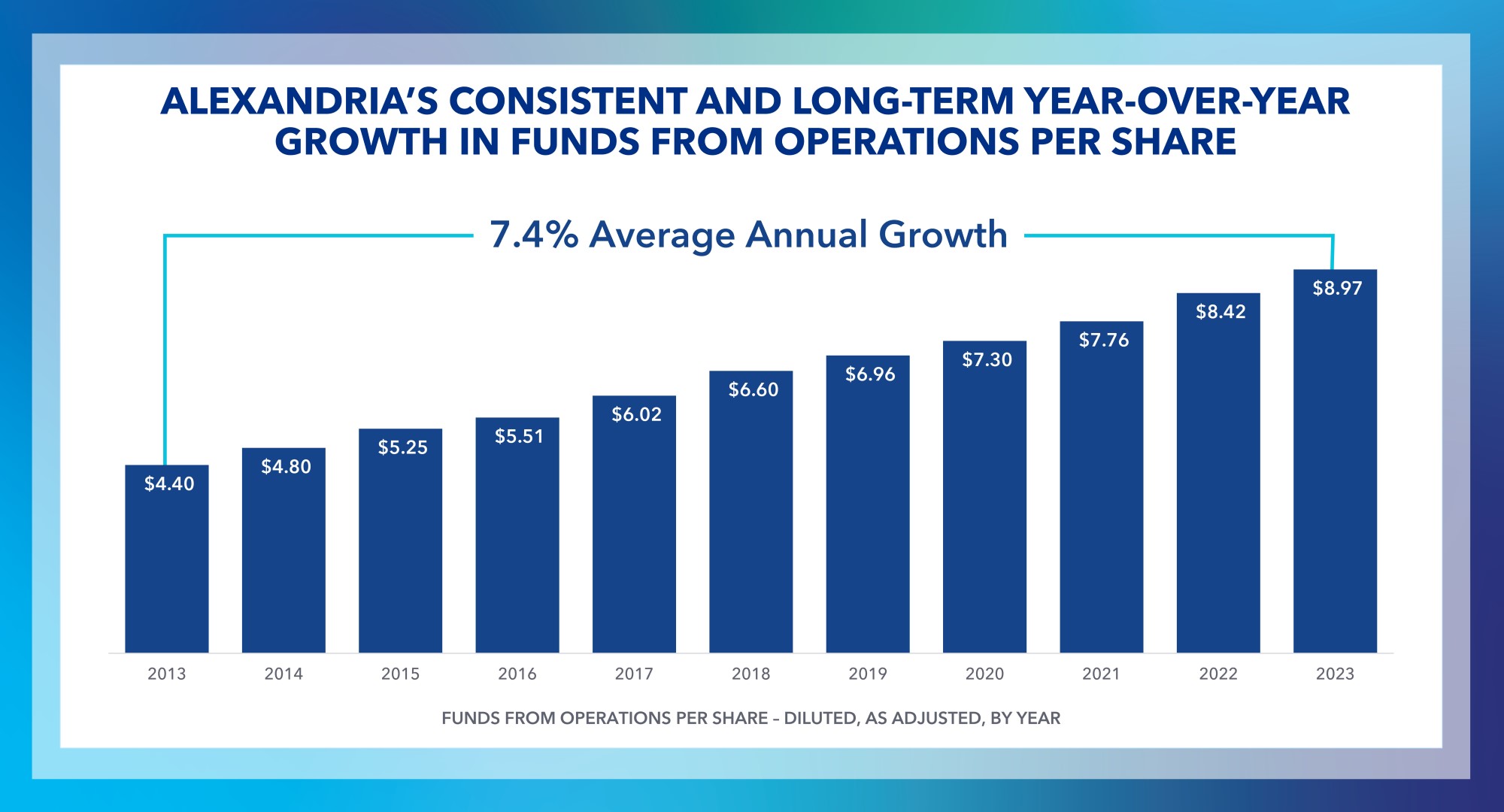

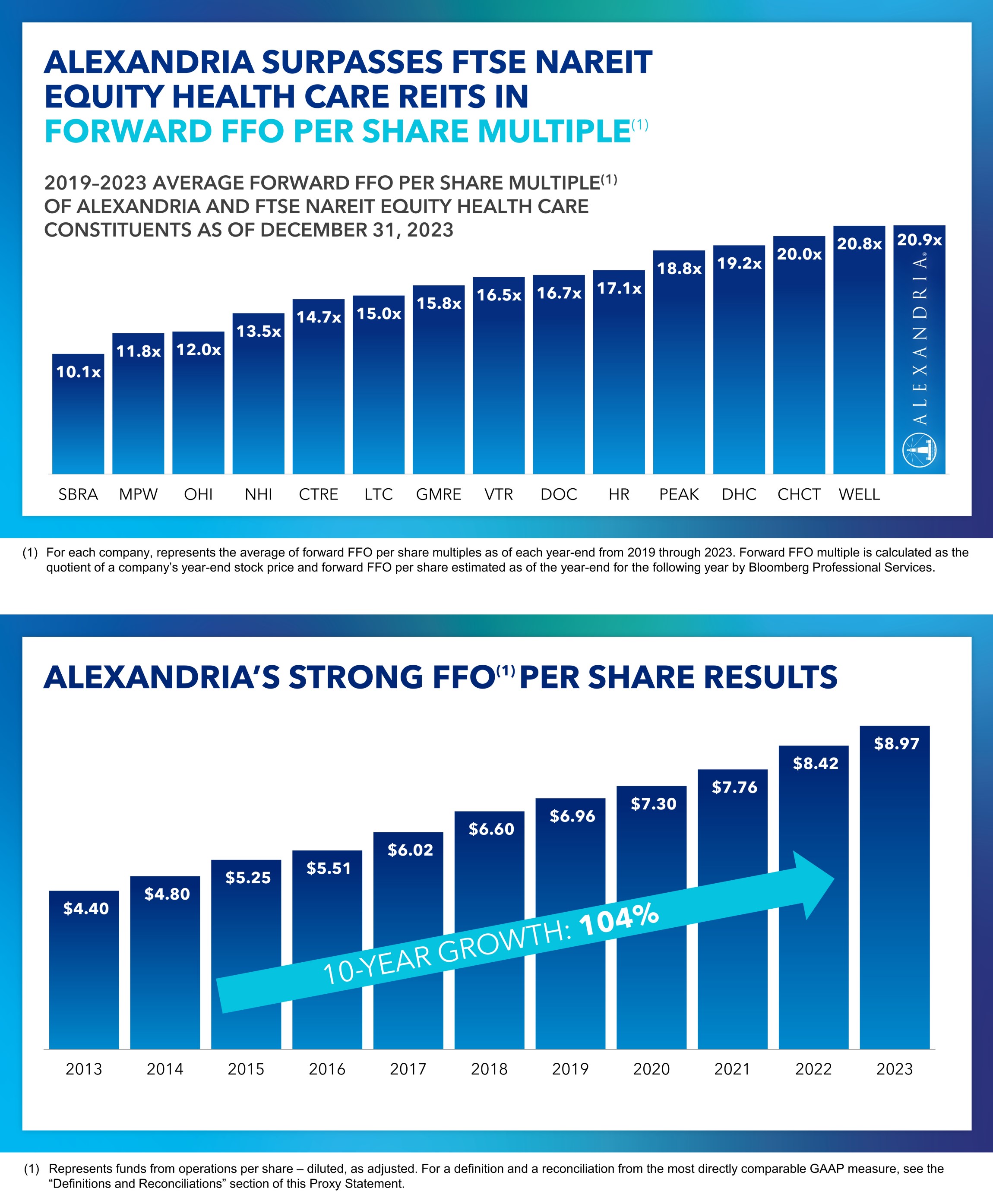

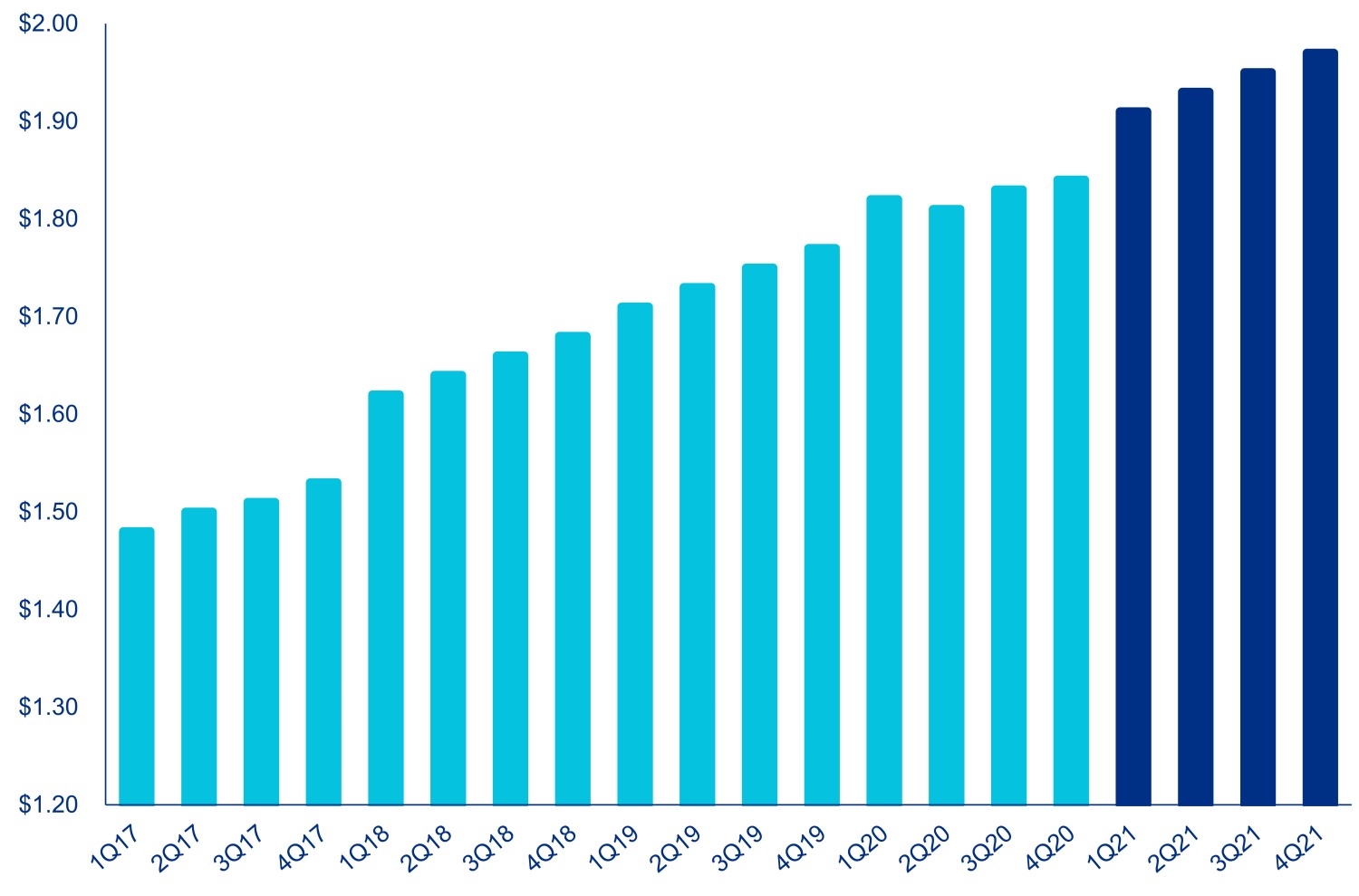

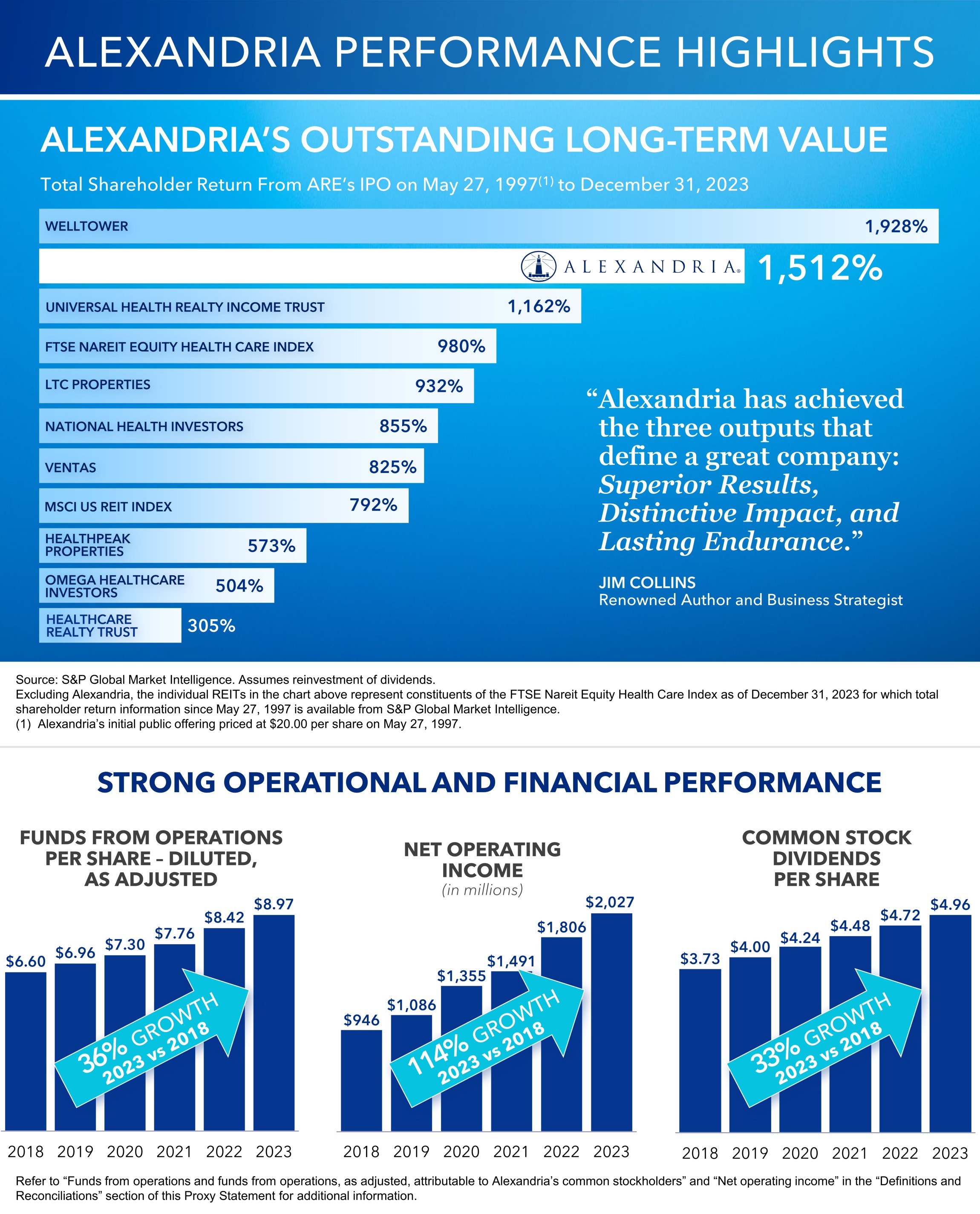

Refer to “Funds from operations and funds from operations, as adjusted, attributable to Alexandria’s common stockholders” in the “Definitions and Reconciliations” section of this Proxy Statement for additional information.

| | | | | | | | |

20222024 Proxy Statement

| v | |

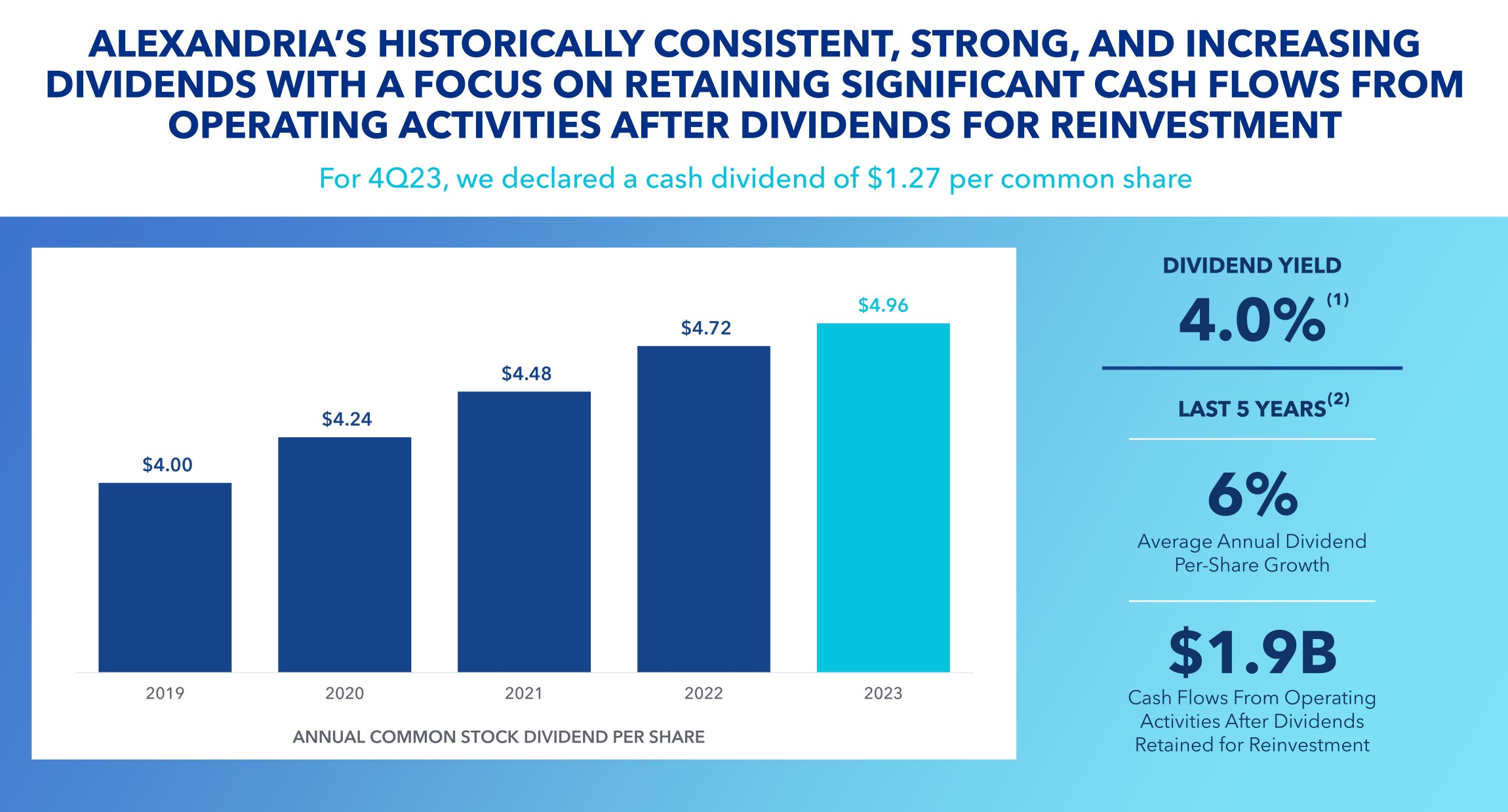

(1)Dividend yield is calculated as the dividend declared for the three months ended December 31, 2023 of $1.27 per common share, annualized, divided by the closing price of our common stock on December 31, 2023 of $126.77.

(2)Represents the years ended December 31, 2019 through 2023.

| | | | | | | | |

20222024 Proxy Statement

| vi | |

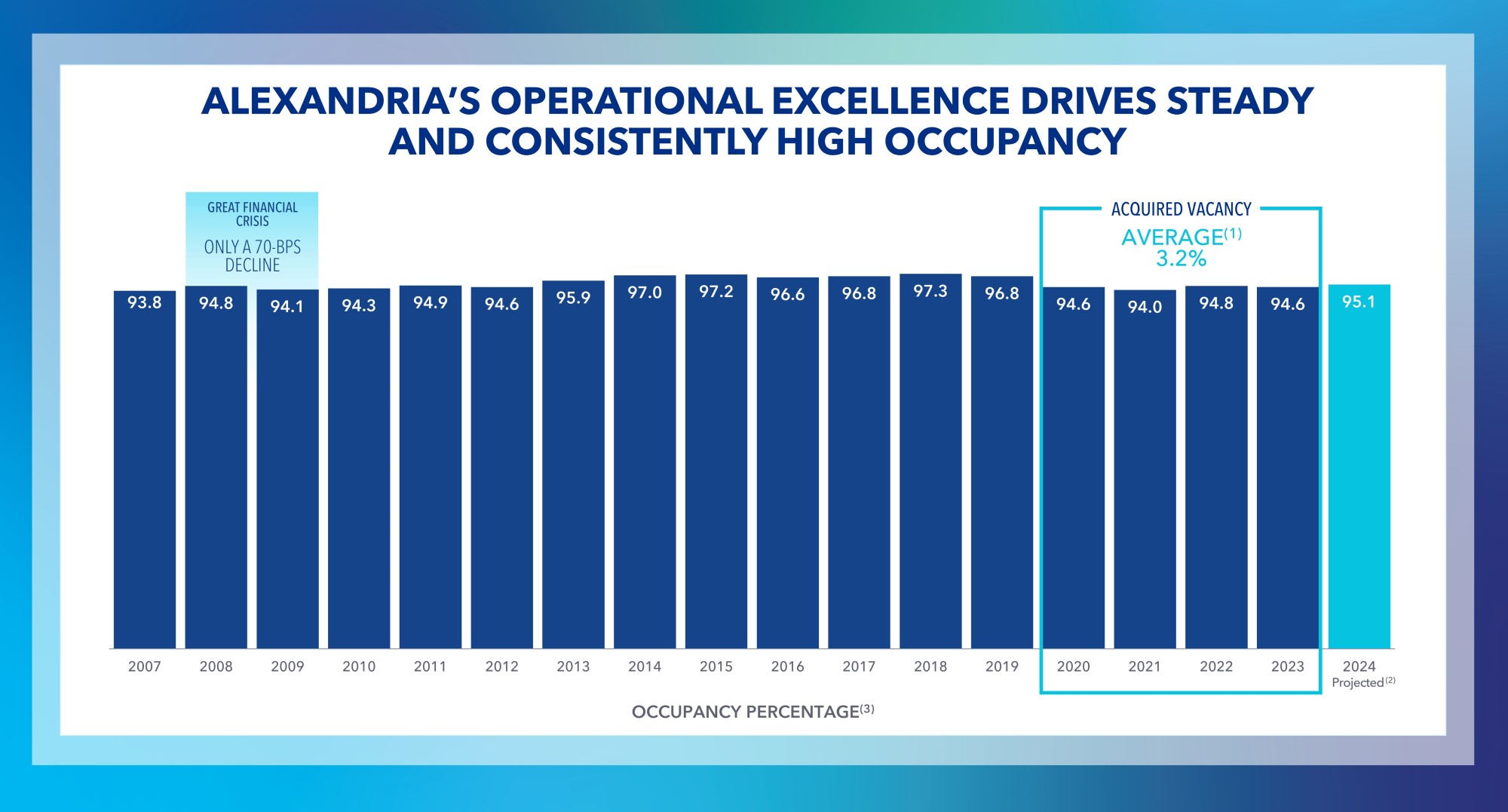

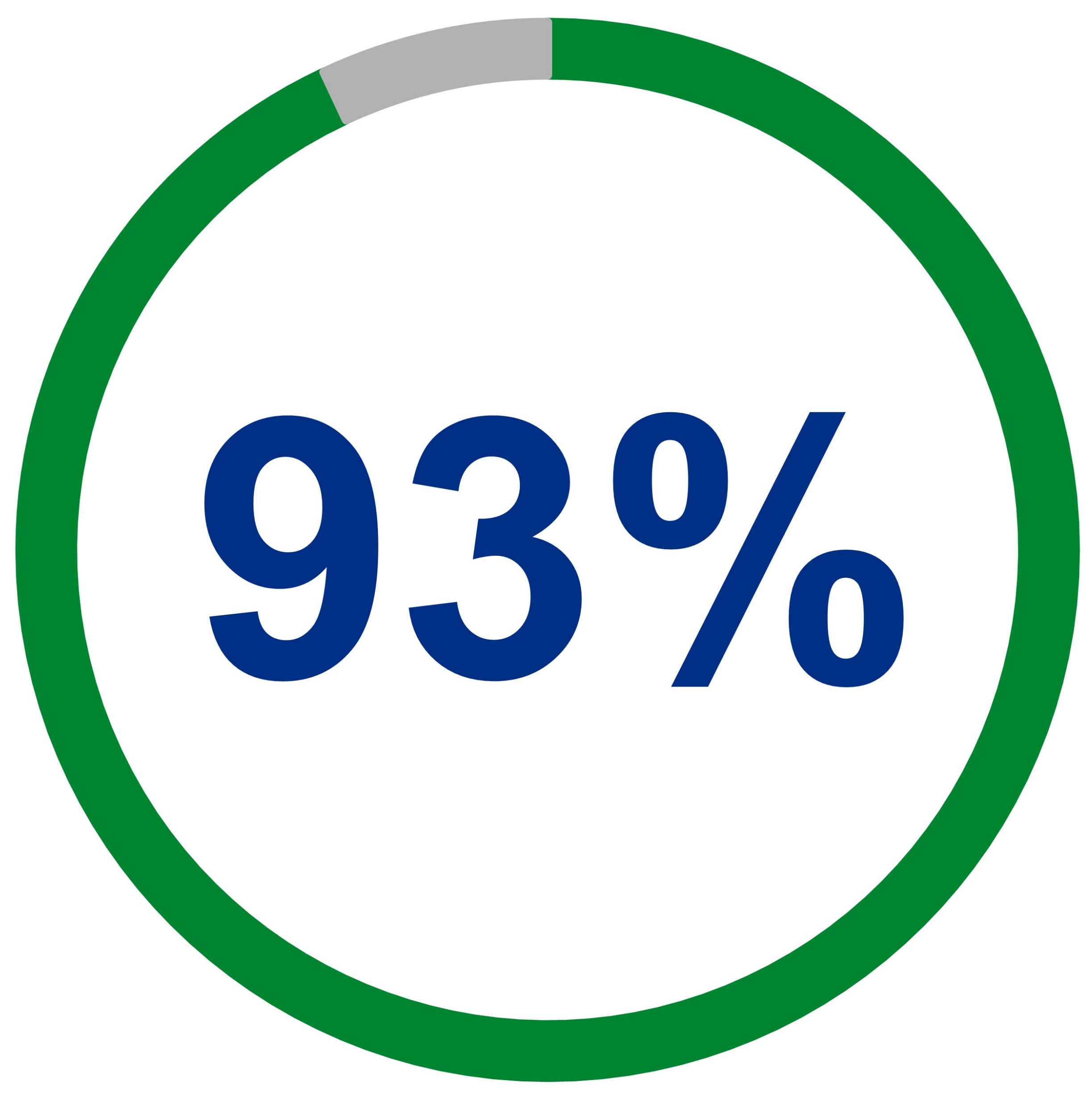

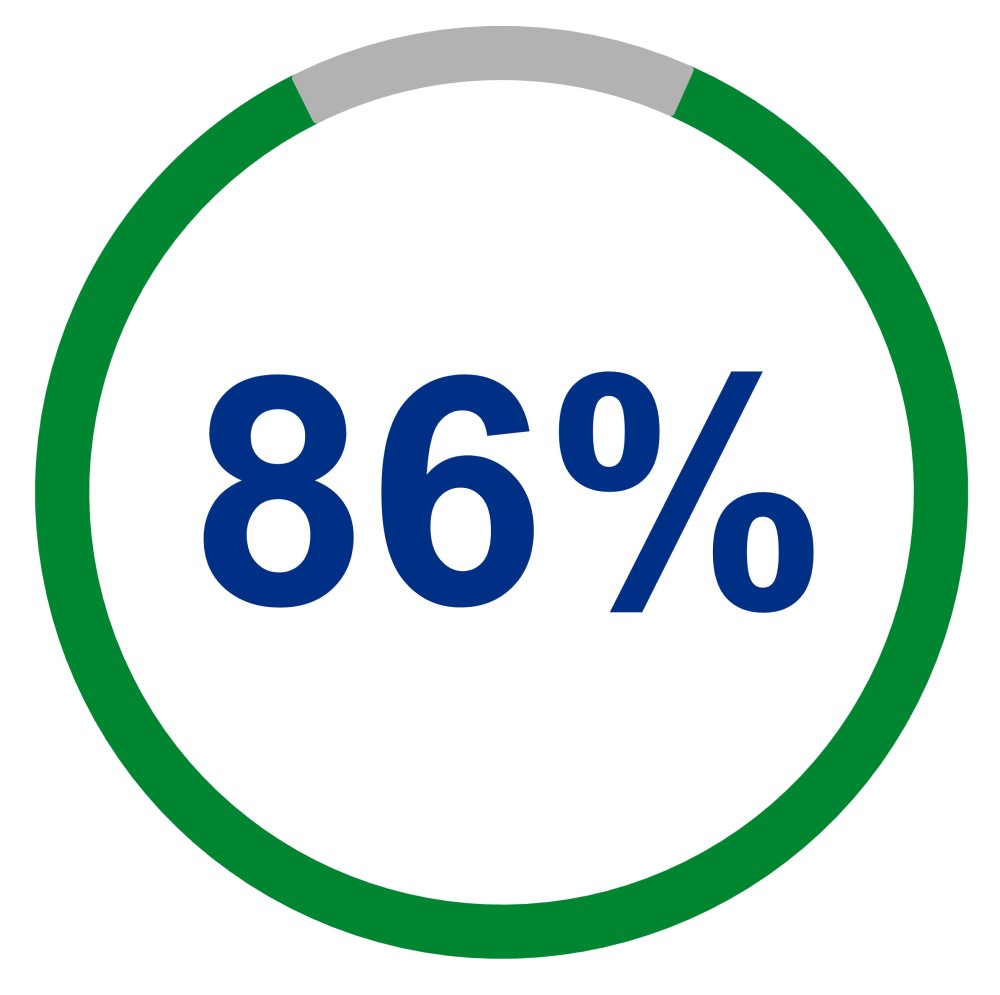

(1)Represents the average of acquired vacancy percentages as of each year end from 2020 through 2023.

(2)Represents the midpoint of our 2024 guidance range, provided on January 29, 2024, for occupancy percentage in North America as of December 31, 2024.

(3)Represents occupancy percentage of operating properties in North America as of each period end.

(1)As of December 31, 2023.

(1)As of December 31, 2023.

As of December 31, 2023.

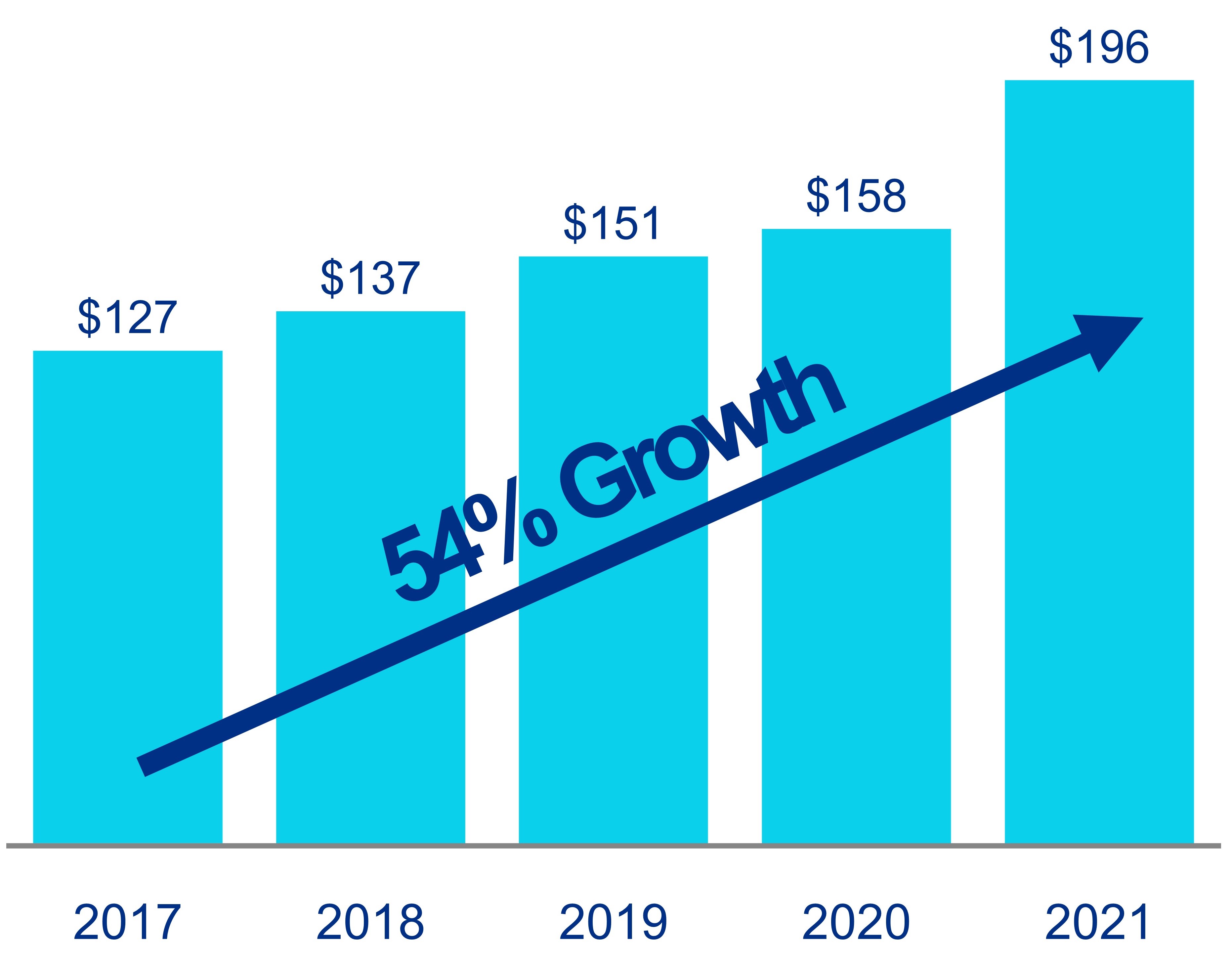

(1)For a definition of “Net operating income” and a reconciliation from the most directly comparable GAAP measure, see the “Definitions and Reconciliations” section of this Proxy Statement.

(2)From development and redevelopment projects. Our share of incremental annual net operating income primarily commencing during 2024–2027 is $389 million.

As of December 31, 2023.

(1)Contributions to existing consolidated joint ventures during 2024–2027.

(2)Quarter annualized. Refer to the “Definitions and Reconciliations” section of this Proxy Statement for additional information.

(1)Includes amounts related to real estate dispositions and partial interest sales completed from January 1, 2019 through December 31, 2023. Excludes sales price, gains, losses, and impairments related to assets held for sale as of December 31, 2023.

(2)Represents aggregate gains on real estate sales, consideration received in excess of book value of partial interests sold, and associated real estate impairments.

As of December 31, 2023, unless indicated otherwise.

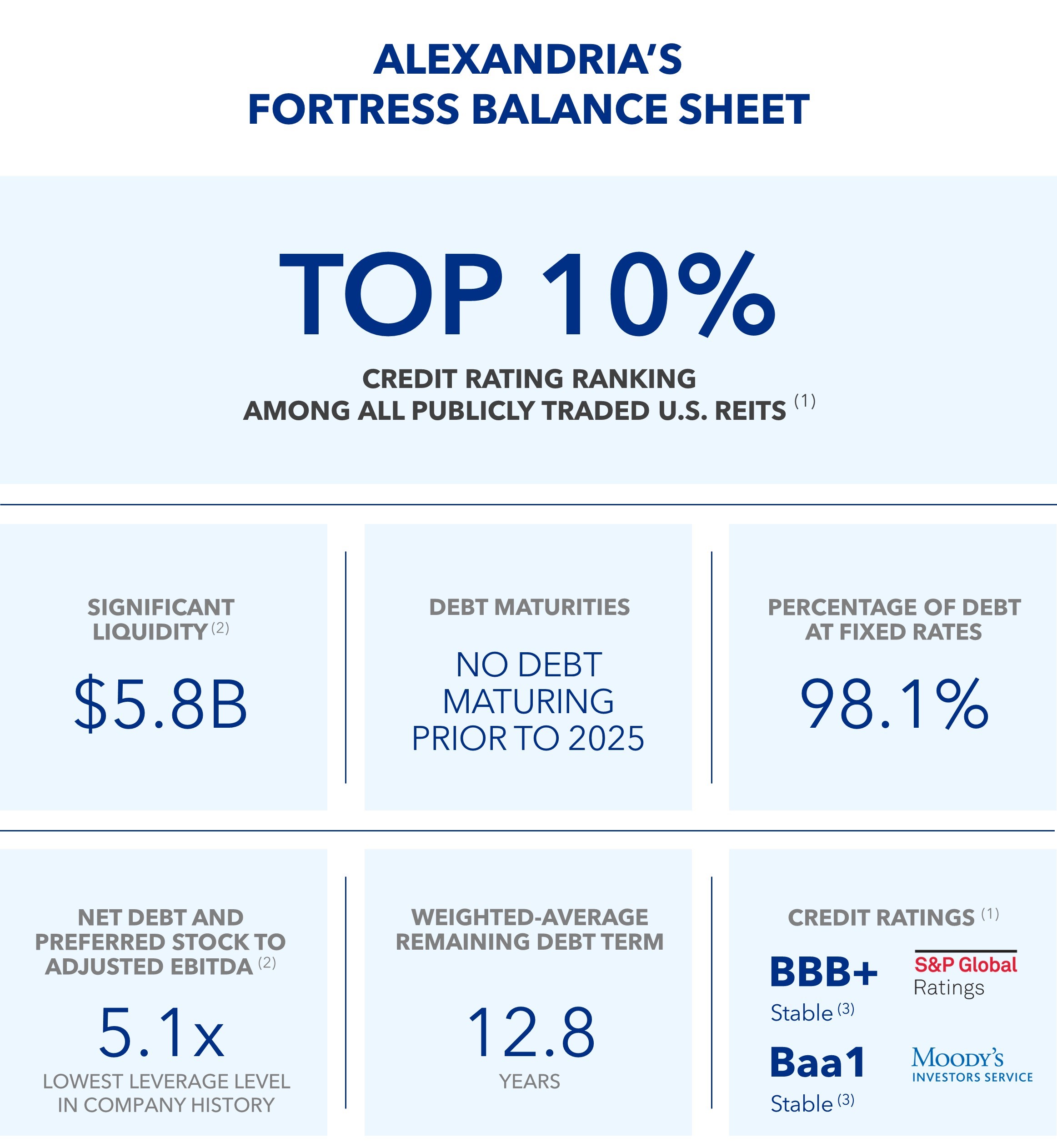

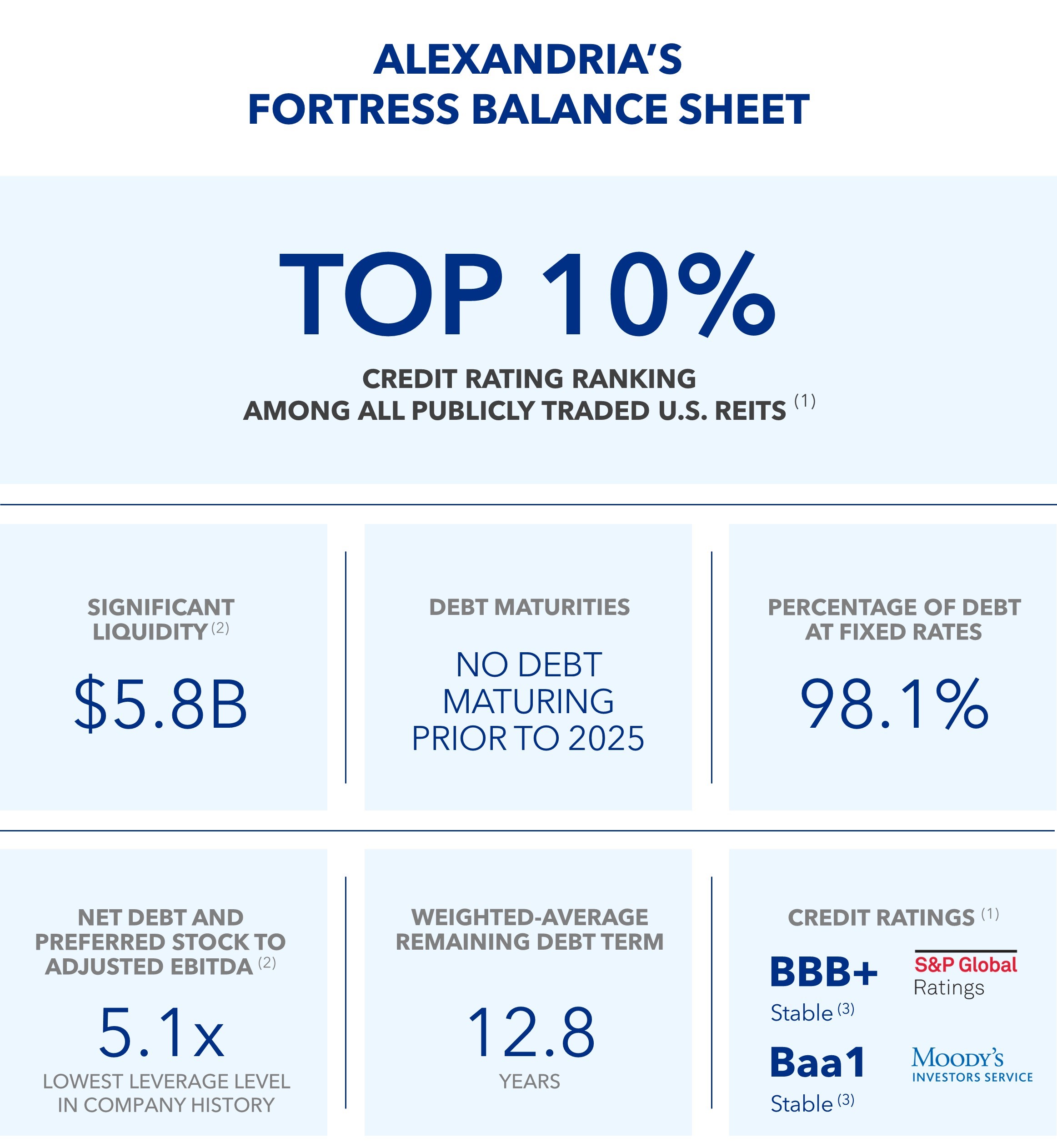

(1)Top 10% ranking represents credit rating levels from S&P Global Ratings and Moody’s Investors Service for publicly traded U.S. REITs, from Bloomberg Professional Services. A credit rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time.

(2)Refer to the “Definitions and Reconciliations” section of this Proxy Statement for additional information.

(3)As of the date of this report.

| | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF

ALEXANDRIA REAL ESTATE EQUITIES, INC. |

| | | | | |

| Date and Time: | Tuesday, May 17, 2022,14, 2024, at 11:00 a.m. EasternPacific Time |

| |

| Place: | Alexandria Center® for Life Science, 450 E. 29th Street, New York, NY 10016

26 North Euclid Avenue, Pasadena, CA 91101 |

| |

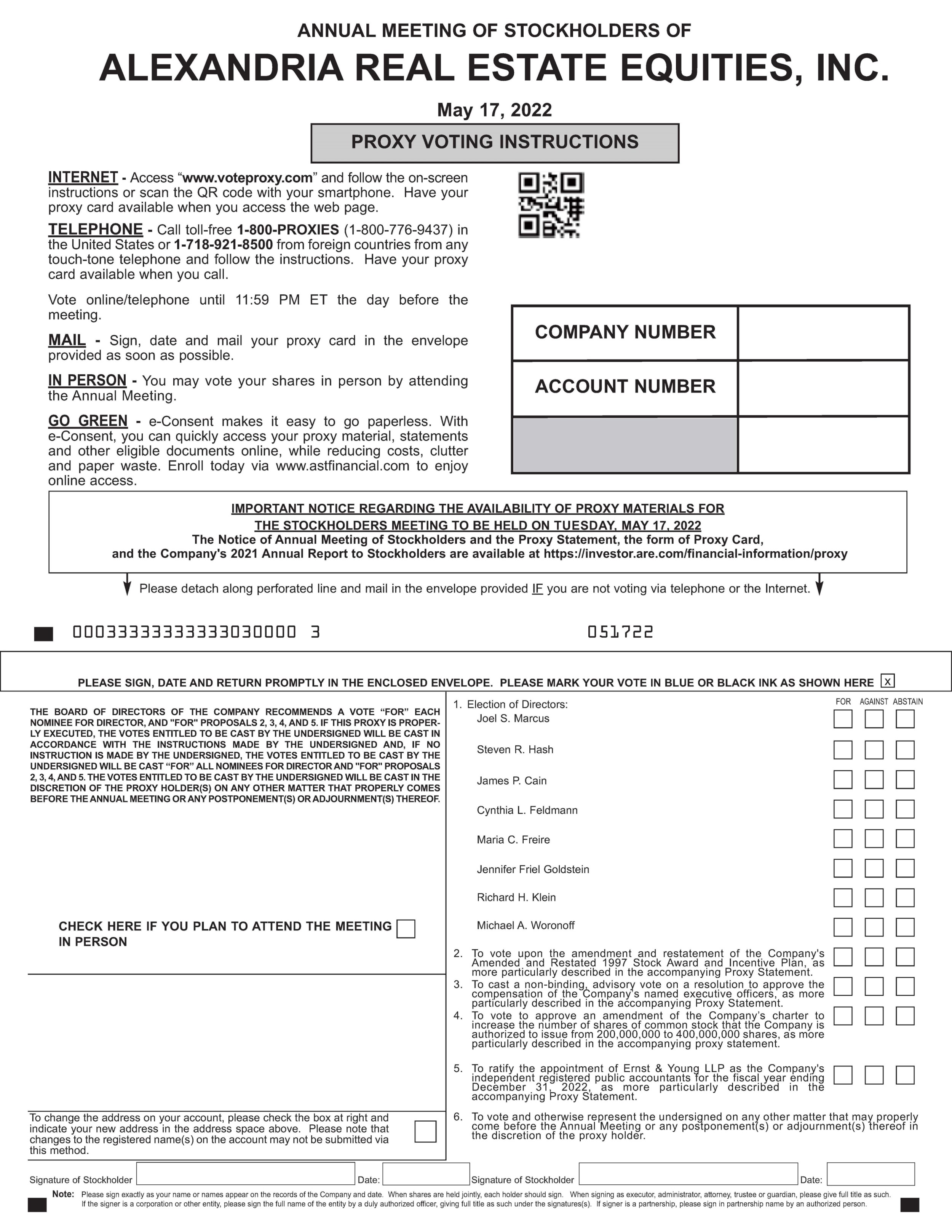

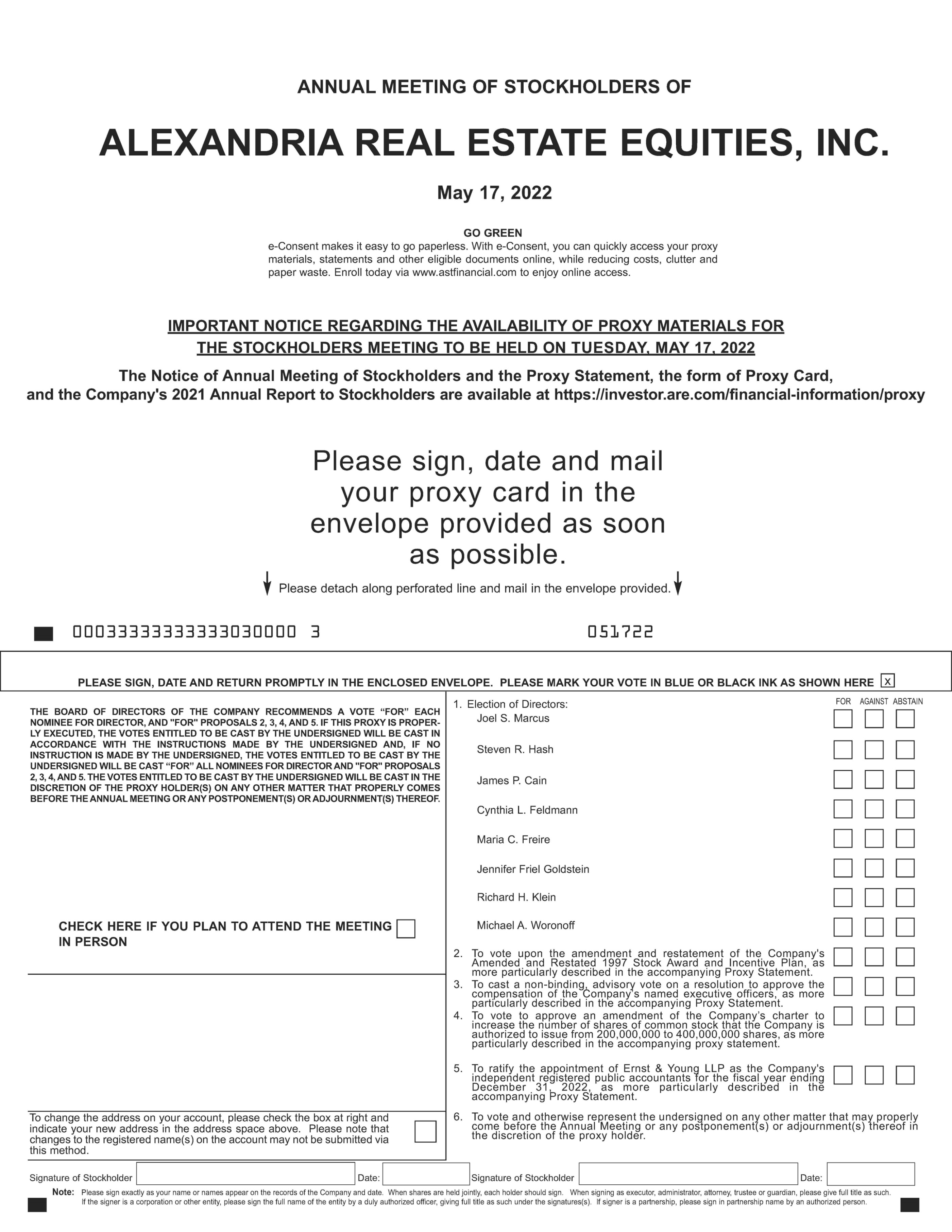

| Items of Business: | 1.To consider and vote upon the election of eight directors from the following eight nominees to serve until the next annual meeting of stockholders of Alexandria Real Estate Equities, Inc., a Maryland corporation (the “Company”), and until their successors are duly elected and qualify: Joel S. Marcus, Steven R. Hash, Ambassador James P. Cain, Cynthia L. Feldmann, Maria C. Freire, Ph.D., Jennifer Friel Goldstein, Richard H. Klein, and Michael A. Woronoff.qualify. |

| |

| 2.To consider and vote upon the amendment and restatement of the Company’s Amended and Restated 1997 Stock Award and Incentive Plan. |

| |

| 3.To consider and vote upon, on a non-binding, advisory basis, a resolution to approve the compensation of the Company’s named executive officers, as described in the Proxy Statement for the 20222024 Annual Meeting of Stockholders of the Company (the “2022“2024 Annual Meeting”). |

| |

| 4.To consider and vote upon an amendment of the Company’s charter to increase the number of shares of common stock that the Company is authorized to issue from 200,000,000 to 400,000,000 shares and make a corresponding increase in the aggregate par value of the Company’s authorized shares of stock. |

| |

| 5.To consider and vote upon the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accountants for the fiscal year ending December 31, 2022.2024.

|

| |

| 6.5.To transact such other business as may properly come before the 20222024 Annual Meeting or any postponement or adjournment thereof.

|

| |

| Record Date: | The Board of Directors of the Company (the ‘‘Board’’) has set the close of business on March 31, 2022,28, 2024, as the record date for the determination of stockholders entitled to notice of and to vote at the 20222024 Annual Meeting andor any postponement or adjournment thereof. |

| |

| | | | | |

| By Order of the Board |

| |

| Jackie B. Clem

General Counsel and Secretary |

Pasadena, California

April 18, 20223, 2024

| | | | | | | | |

20222024 Proxy Statement

| viixv | |

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROPOSAL 2— APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE AMENDED AND RESTATED 1997 STOCK AWARD AND INCENTIVE PLAN | |

| |

| |

| |

| |

| |

| |

| |

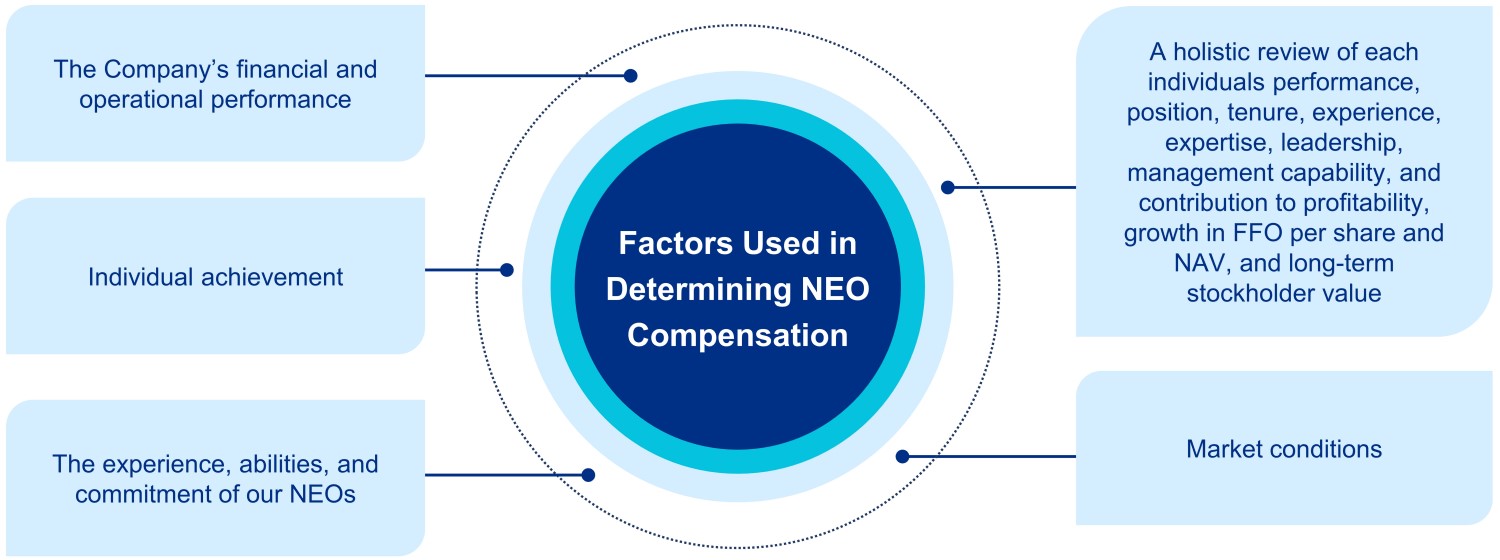

COMPENSATION DISCUSSION AND ANALYSIS | |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | |

20222024 Proxy Statement

| viiixvi | |

TABLE OF CONTENTS (continued)

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROPOSAL 4— APPROVAL OF THE AMENDMENT OF THE COMPANY’S CHARTER TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 200,000,000 TO 400,000,000 SHARES | |

PROPOSAL 5— RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

APPENDIX I – AMENDED AND RESTATED 1997 STOCK AWARD AND INCENTIVE PLAN | |

| | | | | | | | |

20222024 Proxy Statement

| ixxvii | |

TABLE OF CONTENTS (continued)

| | | | | |

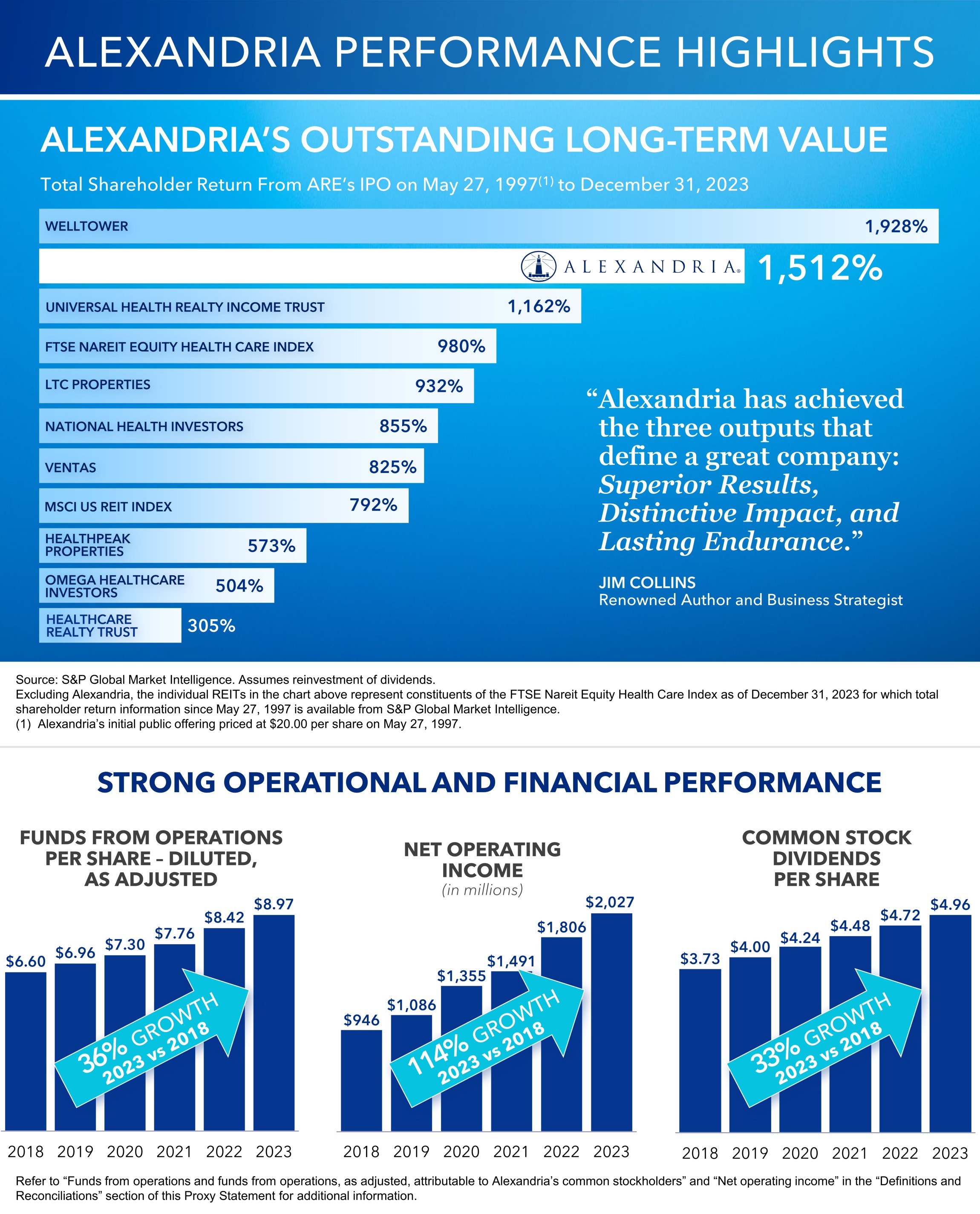

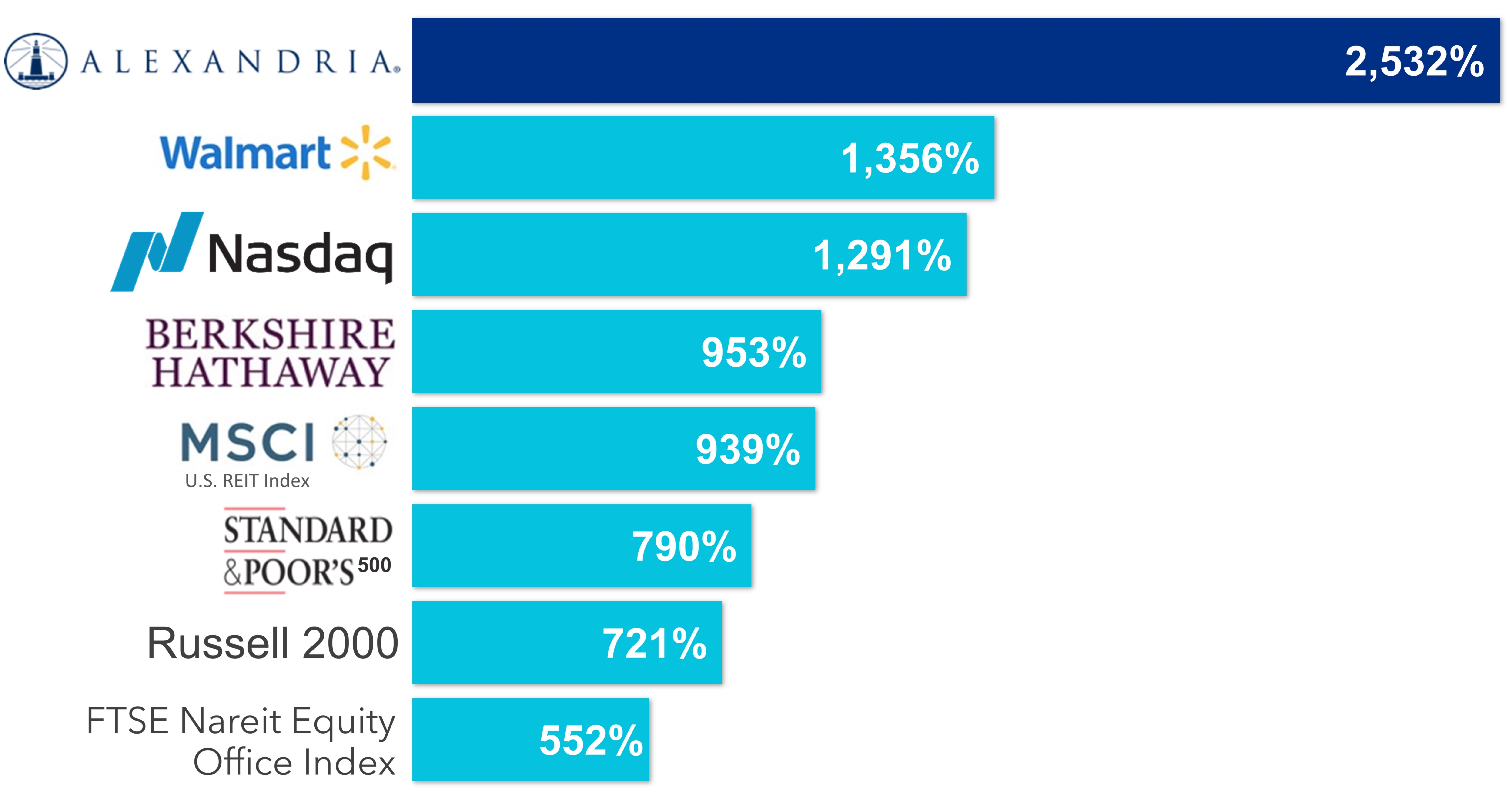

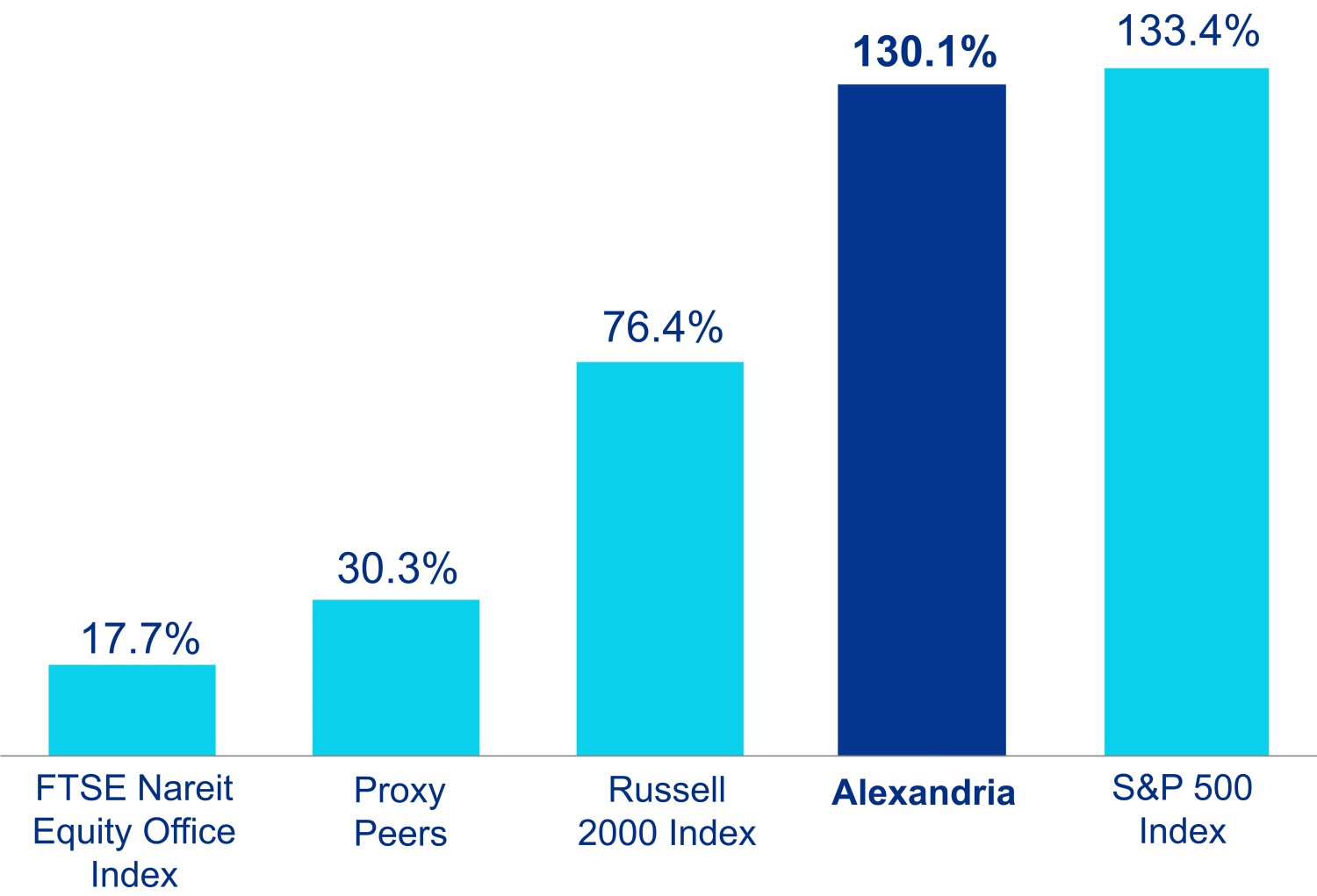

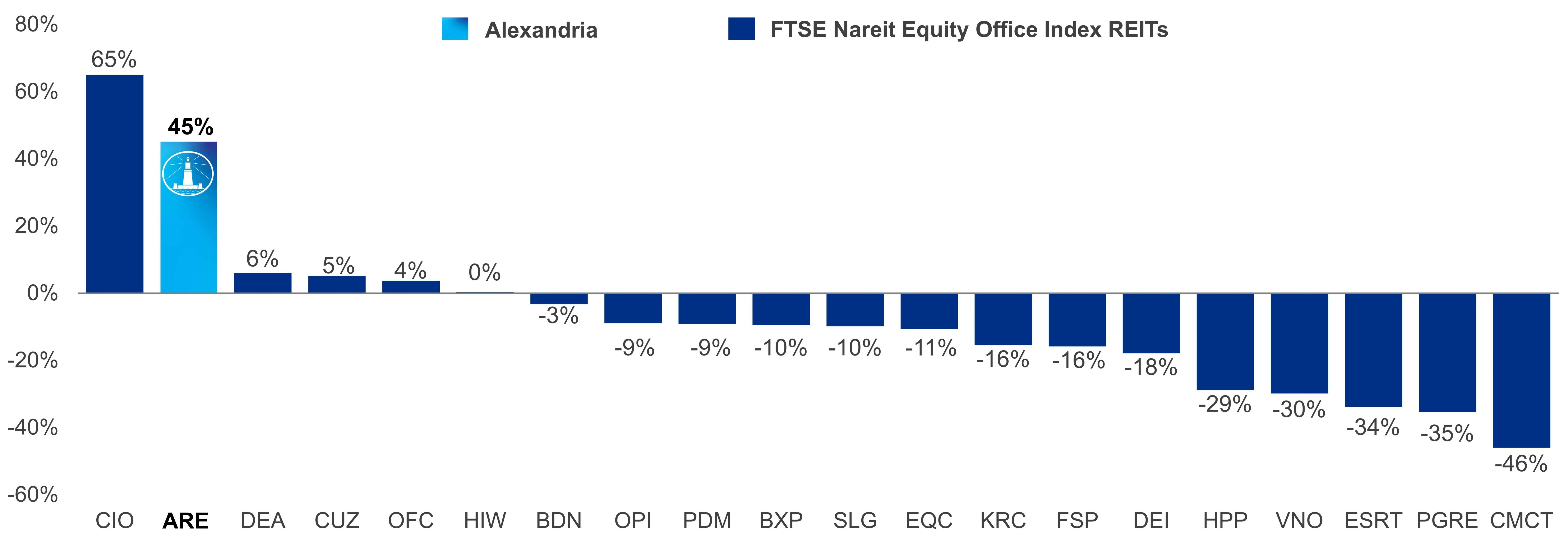

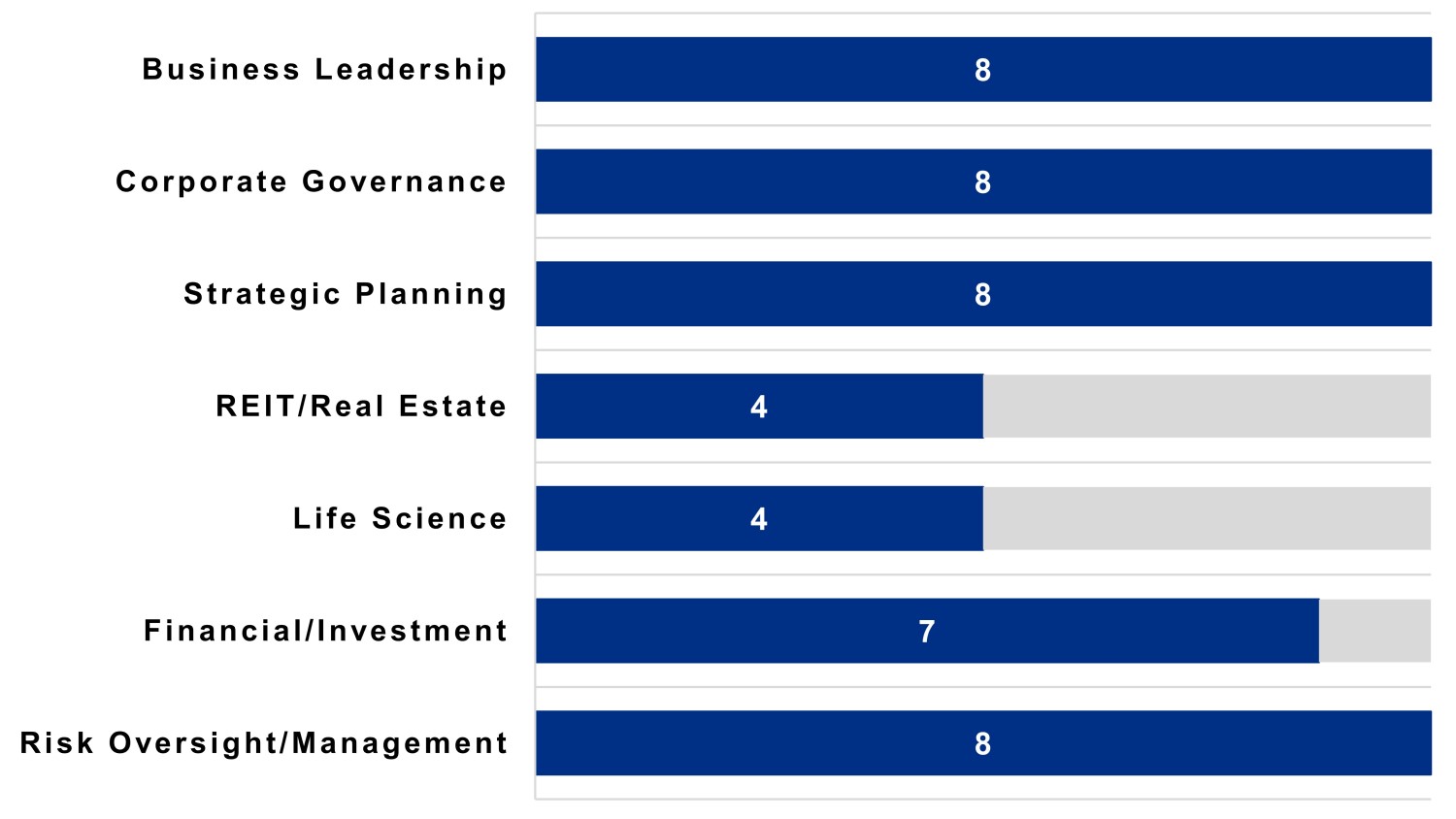

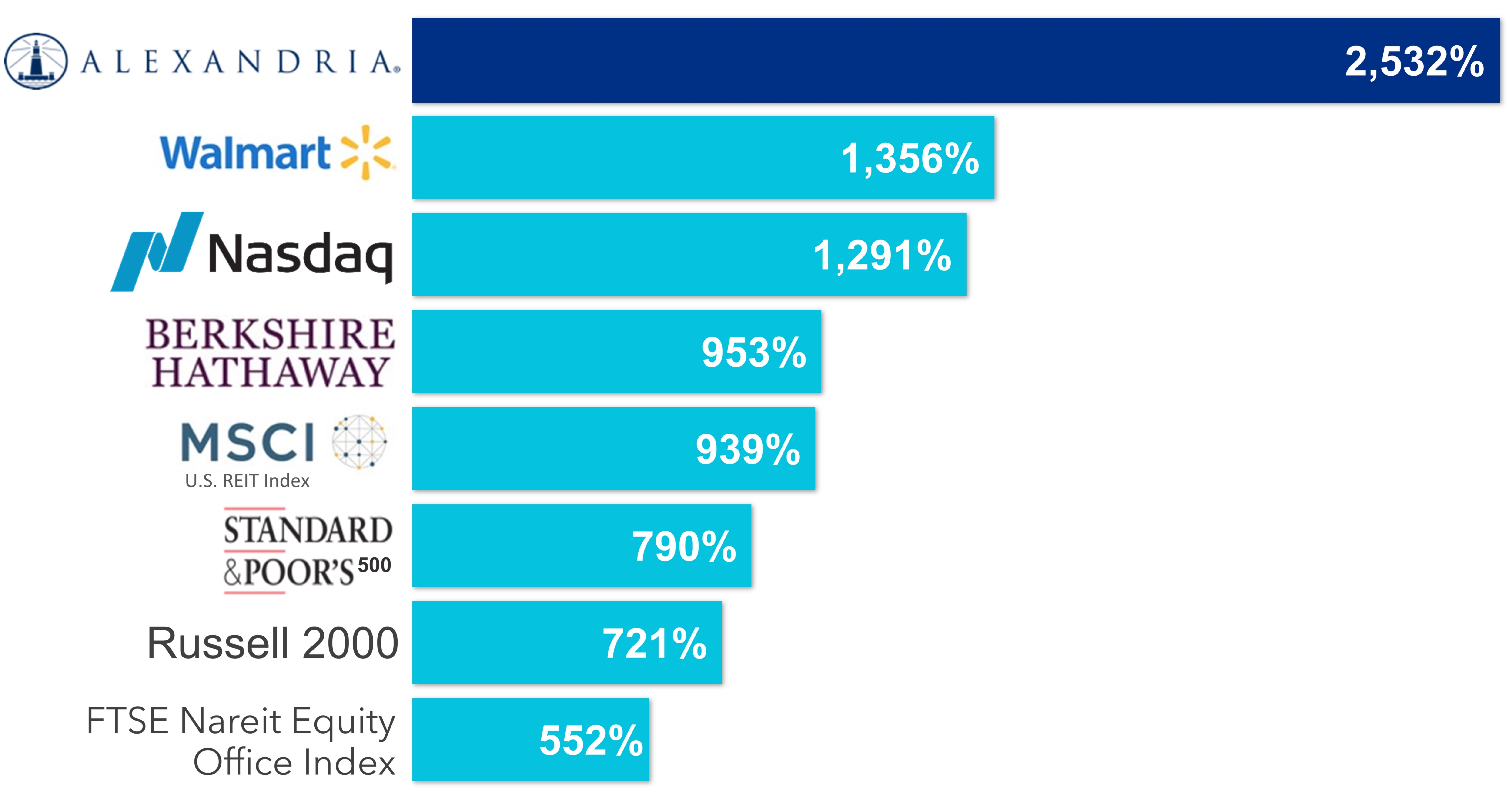

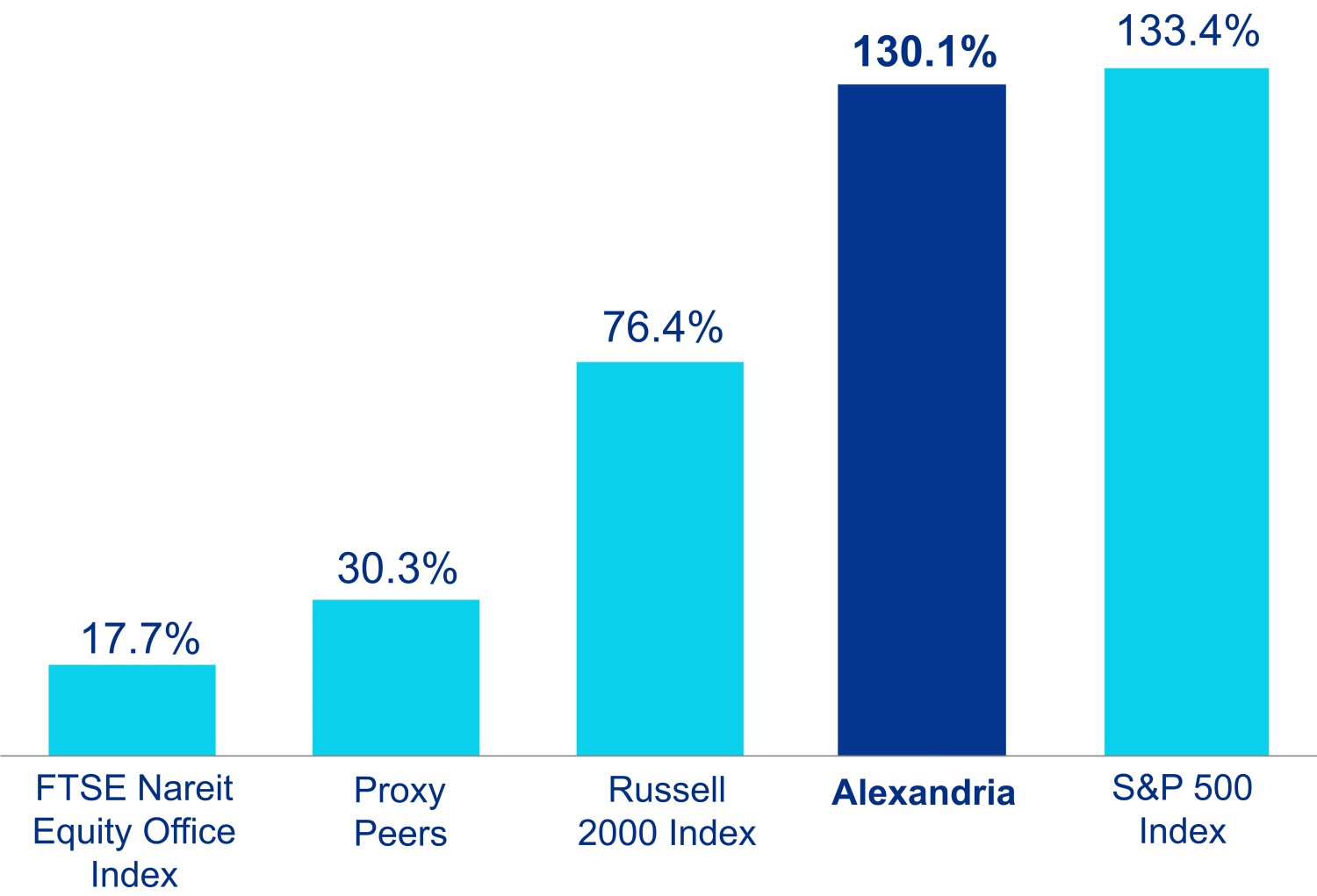

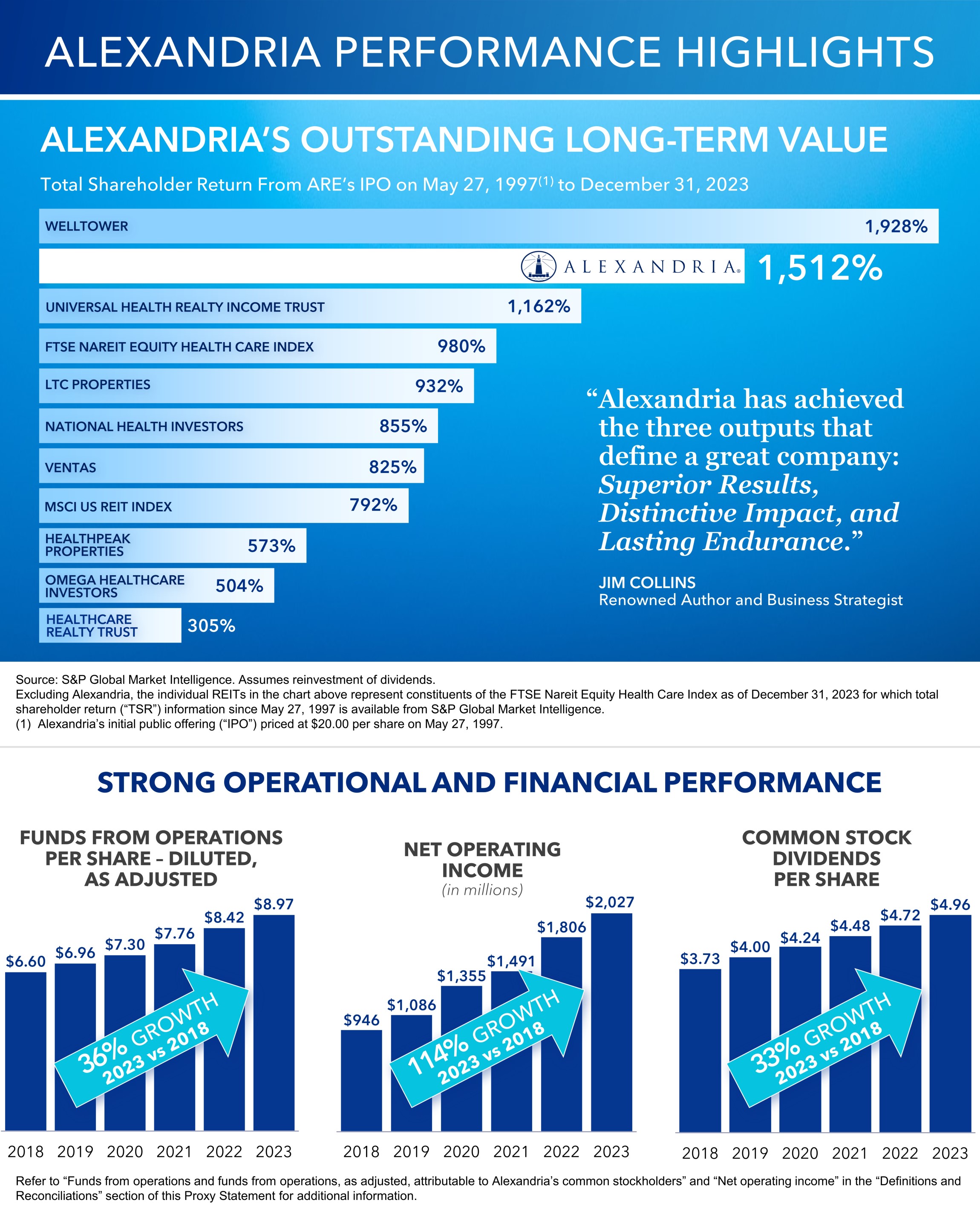

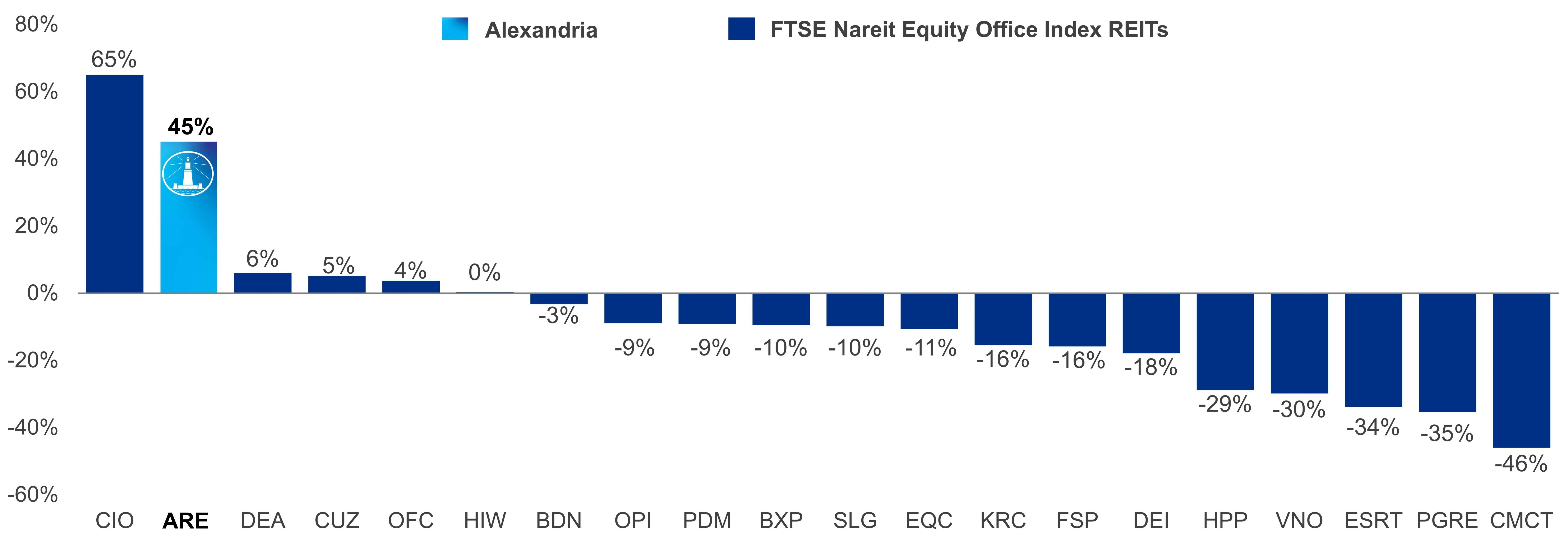

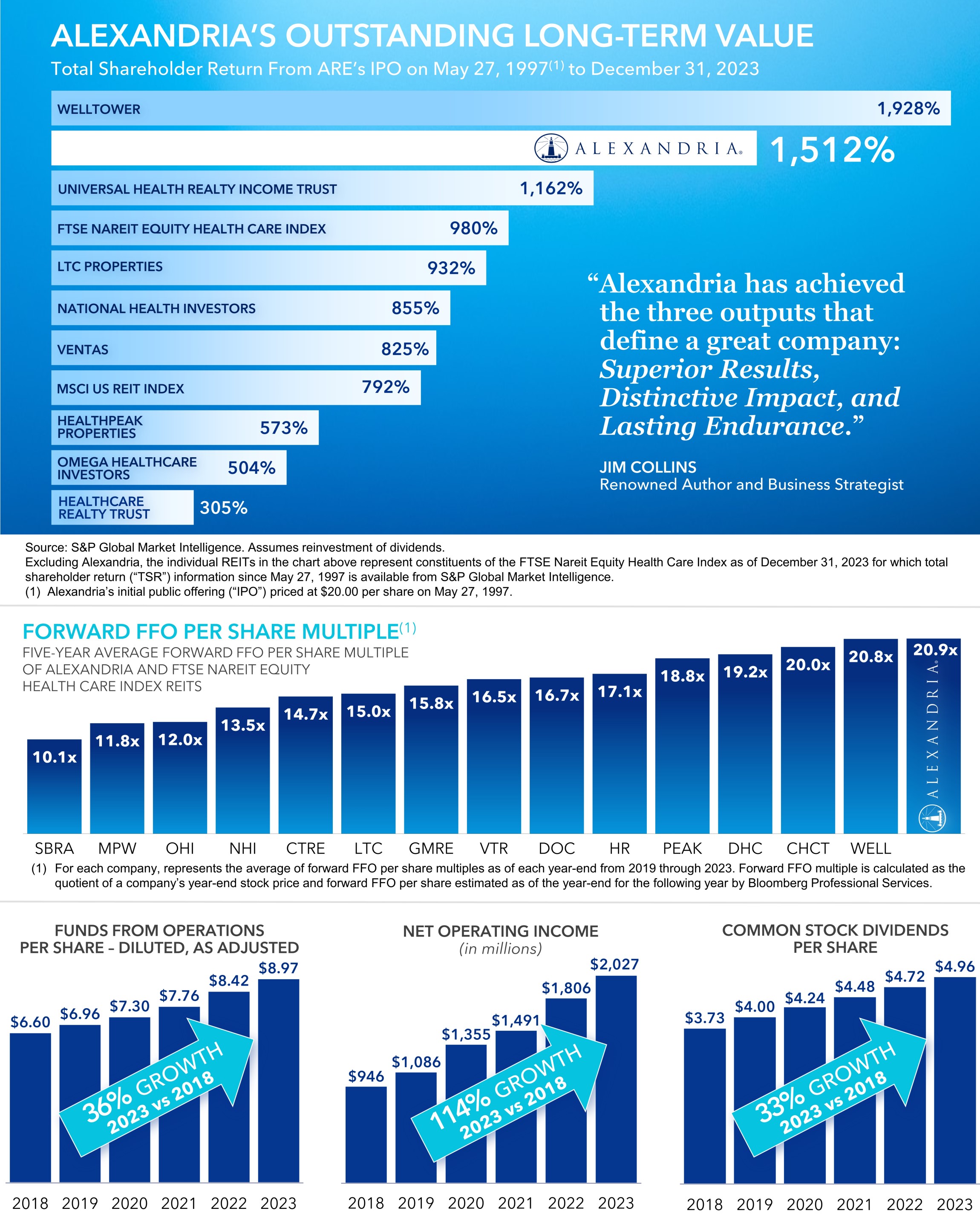

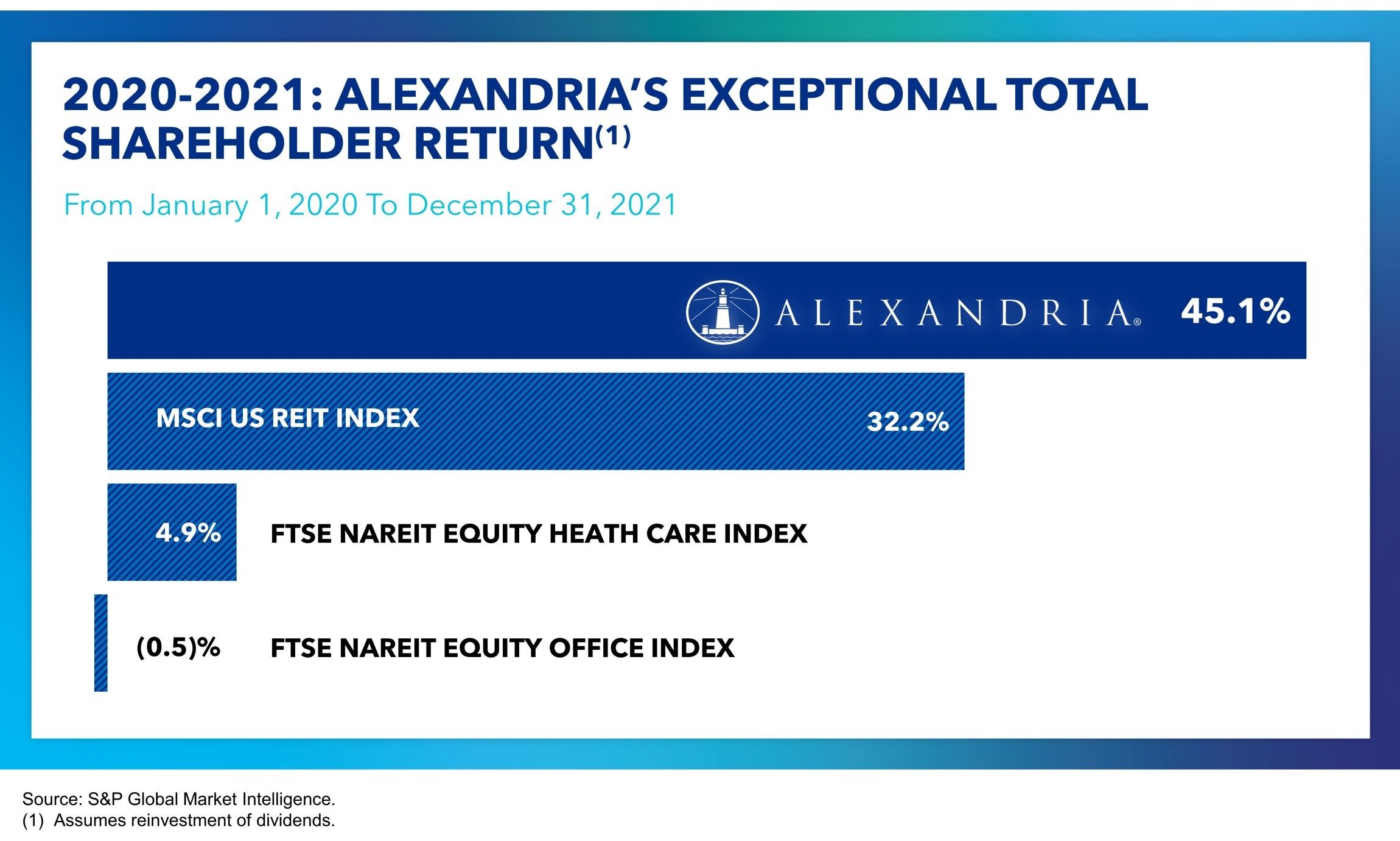

Total Stockholder Return(1)

Alexandria’s IPO to December 31, 2021(2)

2,532%

| Total Stockholder Return(1)

Five Years Ended December 31, 2021

|

| |

| |

Total Stockholder Return(1)

Two Years Ended December 31, 2021

|

|

| | | | | | | | |

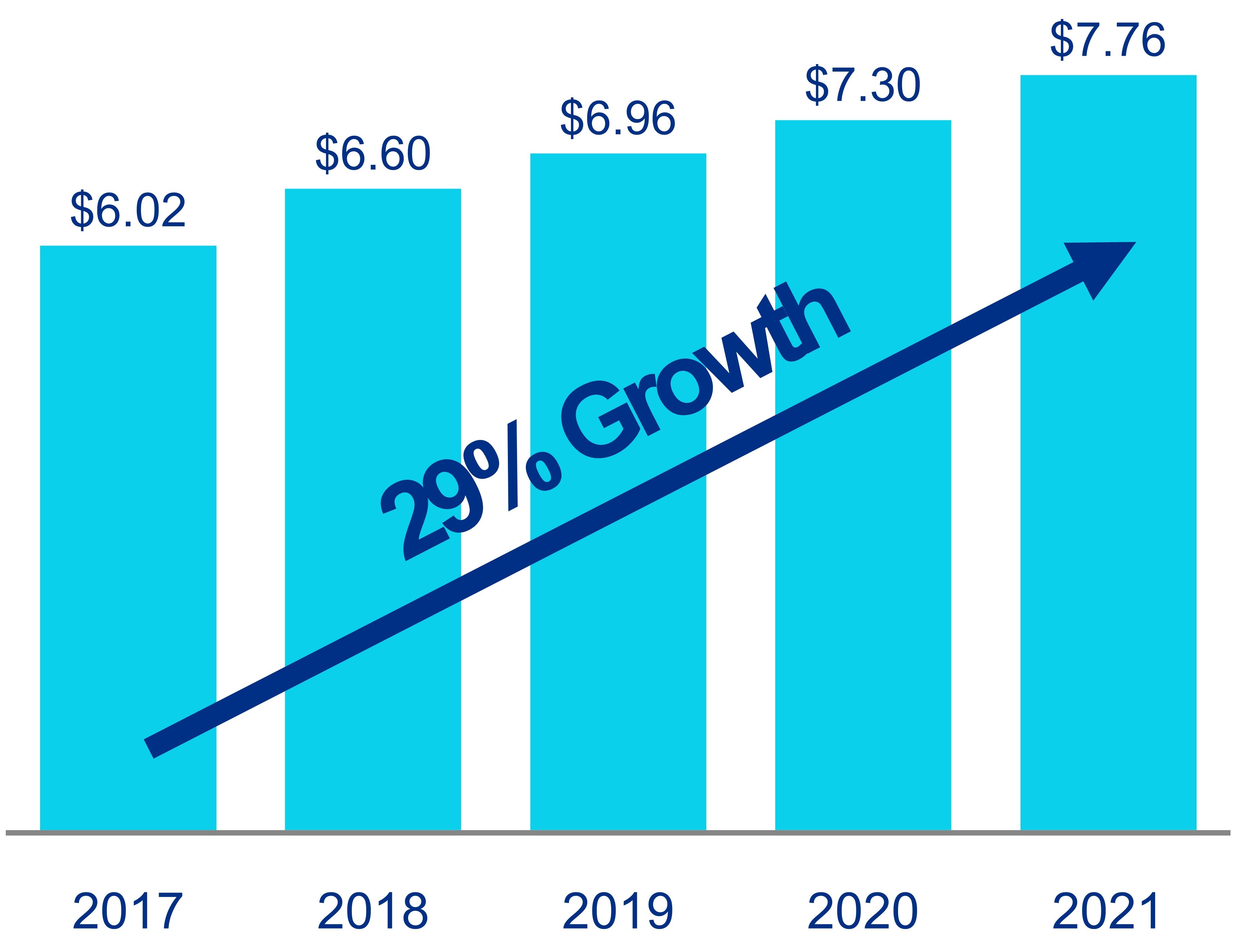

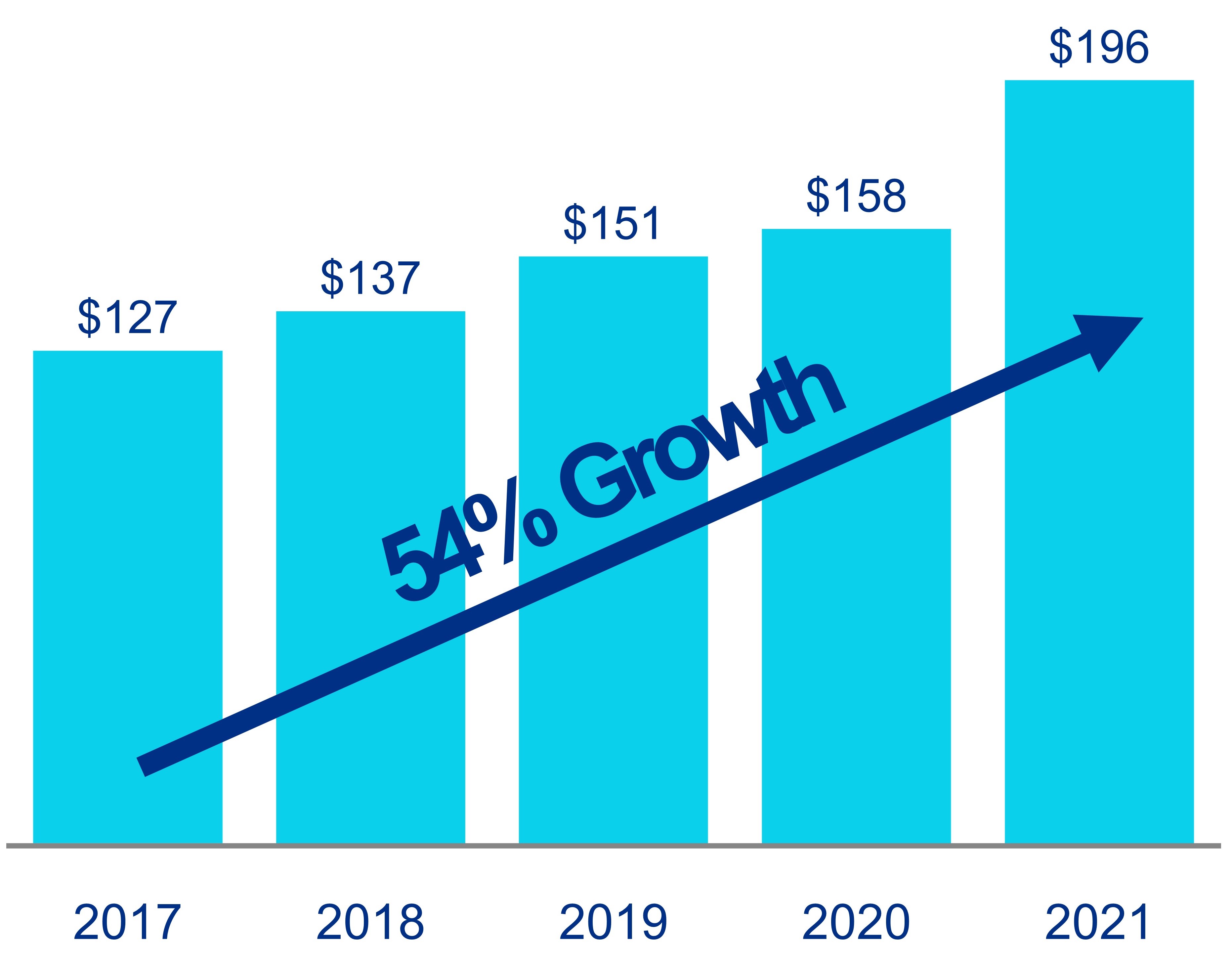

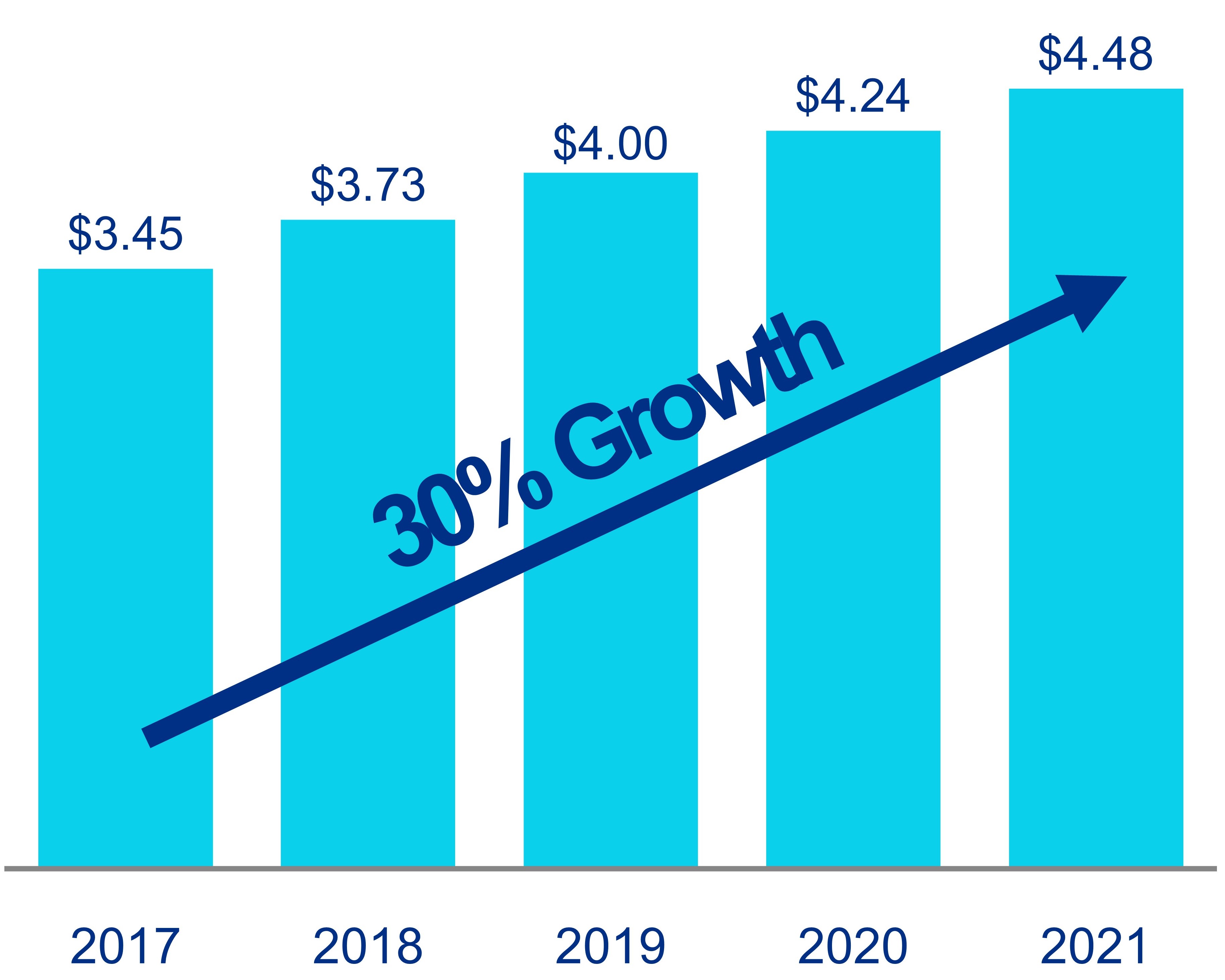

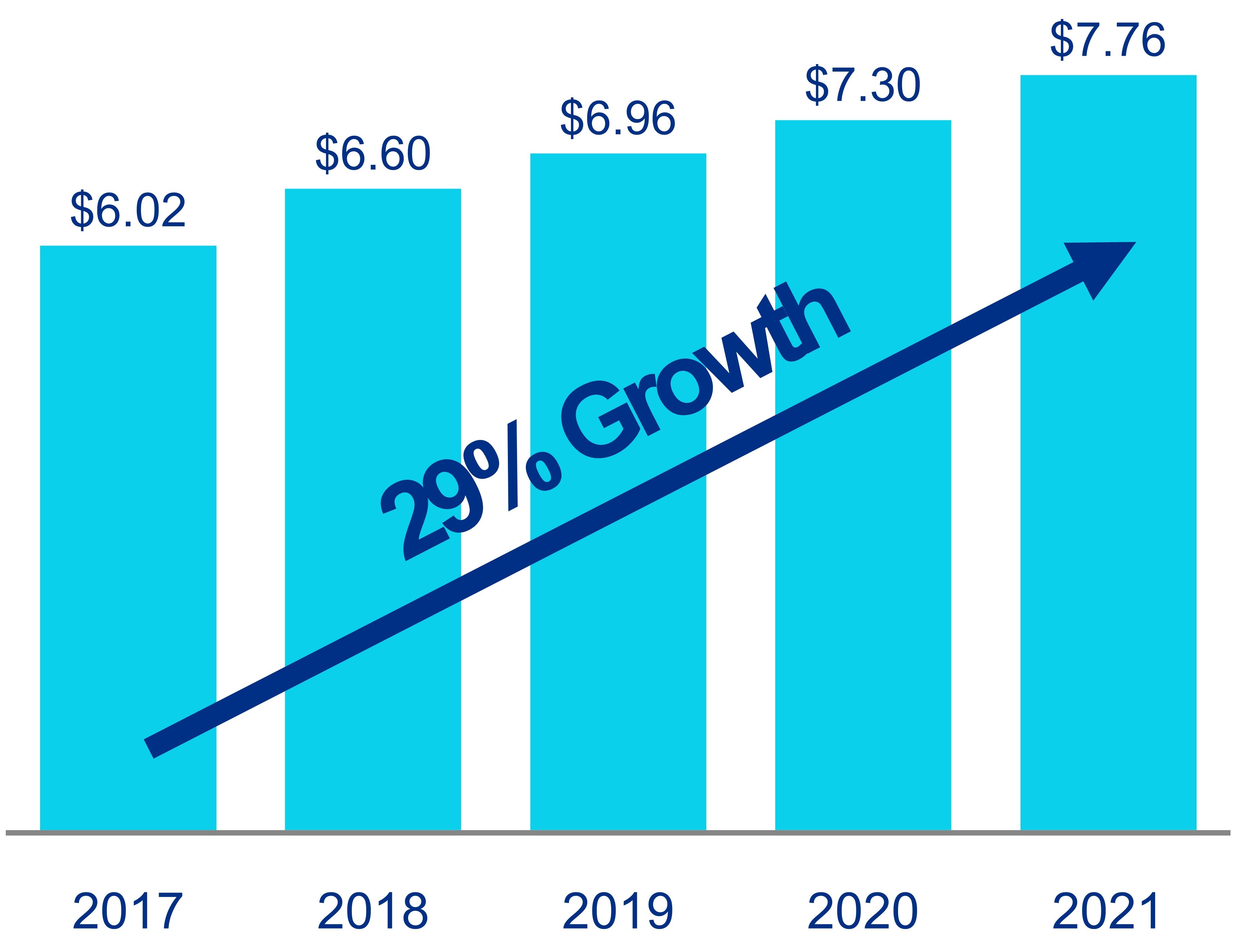

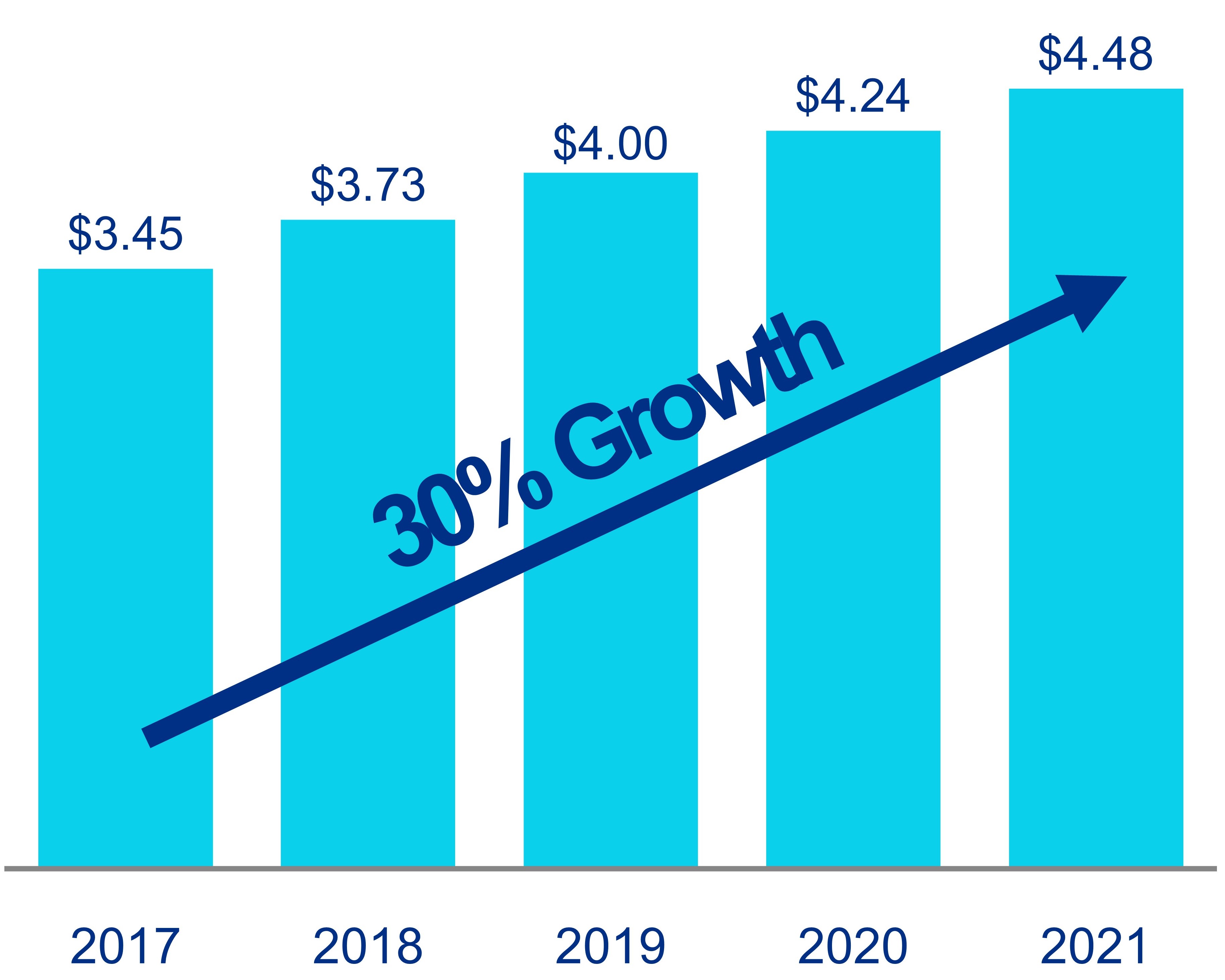

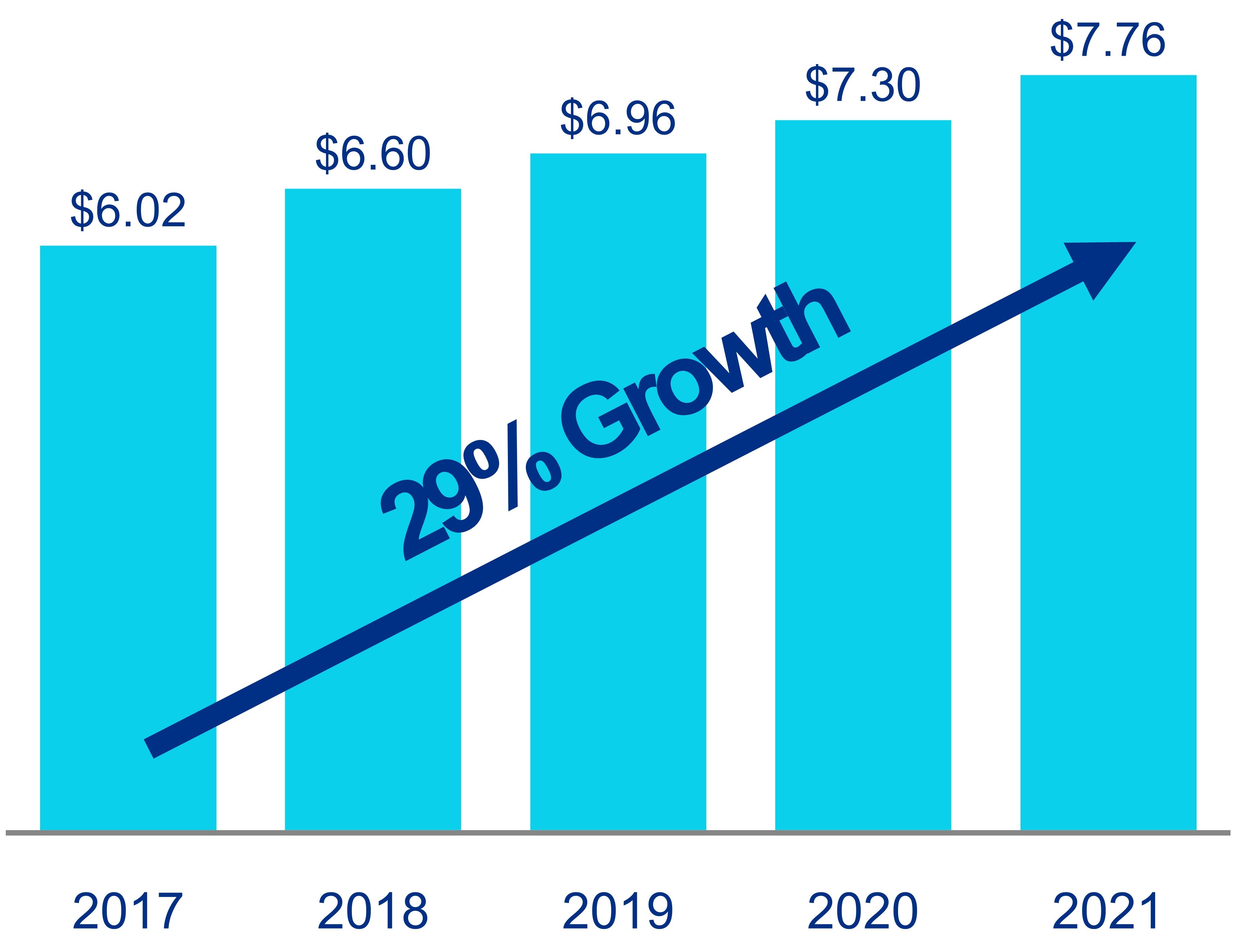

Funds From Operations Per Share(3)

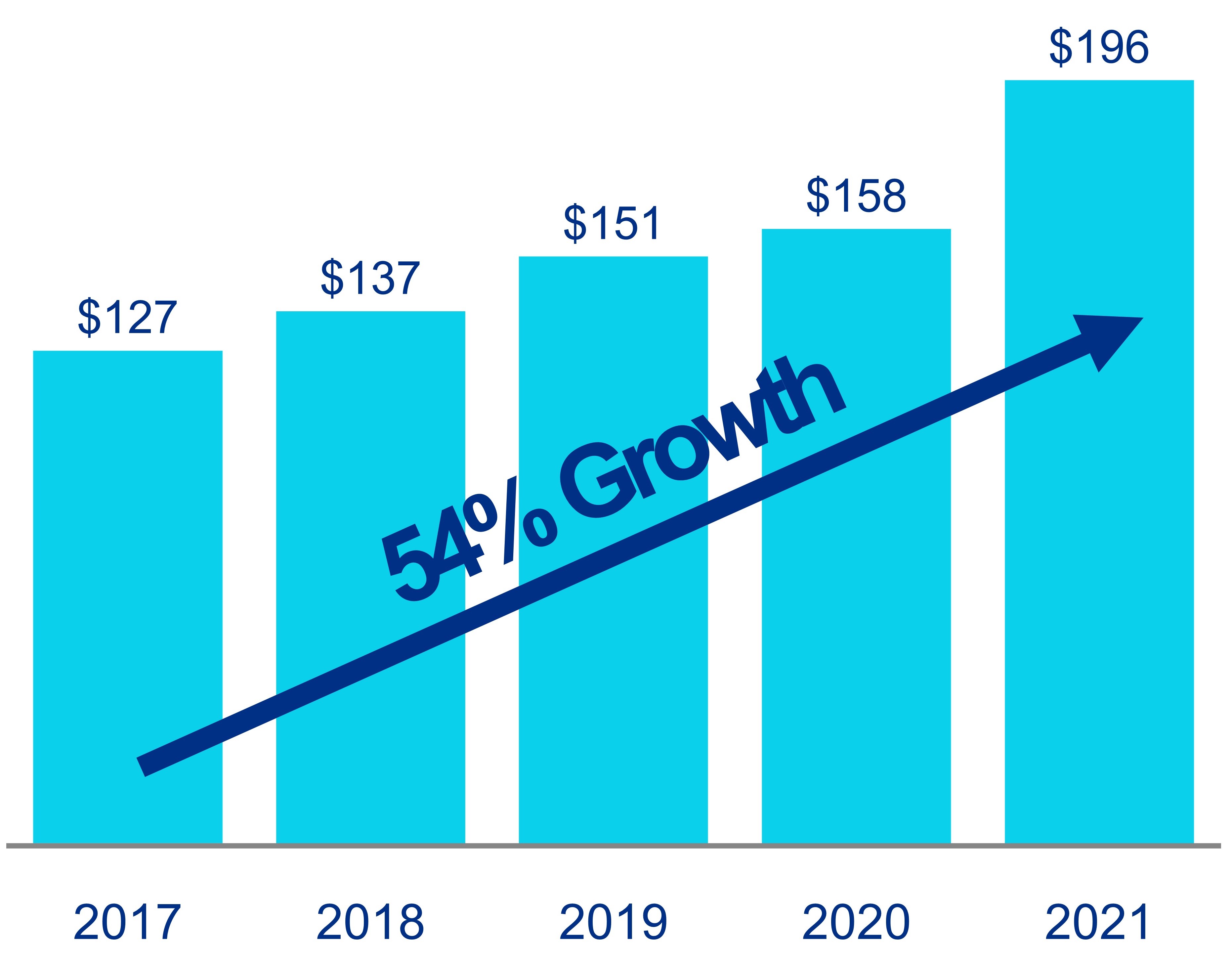

| Net Asset Value

Per Share(4)

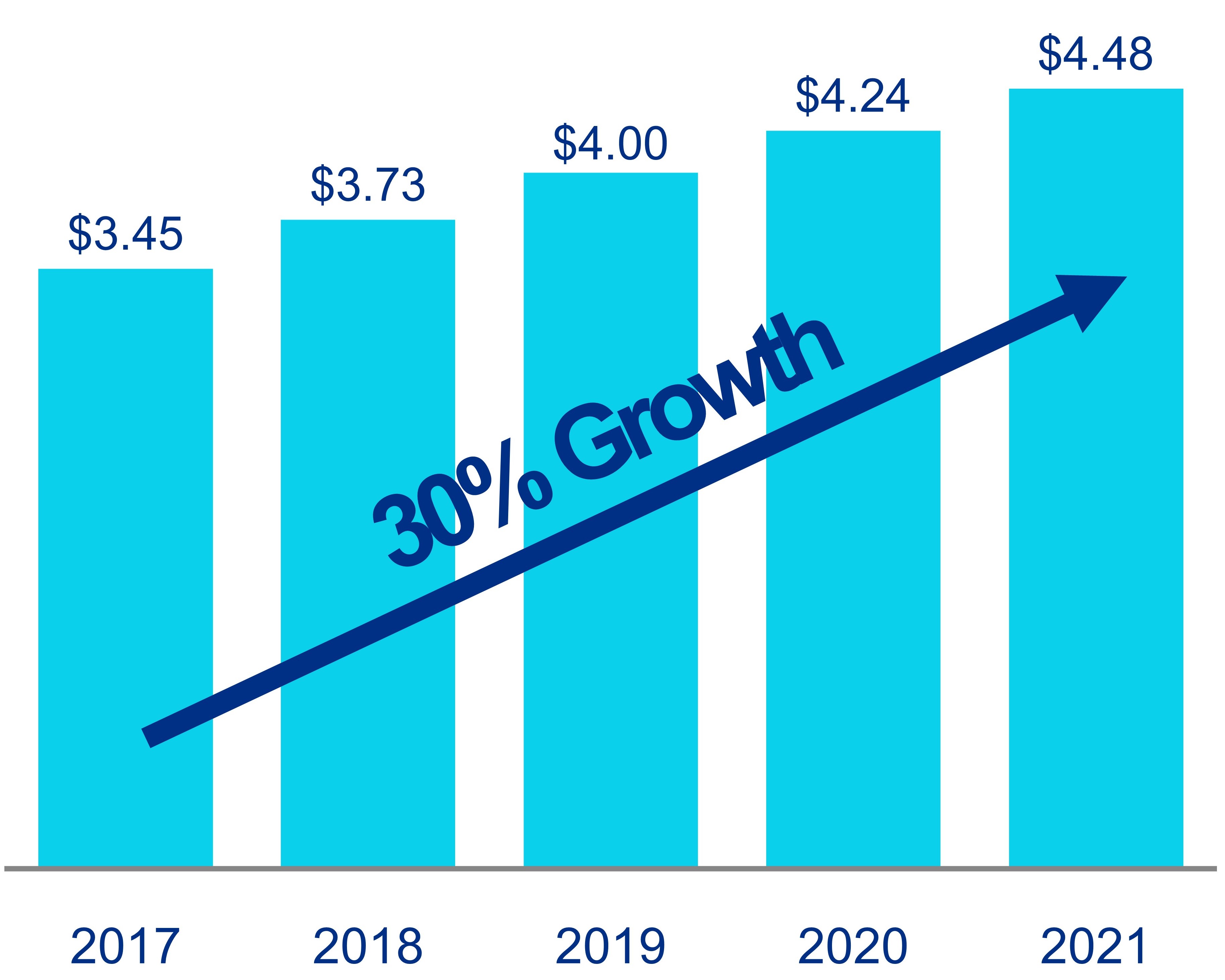

| Common Stock Dividends

Per Share |

| | |

|

|

| | | | | |

(1) | Assumes reinvestment of dividends. |

(2) | Total stockholder return from Alexandria Real Estate Equities, Inc.’s initial public offering, or IPO, priced on May 27, 1997, to December 31, 2021. Source: Bloomberg and S&P Global Market Intelligence. |

(3) | Represents funds from operations per share – diluted, as adjusted. For information on the Company’s funds from operations, including definitions and a reconciliation from the most directly comparable GAAP measure, see “Non-GAAP Measures and Definitions” under Item 7 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021. |

(4) | Based on average net asset value estimates at the end of each year provided by Bank of America Merrill Lynch, Citigroup Global Markets Inc., Evercore ISI, Green Street, and J.P. Morgan Securities LLC. |

For definitions of “Funds from operations per share – diluted, as adjusted” and “Net operating income” and reconciliations from the most directly comparable GAAP measures, see the “Definitions and Reconciliations” section of this Proxy Statement. | | | | | | | | |

20222024 Proxy Statement

| xxviii | |

| | | | | | | | |

| ALEXANDRIA REAL ESTATE EQUITIES, INC.

26 North Euclid Avenue

Pasadena, California 91101 | |

| PROXY STATEMENT for ANNUAL MEETING OF STOCKHOLDERS to be held on Tuesday, May 17, 202214, 2024 | |

This Proxy Statement is provided to stockholders of Alexandria Real Estate Equities, Inc., a Maryland corporation (the “Company,” “Alexandria,” “our, stockholders” “we,” and “us”), to solicit proxies, on the form of proxy enclosed, for exercise at the 20222024 Annual Meeting of Stockholders of Alexandria Real Estate Equities, Inc., a Maryland corporation (“Alexandria” or the “Company”(the “2024 Annual Meeting”), to be held on Tuesday, May 17, 2022, at the Alexandria Center® for Life Science, 450 E. 29th Street, New York, NY 10016,14, 2024, at 11:00 a.m. EasternPacific Time, andat 26 North Euclid Avenue, Pasadena, CA 91101, or at any postponement or adjournment thereof (the “2022 Annual Meeting”).thereof. The Board of Directors of the Company (the “Board”) knows of no matters to come before the annual meeting2024 Annual Meeting other than those described in this Proxy Statement. This Proxy Statement and the enclosed proxy are first being mailed to stockholders on or about April 18, 2022.3, 2024.

At the 20222024 Annual Meeting, stockholders will be asked:

1.Toasked to consider and vote upon theupon:

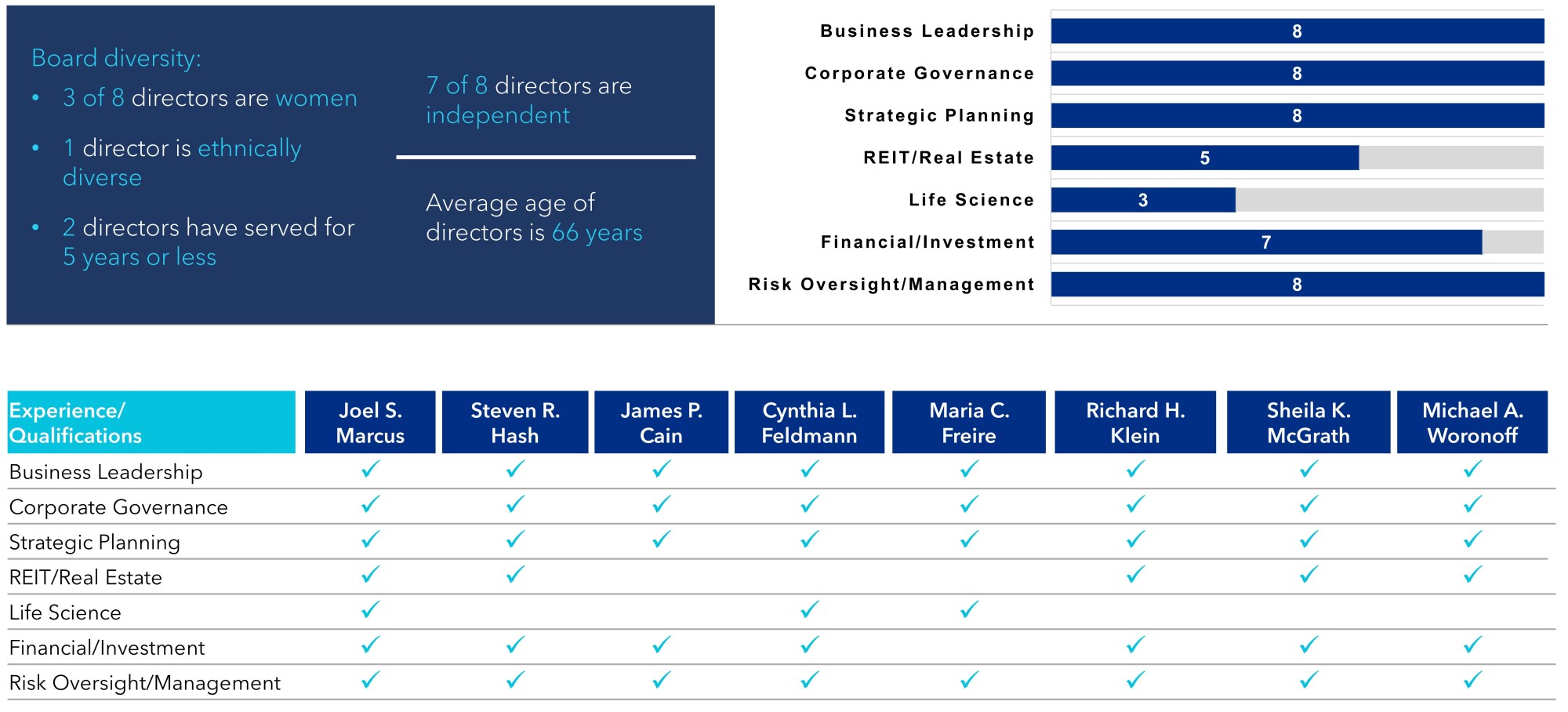

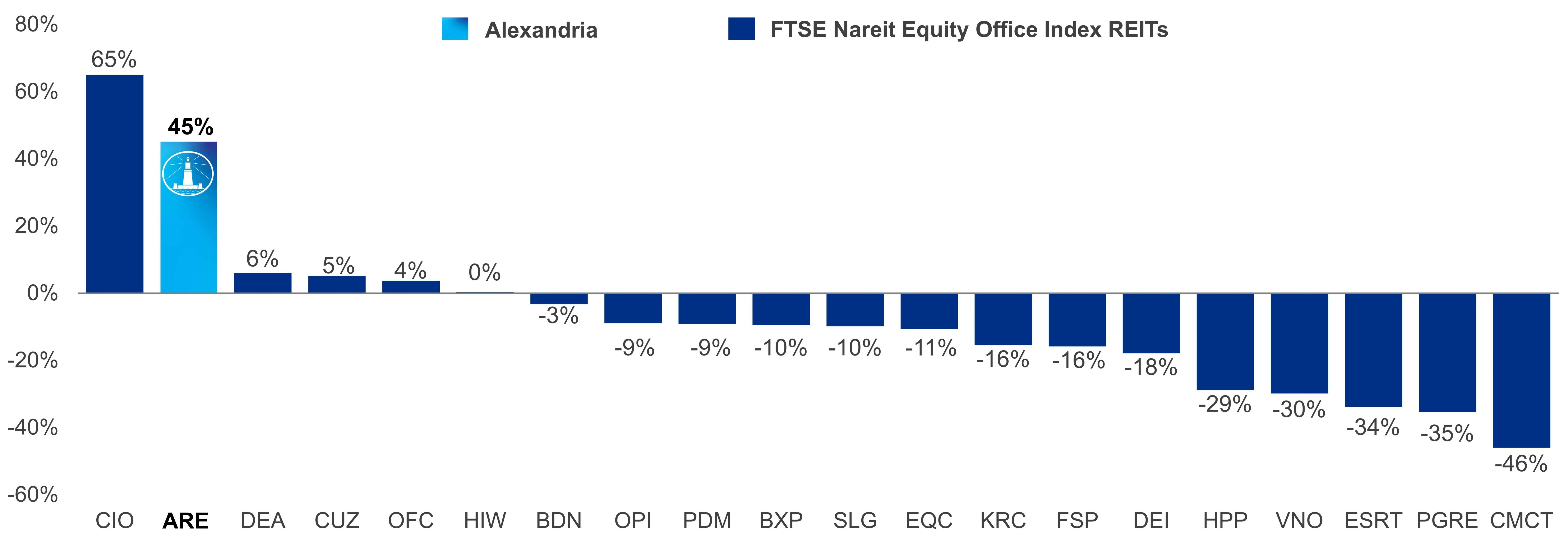

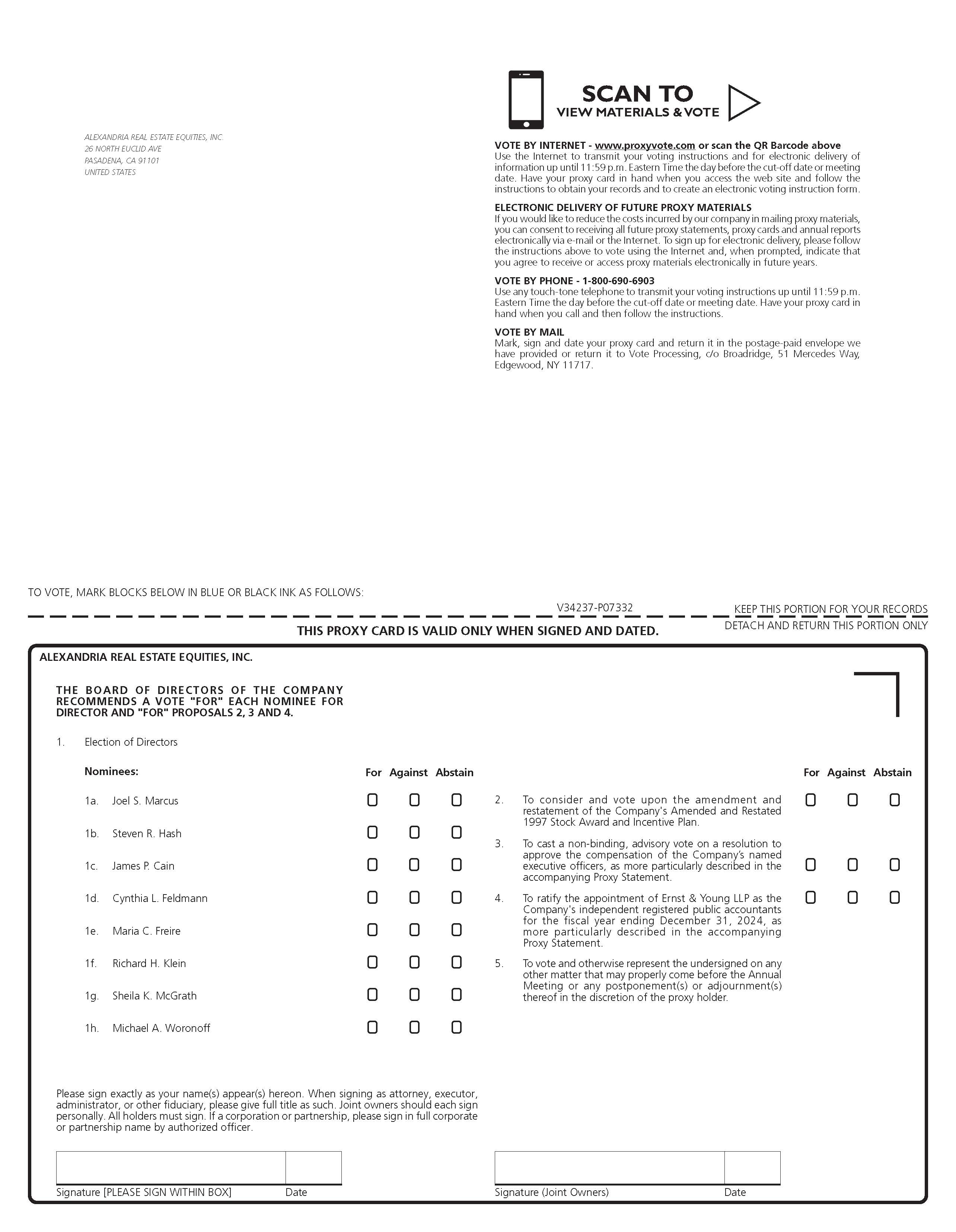

1.The election of eight directors from the following eight nominees to serve until the Company’s next annual meeting of stockholders and until their successors are duly elected and qualify: Joel S. Marcus, Steven R. Hash, Ambassador James P. Cain, Cynthia L. Feldmann, Maria C. Freire, Ph.D., Jennifer Friel Goldstein,PhD, Richard H. Klein, Sheila K. McGrath, and Michael A. Woronoff.Woronoff;

2.To consider and vote upon theThe amendment and restatement of the Company’s Amended and Restated 1997 Stock Award and Incentive Plan (the “1997“Amended 1997 Incentive Plan”).;

3.To consider and vote upon,A resolution to approve, on a non-binding, advisory basis, a resolution to approve the compensation of the Company’s named executive officers (our “NEOs”), as described in this Proxy Statement.Statement;

4.To consider and vote upon an amendment of the Company’s charter to increase the number of shares of common stock that the Company is authorized to issue from 200,000,000 to 400,000,000 shares and make a corresponding increase in the aggregate par value of the Company’s authorized shares of stock.

5.To consider and vote upon theThe ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accountants for the fiscal year ending December 31, 2022.2024; and

6.To transact5.The transaction of such other business as may properly come before the 20222024 Annual Meeting or any postponement or adjournment thereof.

Solicitation

This solicitation is made by mail by the Board. The Company will pay for the costs of the solicitation. Further solicitation of proxies may be made, including by mail, by telephone, by fax, in person, or by other means, by the directors, officers, or employees of the Company or itsour affiliates, none of whom will receive additional compensation for such solicitation. In addition, the Company has engaged Alliance Advisors, LLC, a firm specializing in proxy solicitation, to solicit proxies, and to assist in the distribution and collection of proxy materials, for an estimated fee of approximately $37,500.$40,000. The Company will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to their customers or principals that are beneficial owners of shares of the Company’s common stock, $0.01 par value per share (“Common Stock”).

Internet Availability of Proxy Materials

We are furnishing proxy materials to our stockholders primarily via the internet by mailing a Notice of Internet Availability of Proxy Materials, instead of mailing copies of those materials to each stockholder. The Notice of Internet Availability of Proxy Materials directs stockholders to a website where they may access our proxy materials, including this Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and view instructions on how to vote via the Internet, or by telephone. If you received a Notice of Internet Availability of Proxy Materials and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials.

Voting Procedures

Only holders of record of Common Stock as of the close of business onon March 31, 2022,28, 2024, the record date for the record date,2024 Annual Meeting, will be entitled to notice of and to vote at the 20222024 Annual Meeting. A total of 163,217,991174,953,282 shares of Common Stock were outstanding as of the record date. Each share of Common Stock entitles its holder to one vote. Cumulative voting of shares of Common Stock is not permitted.

•The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the 20222024 Annual Meeting will be necessary to constitute a quorum to transact business at the meeting.

•Stockholders that instruct their proxy to “abstain” on a matter will be treated as present for purposes of determining the existence of a quorum.

GENERAL INFORMATION (continued)

•At the 20222024 Annual Meeting, a nominee will be elected as a director only if such nominee receives the affirmative vote of a majority of the total votes cast with respect to his or her election (that is, the number of votes cast “for” the nominee must exceed

GENERAL INFORMATION (continued)

the number of votes cast “against,” or withheld as to,“against” the nominee).

•The affirmative vote of a majority of the votes cast will be required to (i) amend and restateapprove the Amended 1997 Incentive Plan;Plan, (ii) adopt, on a non-binding, advisory basis, a resolution to approve the compensation of our NEOs, and (iii) ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accountants.

•Abstentions do not count as votes cast on (i) the election of directors, (ii) the approval of the Amended 1997 Incentive Plan, (iii) the adoption of the non-binding, advisory stockholder vote on the compensation of our NEOs, the approval of the amendment and restatement of the 1997 Incentive Plan,or (iv) or the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accountants, and will have no effect on the outcome of those proposals.

•Broker non-votes (proxies that are uninstructed on one or more proposals and are submitted by banks, brokers, or other nominees that lack discretionary authority to vote on a proposal, under applicable securities exchange rules, absent instructions from the beneficial owner of the shares of stock) will have no effect on (i) the election of directors, (ii) the approval of the amendment and restatement of theAmended 1997 Incentive Plan, the adoption of(iii) the non-binding, advisory stockholder votevotes on the compensation of our NEOs, or (iv) the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accountants. The resolution approving an amendment of the Company’s charter to increase the number of shares of Common Stock that the Company is authorized to issue from 200,000,000 to 400,000,000 shares requires the affirmative vote of a majority of the votes entitled to be cast. For purposes of this vote, abstentions and broker non-votes will have the same effect as a vote against the approval of the charter amendment.

If you hold youra stockholder holds shares of Common Stock of record in yourthe stockholder’s own name, as registered on our stock transfer books, the stockholder’s shares of Common Stock represented by a properly executed proxy on the form enclosed, or authorized via telephone or the Internet in accordance with instructions on such form, and that are timely received by the Secretary of the Company and not revoked, will be voted as instructed on the proxy. If no instruction is made on a properly authorized and returned proxy, the shares represented thereby will be voted FOR the election of each of the eight nominees for director named in this Proxy Statement; FOR the approval of the amendment and restatement of theAmended 1997 Incentive Plan; FOR the approval, on a non-binding, advisory basis, of the compensation of our NEOs; FOR the amendment of the Company’s charter to increase the number of shares of Common Stock that the Company is authorized to issue from 200,000,000 to 400,000,000 shares; and FOR the ratification of the appointment of Ernst & Young LLP as the independent registered public accountants of the Company. If any other matters properly come before the 20222024 Annual Meeting, the enclosed proxy confers discretionary authority on the persons named as proxies to vote the shares represented by the proxy inat their discretion.

If you hold youra stockholder holds shares of Common Stock in “street name” (that is, through a broker or other nominee), yourthe stockholder’s broker or nominee willmay not vote yourthe stockholder’s shares for non-routine items unless you providethe stockholder provides instructions to yourthe broker or nominee on how to vote yourthe stockholder’s shares. YouStockholders should instruct yourtheir broker or nominee how to vote yourtheir shares by following the directions provided by yourthe broker or nominee on its voting instruction form, that youwhich the stockholder should have received with these materials.

Revocability of Proxies

Stockholders may revoke a proxy at any time before the proxy is exercised. Stockholders of record as of the close of business on the record date may revoke a proxy by filing a notice of revocation of the proxy with the Secretary of the Company, by filing a later-dated proxy with the Secretary of the Company, by authorizing a later proxy via telephone or the Internet in accordance with the instructions on the enclosed form of proxy, or by voting in person at the 20222024 Annual Meeting. Attendance at the 2024 Annual Meeting without voting will not automatically revoke a previously authorized proxy. Stockholders that own shares of Common Stock beneficially (in street name) through a bank, broker, or other nominee should follow the voting instruction form provided by their bank, broker, or other nominee to change their voting instructions.

No Dissenters’ or Appraisal Rights

No dissenters’ or appraisal rights are available with respect to any of the proposals being submitted to stockholders for their consideration at the 20222024 Annual Meeting.

Forward-Looking Statements

Certain information and statements included in this Proxy Statement, including, without limitation, statements containing the words “forecast,” “guidance,” “goals,” “projects,” “estimates,” “anticipates,” “believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,” “potential,” “targets,” “aims,” or “will,” or the negative of these words or similar words, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements in this Proxy Statement include, without limitation, statements regarding our future growth and capital plans; our environmental, social, and governance initiatives, policies, practices, and performance; our sustainability goals; and performance goals of our NEOs to the extent such goals are premised on future performance or events. Forward-looking statements involve inherent risks and uncertainties regarding events, conditions, and financial trends that may affect our future plans of operations, business strategy, sustainability goals, results of operations, and financial position. A number of important factors could cause actual results to differ materially from those included within or contemplated by the forward-looking statements herein, including, without limitation, the risks and uncertainties described under “Risk Factors” in ourthe Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.2023. We do not undertake any responsibility to update any of these factors or to announce publicly any revisions to forward-looking statements, whether as a result of new information, future events, or otherwise.

| | | | | | | | |

20222024 Proxy Statement

| 2 | |

ALEXANDRIA REAL ESTATE EQUITIES, INC.

26 North Euclid Avenue

Pasadena, California 91101

This summary highlights information contained elsewhere in this Proxy Statement. As this is only a summary, please read the entire Proxy Statement carefully before voting or authorizing your proxy to vote for you. This Proxy Statement and the enclosed form of proxy are first being mailed to stockholders of Alexandria Real Estate Equities, Inc., a Maryland corporation (the “Company,” “we,” “our,” “us,” or “Alexandria”),the Company on or about April 18, 2022.3, 2024.

20222024 Annual Meeting of Stockholders

Date and Time: Tuesday, May 17, 2022,14, 2024, at 11:00 a.m. EasternPacific Time

Place: Alexandria Center® for Life Science, 450 E. 29th Street, New York, NY 1001626 North Euclid Avenue, Pasadena, CA 91101

Voting: Only holders of record of the Company’s common stock, $0.01 par value per share (“Common Stock”),Stock as of the close of business on March 31, 2022,28, 2024, the record date, are entitled to notice of andand to vote at the 20222024 Annual Meeting of Stockholders (the “2022 Annual Meeting”).Meeting. Each share of Common Stock entitles its holder to one vote.

Proposals and Board Recommendations

| | | | | | | | | | | | | | |

| Proposal | | Board Recommendation | | For More Information |

1.Election of directors | | “FOR” all nominees | | |

2.Amendment and restatementApproval of the Company’s Amended and Restated 1997 Stock Award and Incentive Plan (the “1997 Incentive Plan”) | | “FOR” | | “FOR” | |

3.Approval, on a non-binding, advisory basis, of the compensation of the Company’s named executive officersNEOs | | “FOR” | | “FOR” | |

4.Amendment of the Company’s charter to increase the number of shares of common stock that the Company is authorized to issue from 200,000,000 to 400,000,000 shares | | “FOR” | | |

5.Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accountants for the fiscal year ending December 31, 20222024

| | “FOR” | | “FOR” | |

| | | | |

How to Cast Your Vote

You may vote or authorize your proxy by any of the following methods:

| | | | | | | | |

| Internet | | | | | | | | Mail |

Internet | | Mail |

until 11:59 p.m. Eastern Time on May 16, 202213, 2024 | | Sign, date, and mail your proxy card or voting instruction form in the envelope provided as soon as possible. It must be received no later than May 13, 2024. |

Beneficial Owners

and Registered Stockholders

www.proxyvote.com | |

| | |

| Phone | | In Person |

Registered Stockholders

www.voteproxy.com

| |

| | |

Phone | | In Person |

until 11:59 p.m. Eastern Time on May 16, 202213, 2024 | | Beneficial Owners Admission is based on proof of ownership, such as a recent brokerage statement; voting in person requires a valid “legal proxy” signed by the holder of record.

Registered Stockholders Attend and vote your shares in person. |

Beneficial Owners

800-454-8683 | |

Registered Stockholders

800-776-9437

800-690-6903 | |

Important Notice Regarding Availability of Proxy Materials for the 2024 Annual Meeting of Stockholders: The Notice of 2024 Annual Meeting of Stockholders, the Proxy Statement, and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available free of charge athttps://investor.are.com/financial-information/proxy.

| | | | | | | | |

20222024 Proxy Statement

| 3 | |

PROXY STATEMENT SUMMARY (continued)

Business Overview

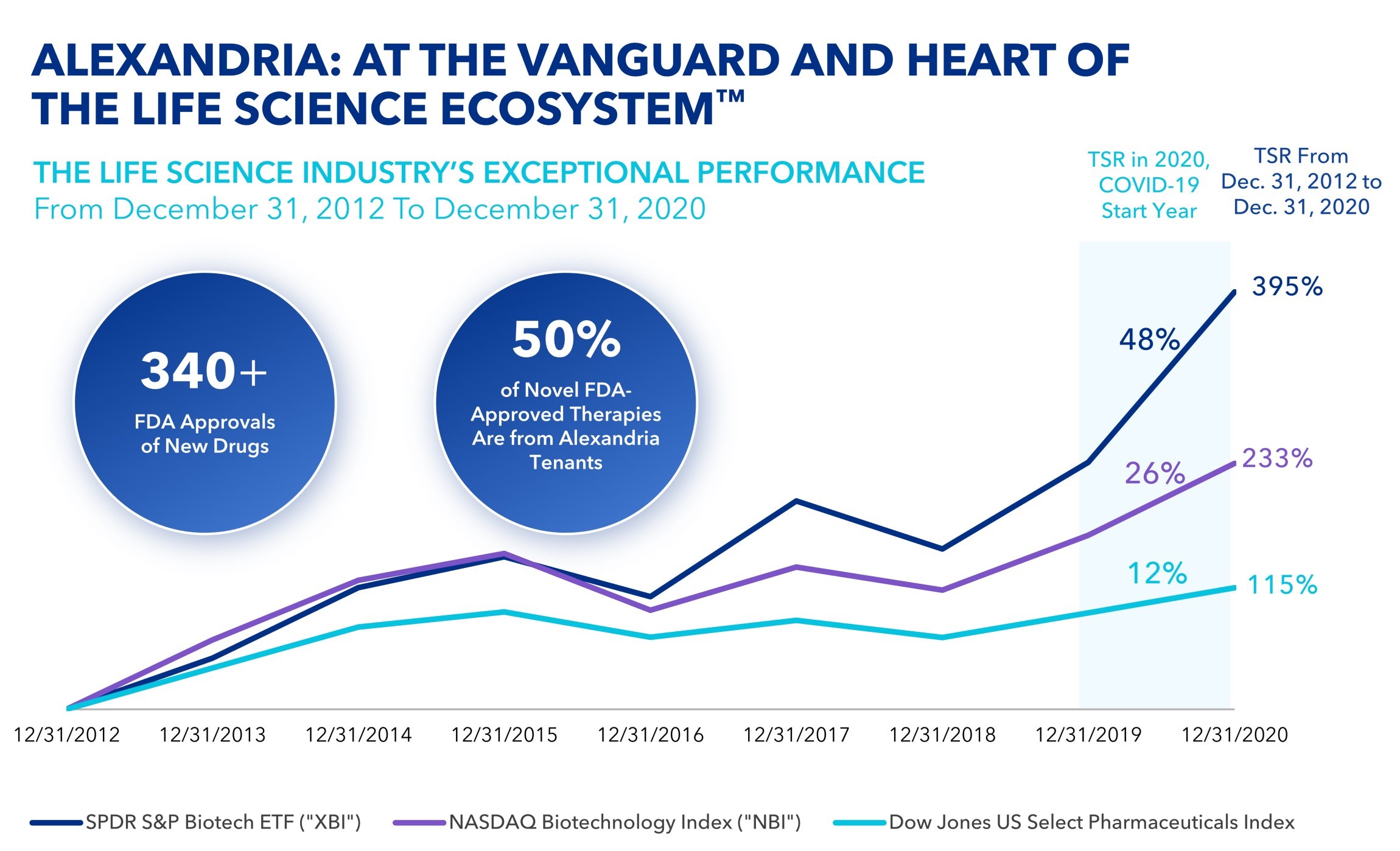

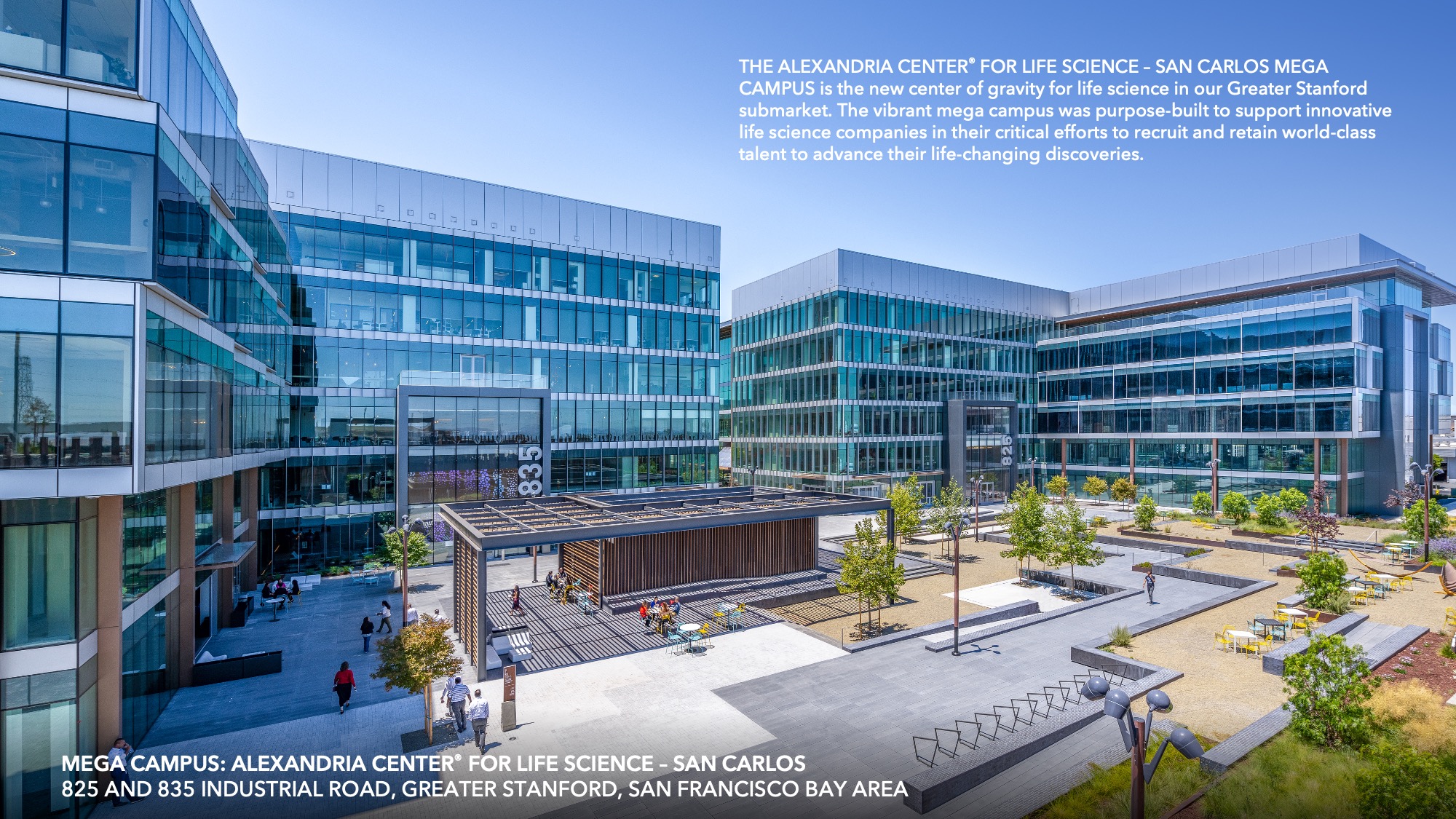

Over 28 yearsMore than three decades ago, Alexandria’s Executive Chairman and Founder, Joel S. Marcus, led the formation, financing, development, personnel recruitment, and operations of a new mission-driven real estate company. Founded in 1994 as a garage startup with $19 million in Series A capital and a bold vision to support and drive forward the mission-critical life science industry, Alexandria invented and pioneered the life science real estate niche to deliverdevelop and operate the highly complex infrastructure and foster the holistic ecosystems needed to catalyze innovation and improve human health. Today, the highlyAlexandria has built a stellar reputation of delivering world-class, sophisticated S&P 500Labspace® urban office facilities to transformative life science companies and has cultivated trusted, strategic relationships with a real estate investment trust (“REIT”) isindustry-leading, high-quality and well-diversified client base. Today, Alexandria remains the leadingpreeminent and longest-tenured owner, operator, and developer uniquely focused on collaborative life science agricultural technology (“agtech”), and technologymega campuses in AAA innovation cluster locations. locations, including Greater Boston, the San Francisco Bay Area, New York City, San Diego, Seattle, Maryland, and the Research Triangle.

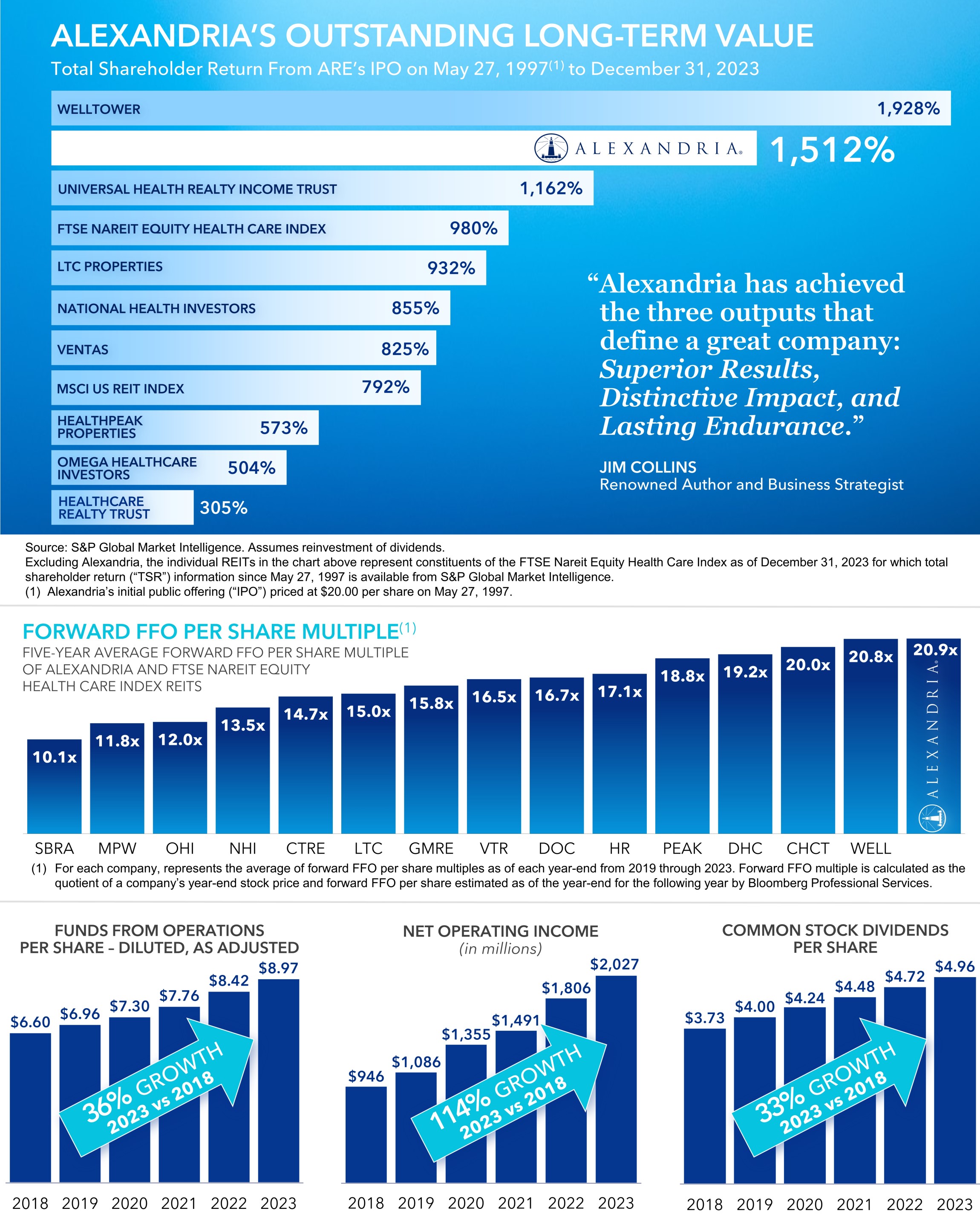

As of December 31, 2021,2023, Alexandria had a total marketequity capitalization of $44.0$21.8 billion and an asset base in North America of 67.073.5 million square feet (“SF”), which includes 38.842.0 million rentable square feet (“RSF”) of operating properties, and 4.85.5 million RSF of Class AA/A+ properties undergoing construction 8.7and one near-term project expected to commence construction in the next two years, 2.1 million RSF of near-term and intermediate-termpriority anticipated development and redevelopment projects, and 14.723.9 million SF of future development projects. In May 2022,January 2024, Alexandria celebrated the Company will celebrate 25 years as a New York Stock Exchange (“NYSE”) listed company. We are extremely proud and honored to be at the vanguard and heart30th anniversary of the mission-critical life science ecosystem, where we have cultivated trusted relationships with our industry-leading, high-quality tenant base of over 850 companies to advance solutions to current and future healthcare challenges, and ultimately to benefit humankind.Company’s founding.

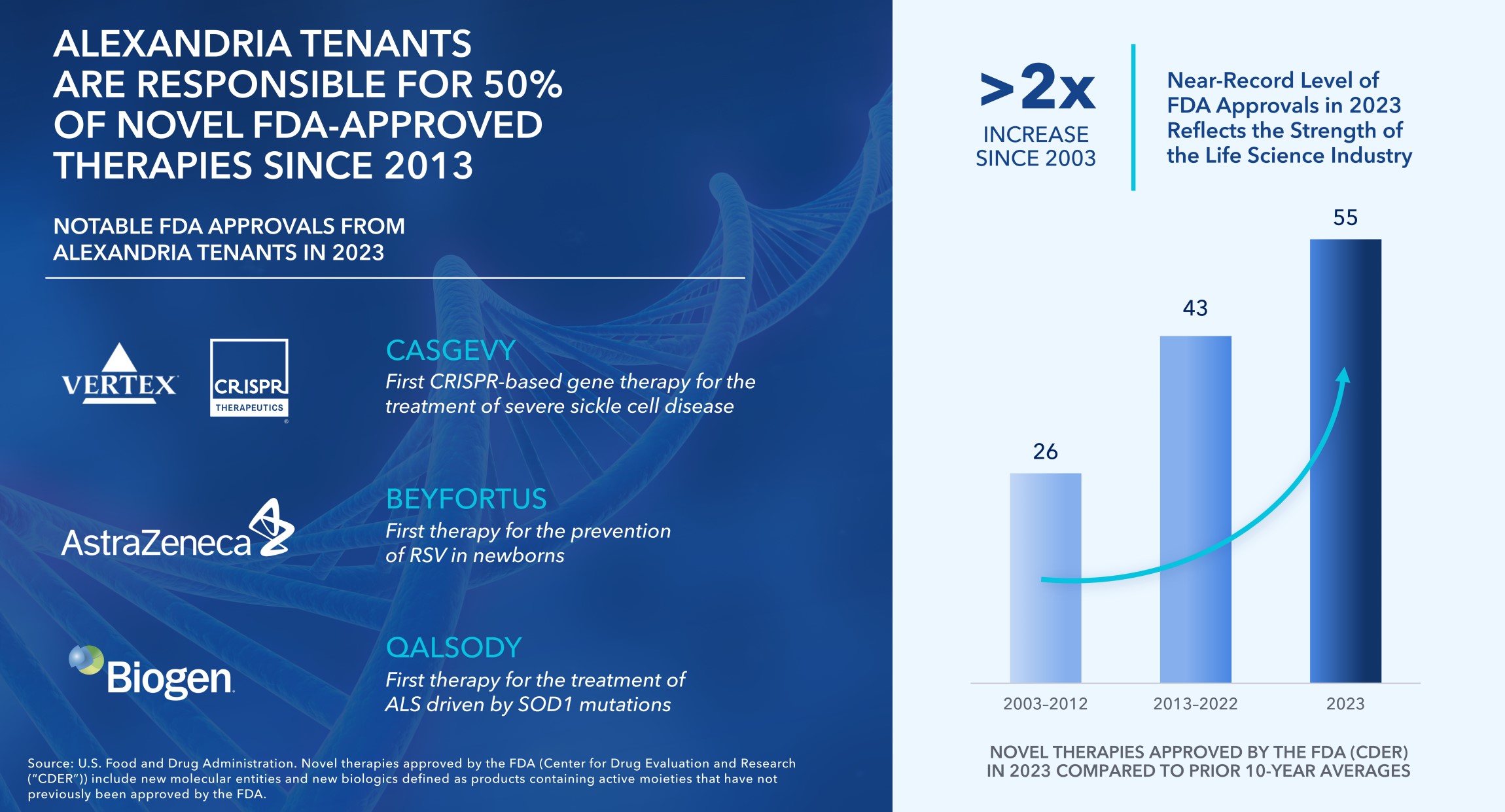

Our primary business objective is to maximize stockholder value by providing our stockholders with the greatest possible total return and long-term asset value and stockholder returns based on a multifaceted platform of internal and external growth. Since the Company’s inception, Alexandria has focused itsour strategy on developing and implementing our unique and successful business model and has generated long-term value and growth in net asset valueoperating income (“NOI”), while also making a positive and lasting impact on society. Alexandria has also continued to enhancemaintain our exceptional credit profileprofile. As of December 31, 2023, our credit ratings from S&P Global Ratings and has a corporate credit rating of Baa1/Stable by Moody’s Investors Service were BBB+ and BBB+/Positive by S&P Global Ratings, which ranksBaa1, respectively, and continued to rank in the top 10% among all publicly traded U.S. REITs. In addition, as of December 31, 2023, Alexandria is alsowas in the top 10% among all publicly traded U.S. REITs by total equity capitalization as of December 31, 2021.capitalization.

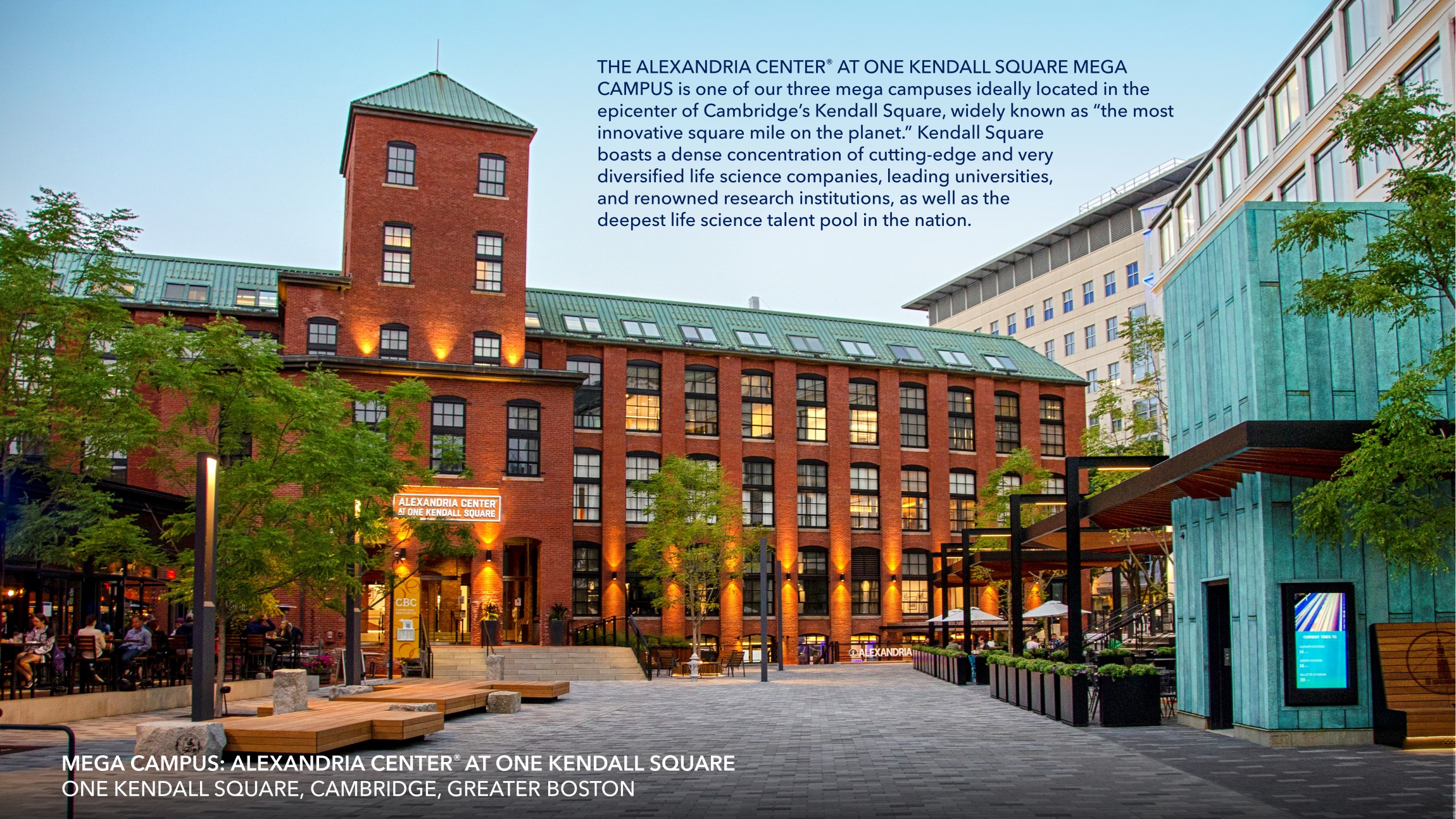

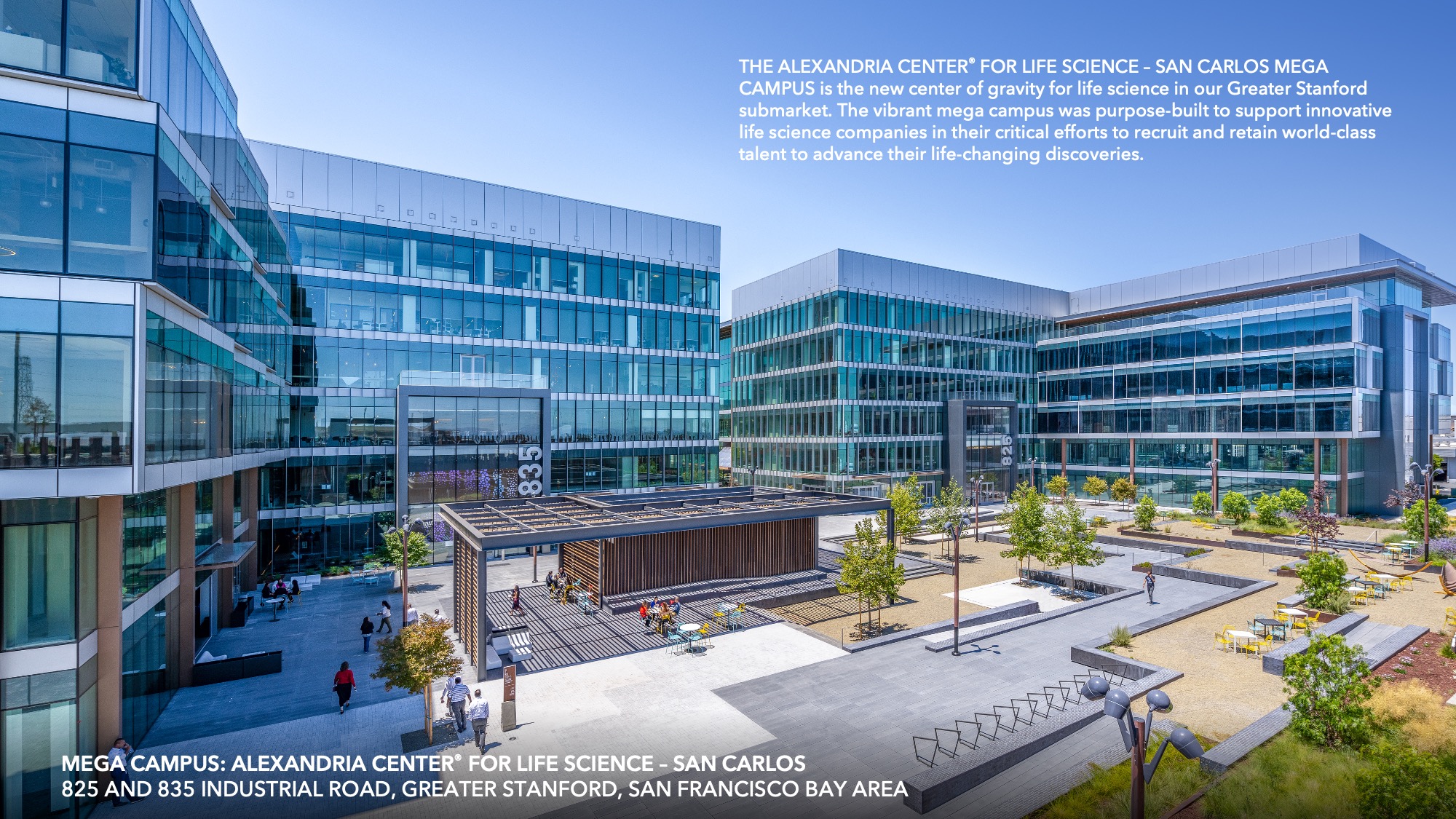

The Company’s extraordinary growth was accelerated through the tremendous execution of our visionary ecosystem-building and cluster campusdevelopment strategy as informed byapplied to the life science industry. Utilizing Harvard Business Professor Michael E. Porter’s cluster theory. Utilizing this theory as the basis for our proven cluster model, we identified and brought togetherwere first to identify the four critical components necessary forto create a successful life science companies to thrive —cluster: location, innovation, talent, and capital. We also intentionally evolved our original focus on single assets to amenity-rich, collaborative cluster campuses and then to today’s differentiated mega campuses. Our world-class mega campuses consist of approximately 1 million RSF or more RSF and provide a superior set of amenities, services,our innovative tenants with highly dynamic and transitcollaborative environments that offer our tenants valuable strategic optionality and increaseenhance their ability to attractsuccessfully recruit and retain top talent.world-class talent and inspire productivity, efficiency, creativity, and success. Our mega campuses also generate premium rental rates relative to single assets.

Our strategy for producing long-term, sustainable stockholder value has been developed over nearlymore than three decades by management in collaboration with the Board. ManagementAlexandria’s highly experienced management team and the Board work together to develop, implement, monitor, and, as necessary, adjust our strategy and measure our progress toward executing and achieving it.

Fully Integrated Team Driving Long-Term Value Through Our Differentiated and Mission-Driven Business Model

At Alexandria, our people are our most important asset. We are profoundly grateful for the Alexandria team, whose passion, commitment, and operational excellence have directly contributed to Alexandria’s strong and sustainedoperating performance. Alexandria’s highly experienced and fully integrated team has expertise inacross a range of functions, including real estate, leasing and asset management, construction and development, laboratory operations, accounting and finance, venture investing, strategic programming, sustainability,, philanthropy, legal matters, communications, design, and information technology.

As a mission-driven company, at the vanguard and heart of the life science industry, we are deeply committed to building the future ofcatalyzing life-changing innovation and leading the way for positive change to benefit human health, our local communities, and the world. We differentiate ourselves by having a deep-rooted passion for our mission, a pioneering spirit to continually innovate, and a disciplined approach that delivers financial consistency and stability for our investors. We believe that accomplishing meaningful endeavors drives extraordinary growth, and we remain highly focused on fulfilling our important mission and executing our multifaceted business model, both of which continue to distinguish us from other REITs and provide us with a significant competitive advantage and give us confidence for the future.

Alexandria’s differentiated business has longalways been about more than real estate, and our mission — to create and grow life science ecosystems and clusters that ignite and accelerate the world’s leading innovators in their noble pursuit to advance human health by curing disease and improving nutrition — drives everything we do. It has shaped our pioneering, impactful, and enduring business, and it is the unifying basis on which we have built on the foundation of our four strategic and integrated verticals of real estate, venture investments, corporate responsibility, and thought leadership, and venture investments. Alexandria has amassed a nearly three-decade track record of successfully creating, nurturing, managing, and growing life science ecosystems and clusters across the country, where we have extended our proven approach to cluster building beyond the built environment.leadership. We also leverage our deep engagement in corporate responsibility, venture investments, and thought leadershipacross each of our four key verticals to catalyzefoster vibrant ecosystems that accelerate the translation of scientific discoveries into new treatments and cures that aim to improve and save people’s lives.

| | | | | | | | |

20222024 Proxy Statement

| 4 | |

PROXY STATEMENT SUMMARY (continued)

| | | | | | | | |

20222024 Proxy Statement

| 5 | |

PROXY STATEMENT SUMMARY (continued)

| | | | | | | | |

20222024 Proxy Statement

| 6 | |

PROXY STATEMENT SUMMARY (continued)

(1)Based on Alexandria’s score as of January 29, 2024, and scores available for the FTSE Nareit All REITs Index companies from Bloomberg Professional Services as of December 31, 2023.

(2)Based on Alexandria’s score as of January 29, 2024, and scores available for the FTSE Nareit All REITs Index companies on ISS’s website as of December 31, 2023.

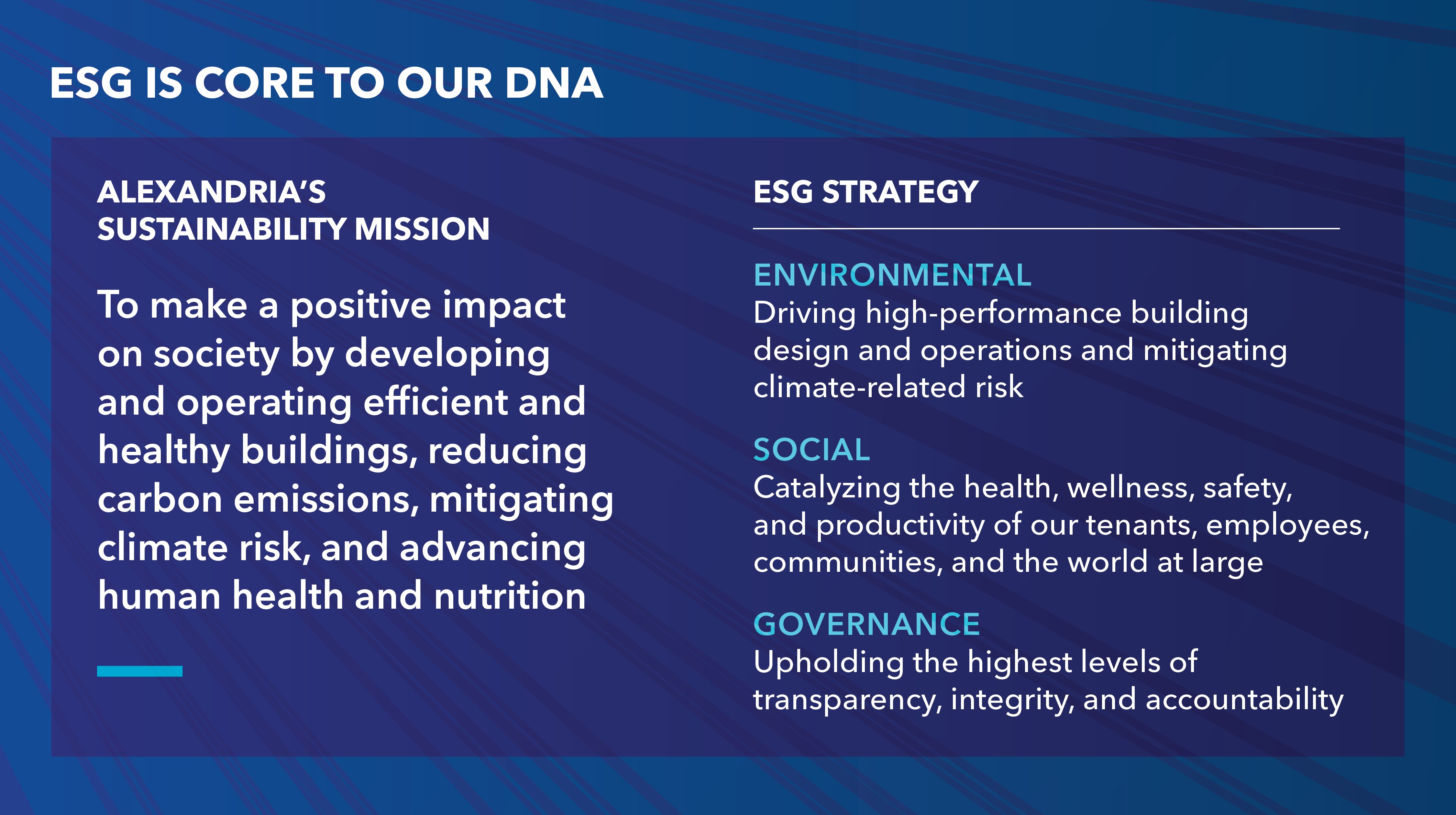

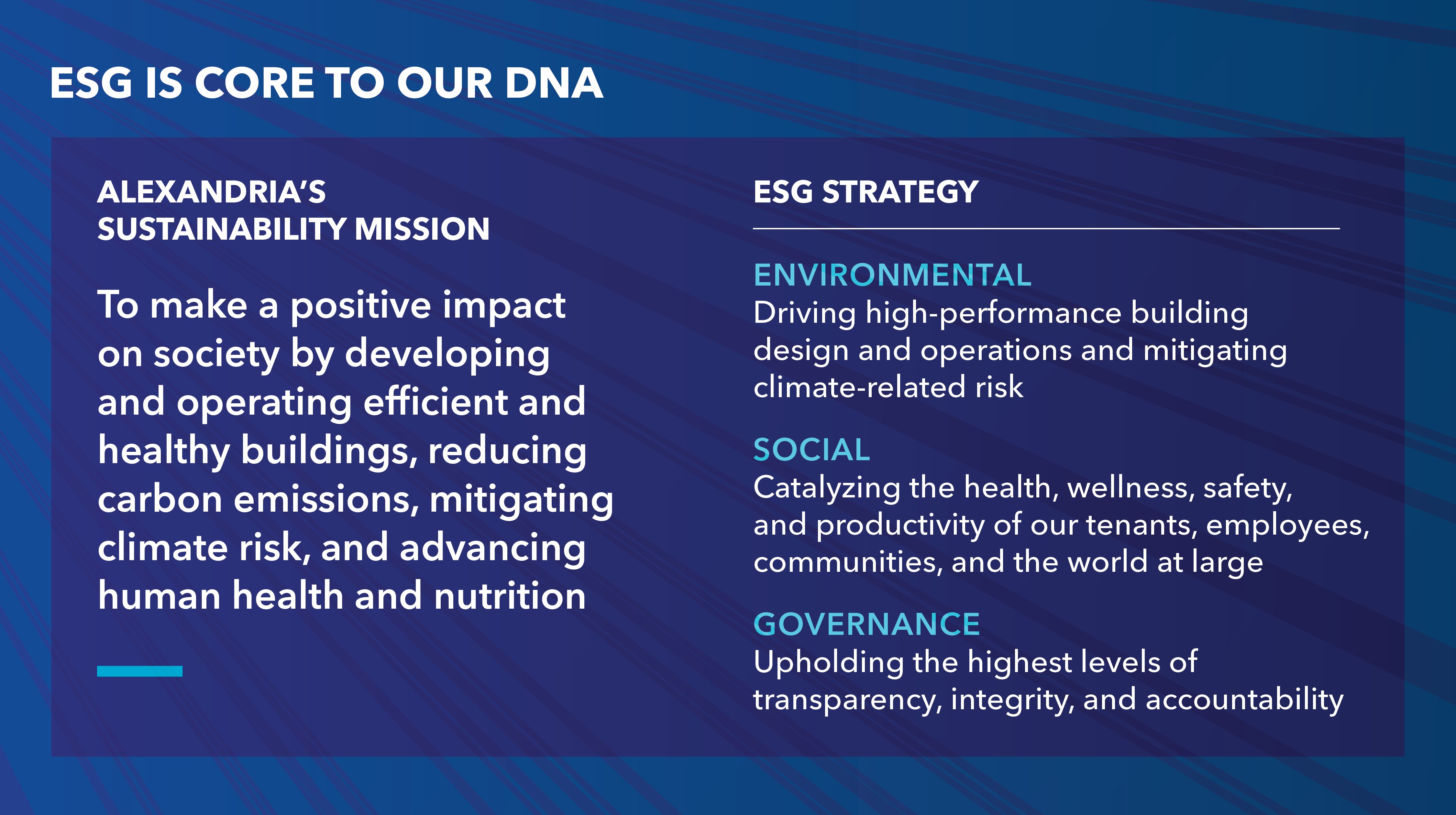

Overview of Our Environmental, Social, and Governance LeadershipCorporate Responsibility Initiatives

| | | | | |

| ESG HIGHLIGHTS

Our ESGcorporate responsibility efforts are reflected throughout this Proxy Statement. Key topics include: |

Climate Change and Environmental Sustainability | |

| Social Responsibility | |

Building a Diverse and Inclusive WorkforceOur People: Dedication to Our Best-in-Class Team | 19 |

| Corporate Governance Highlights | |

Board DiversityComposition | 23 |

| Stockholder Outreach and Engagement | |

| Human Rights Policy and Vendor Code of Conduct | 29 |

We are guided by our culture of idea meritocracy, mutual respect, diversity, humility, transparency, and teamwork, and we are profoundly grateful to be a trusted partner within the life science industry. In addition to enabling the discovery and development of life-improving and lifesaving treatments and cures that are key to solving current and future healthcare challenges, we are working to revitalize and support our communities, empower the next generation of innovators, and, ultimately, contribute to a more sustainable and productive society.

As a mission-driven company, environmental, social, and governance (“ESG”) leadershipour corporate responsibility platform is core to our DNA. At Alexandria, we believe that doing well in our business and doing good for society are inherently linked endeavors. This belief shapes every aspect of our multifaceted business model and supports our industry-leading corporate responsibility efforts. For us, ESG is about much more than meeting target metrics — it is criticalplatform.

Alexandria continues to fulfilling our mission to advance human health and improve nutrition. It remains our goal to tackle climate change by reducing carbon emissions associated with the operations and construction of our assets, mitigating climate-related risk in our real estate portfolio, and investing in and providing essential infrastructure for sustainable agrifoodtech companies. We continue to catalyze the health and vitality of the communities where we live, work, and develop; and we also implement impactful solutions to society’s most pressing challenges to contribute to a healthier, more sustainable, and more productive society. Our longstanding efforts have benefited our tenants, employees, and communities, as well as preserved and enhanced value for our stockholders over the long term.

Our deepdemonstrate its commitment to corporate responsibility continuessustainability. Our leadership in this area was recognized by GRESB, which awarded us several achievements in the 2023 GRESB Real Estate Assessment. We earned 4-Star Ratings in the operating asset and development benchmarks and our seventh consecutive Green Star designation. Additionally, we received our sixth consecutive “A” disclosure score with a perfect score of 100 and a #1 ranking for transparency regarding our sustainability practices and reporting.

PROXY STATEMENT SUMMARY (continued)

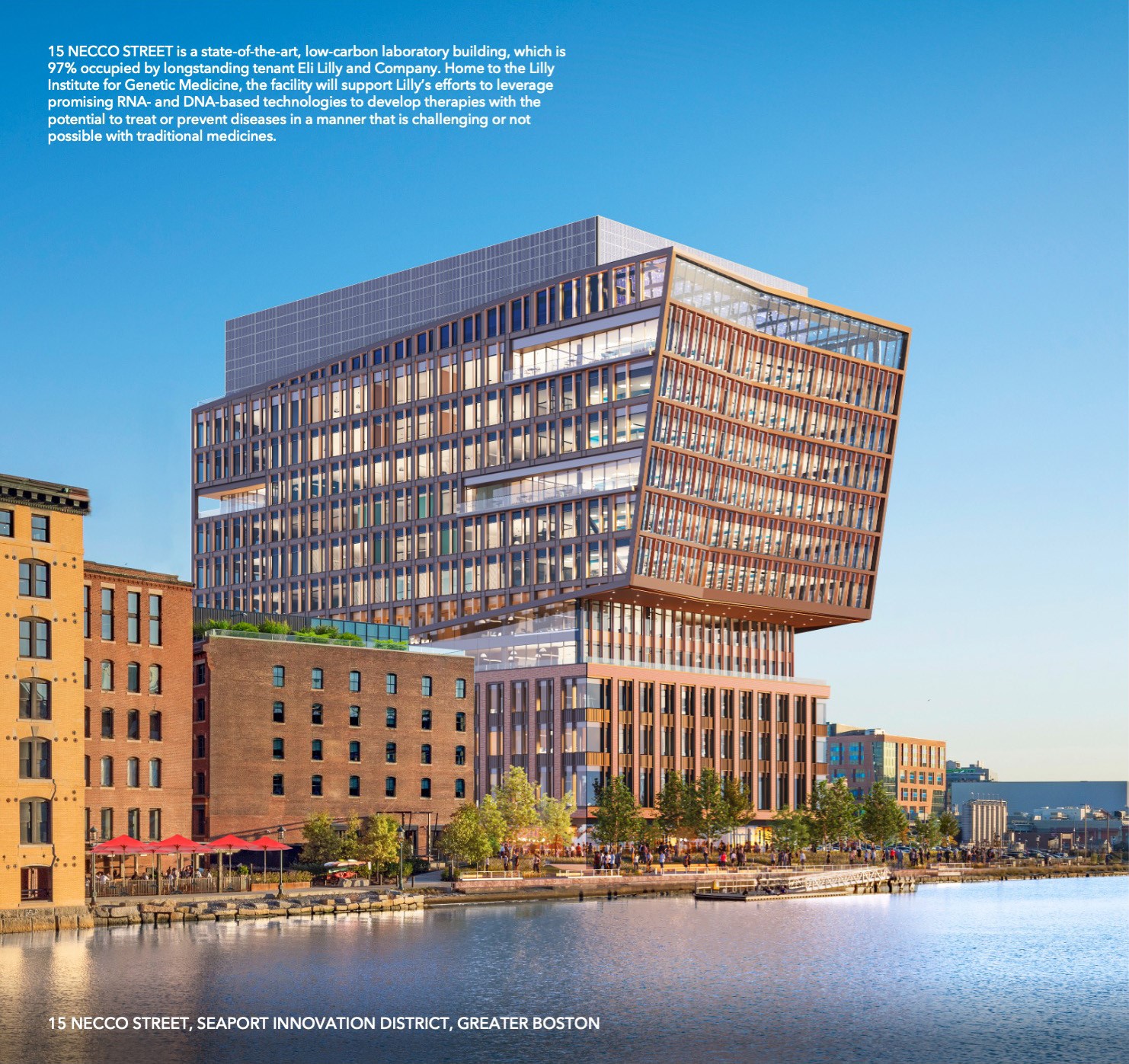

In August 2023, we were awarded a 2023 Design Award in the Climate Action category by the American Institute of Architects California (“AIA California”) for 685 Gateway Boulevard in South San Francisco, an amenities hub designed at the forefront of sustainability. The building, which is designated as Zero Energy Ready and is on track to

earn us broad external recognition. See page 12 for a selectionachieve the International Living Future Institute’s Zero Energy certification, was one of

only two projects to achieve the highest level of recognition in the awards

and recognition program.

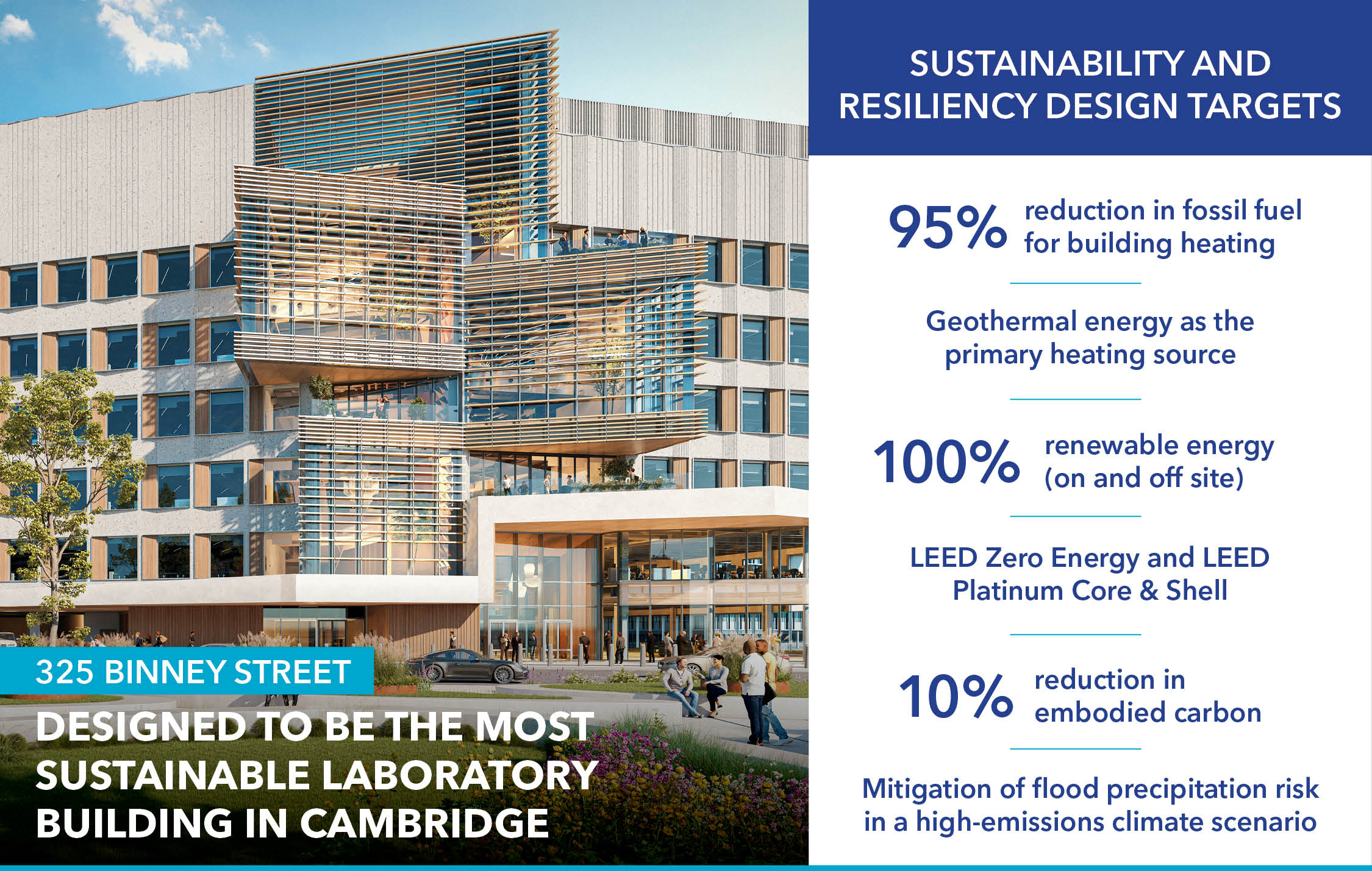

Alexandria hasalso received over the past year. Among our ESG highlights, we are particularly proudCambridge Chamber of our focus on highly sustainable and climate-resilient buildings, including our development atCommerce’s 2023 Visionary Award for developing 325 Binney Street, — designed to be the most sustainable laboratory building in Cambridge — that wasand selected by Moderna Inc. (“Moderna”) foras its futurenew global headquarters and core R&D facility; our leadershipcenter. The chamber’s annual awards recognize innovators from the business, institutional, and non-profit communities effecting change and making a positive impact on people’s lives in pioneering OneFifteen, a novel, data-driven comprehensive model providing a full continuum of care to support the fullCambridge and sustained recovery of people living with addiction; and continued enhancement of our pioneering social responsibility initiatives, including the launch of two new pillars: one addressing the growing mental health crisis, with a focus on helping children cope with the loss of a parent or family member to suicide; and another supporting national museums to preserve our nation’s history and honor our greatest heroes.beyond.

PROXY STATEMENT SUMMARY (continued)

During 2021, we were recognized by Global Real Estate Sustainability Benchmark (“GRESB”), one of the leading global ESG benchmarks for real estate and infrastructure investments, as the Global Sector Leader and achieved the highest 5 Star rating in the Diversified Listed sector for outstanding ESG integration in our value-creation development projects. Alexandria earned the #2 ranking in the U.S. Science & Technology sector, reflecting our continued sustainability performance leadership across our mission-critical office/laboratory properties, which operate 24/7. We also received our fourth consecutive “A” disclosure score for transparency around our practices and performance.

In addition, Alexandria was ranked #5 in Barron’s publication of the “10 Real Estate Companies That Are Both Greener and More Profitable” on February 19, 2022. Alexandria also received an ESG Rating of “A” from MSCI Inc. (“MSCI”) due to our continued advancement of green building opportunities, our talent management programs, and our below-industry-average employee turnover rate, among other achievements. Our MSCI ESG Rating is in the top 10% among all publicly traded U.S. equity REITs.

As a testament to our comprehensive and rigorous approach to protecting the health, wellness, and safety of our building occupants, Alexandriawe achieved a Fitwel® Viral Response Certification with Distinction, the highest designation within the Viral Response Module, for the secondfourth consecutive year. The evidence-based, third-party certification was developed by Fitwel, the world’s leading certification system committed to healthier buildings and workplace environments. Alexandria continuesWe continue to pursue Fitwel and WELL® healthy building certifications, which recognize industry-leading approaches to promoting the health, wellness, and productivity of the Company’sour employees and tenants in the workplace.

The tangible impact of our corporate responsibility endeavors is also highlighted in our leadership in pioneering OneFifteen, a personalized, non-profit data-driven healthcare system providing a full continuum of care dedicated to addiction recovery. Since it opened its doors in 2019, OneFifteen has treated over 7,500 patients living with opioid addiction and other substance use disorders.

In 2021,2023, we earned our fourth consecutiveseventh Gold and sixtheighth overall Nareit Investor CARE Gold Award in the Large Cap Equity REIT category for superior communications and reporting. This distinction, which represents the most Nareit Investor CARE Gold Awards earned by any equity REIT, is directly attributed to our world-class team’s operational excellence in upholding the highest levels of transparency, integrity, and accountability to our stockholders.

In the following sections, we provide some additional background on our ESG efforts. For more information, please see our annual ESG Report, which is available at www.are.com/corporate-responsibility.html and is in accordance with the Core option of the Standards of the Global Reporting Initiative (“GRI”). We continue to evaluate the use of the standards developed by the Sustainability Accounting Standards Board (“SASB”) as a non-financial reporting framework to supplement or complement our current reporting.

While we are proud of our achievements and actions to date weand recognize that it is vital to continue aiming for higher levels of sustainability and ESG performance.making an impact through our corporate responsibility initiatives. We strive to make continuous improvements to our ESG platform, as well asand to partner with our innovative tenants to help them realize their ESGsustainability goals and priorities, in ordereach case to expand our trusted relationships, drive long-term progress, and make a positive and meaningful impact on our society. We are guided by our culture of idea meritocracy, mutual respect, diversity, humility, transparency, and teamwork, and we are profoundly grateful for our position at the vanguard and heart of the life science ecosystem, where we are able to catalyze and lead the way for positive change to benefit human health and society. Alexandria’s enduring business success reflects our team’s shared passion for, and execution of, our pioneering ESG initiatives. We are proud to do our part to: enable the scientific and technological breakthroughs that are key to solving major healthcare challenges; revitalize and support our communities; empower the next generation of innovators; and, ultimately, contribute to a more sustainable and equitable society.

PROXY STATEMENT SUMMARY (continued)

Climate Change and Environmental Sustainability

Board of Directors and Leadership Oversight

Alexandria is committed to conducting its business in accordance with high standards of corporate governance, transparency, integrity, and accountability, led by an independent and objective Board. The Board has overall responsibility for oversight of the Company’s risk management, including the Company’s corporate responsibility strategy. This oversight takes place both directly by the Board and through its committees.

As provided in the Audit Committee Charter and disclosed in the Audit Committee Charter and in theEnvironmental Sustainability Policy, the Audit Committee of the Board oversees the management of the Company’s financial and other systemic risks, including those related to climate change and sustainability.change. At a management level, Alexandria’s Sustainability Committee,sustainability committee, which comprises members of the executive team and senior decision makers fromspanning the Company’s Real Estate Development, Asset Management, Risk Management,real estate development, asset management, risk management, and Sustainabilitysustainability teams, leads the development and execution of our approach to sustainability and climate-related risk.

The Company’s Environmental Sustainability Policy applies to all of the operations of the Company and itsour direct and indirect subsidiaries, regardless of geographic location. As documented in the Company’s Vendor Code of Conduct, we also expect our vendors, service providers, contractors, and consultants, as well as their employees, agents, and subcontractors, to embrace our commitment to ethical, environmental, and social standards throughoutacross the Company’s supply chain.

The Audit Committee Charter, the Environmental Sustainability Policy, and the Vendor Code of Conduct are posted on the Company’s websiteavailable at https://investor.are.com/corporate-governance/disclosure/www.are.com/corporate-responsibility.html.

Proactively Managing and Mitigating Climate Risk

The resilience of our properties under a changing climate is paramount both for our business and our tenants’ mission-critical research, development, manufacturing, and commercialization efforts. We are reviewing the potential impacts associated with climate change and extreme weather conditions as they relate to the acquisition, design, development, and operations of our buildings and campuses. We align our climate change management efforts with the guidelines issued by the Task Force on Climate-related Financial Disclosures (“TCFD”), which we endorsed in 2018. Our industry-leading environmental initiatives, programs, and policies and our proactive approach to the identification and management of evolving physical conditions and transition issues continue to raise the bar in the industry for mitigating greenhouse gas (“GHG”), or carbon, emissions and bolstering climate resilience. Furthermore, our tenant preferences for green, efficient, and healthy buildings continue to rise. As of December 31, 2021, 80% of Alexandria’s top 20 tenants (by annual rental revenue) have set net-zero carbon and/or carbon neutrality goals, compared to 50% of our top 20 tenants as of December 31, 2020. Our sustainability mission compels us to reduce carbon emissions and mitigate climate risk, as do our tenants’ expectations and the changing regulatory environment. Recognizing these imperatives, we are evaluating a comprehensive approach to assessing and mitigating physical risk to our properties and to preparing for the net-zero transition, as described below.

Assessing and Mitigating Physical Risk to Our Properties

In accordance with TCFD methodology, we are reviewing a range of scenarios for 2030 and 2050 in evaluating physical risk to our properties: (1) a business-as-usual scenario in which GHG emissions continue to increase with time (Representative Concentration Pathways (“RCP”) 8.5); and (2) a mitigation scenario in which GHG emissions level off by 2050 and decline thereafter (RCP 4.5). To ensure a conservative evaluation of potential risk at the asset level, we will use the RCP 8.5 scenario, which has greater climate hazard impacts than RCP 4.5. These climate change assessments covering both acute and chronic risks will enable us to assess preparedness for climate-related risks across the real estate life cycle.

For our property acquisitions, our risk management and sustainability teams will conduct climate change evaluations and advise the transactions and property teams of any need for potential property upgrades, which will be evaluated in our financial modeling and transactional decisions.

For our developments and redevelopments of new Class A properties, we will evaluate the potential impact of sea level rise, storm surges in coastal or tidal locations, and changing temperatures out to the year 2050. As feasible, we will consider designs that accommodate potential expansion of cooling infrastructure to meet future building needs while also providing flexibility and optimization of infrastructure funds for more immediate needs. In water-scarce areas, we will consider planting drought-resistant vegetation and equipping buildings to connect to a municipal recycled-water infrastructure where available and feasible. In areas prone to wildfire, we will work toward incorporating brush management practices into landscape design and including enhanced air filtration systems to support safe and healthy indoor air.

At our buildings in operation, we are evaluating the extent to which we have mitigations in place and which operational and physical improvements may be made. For example, resilience measures that may be implemented at some of our properties will include the following: in areas prone to floods, critical building mechanical equipment will be positioned on the roofs or significantly above the projected potential flood elevations; temporary flood barriers will be stored on-site to be deployed at building entrances prior to a flood event; property entrances or the first floor will be elevated above projected present day and future flood elevations; backflow preventers on storm/sewer utilities that discharge from the building will be installed; and the building envelope will be waterproofed up to the projected flood elevation. In areas prone to fire, we will position our properties away from large fire hazards, such as large grassy or brush areas; we will select less flammable landscaping vegetation species and position them in a reasonable distance from a property; we will construct building

| | | | | | | | |

20222024 Proxy Statement

| 98 | |

PROXY STATEMENT SUMMARY (continued)

envelopes with fire-resistant materials; and we will install HVAC systems that are able to filtrate smoke particulates in the air in the event of fire.

Monitoring and Preparing for Transition Risk

Alexandria will evaluate a comprehensive approach to responding to transition risk through the following strategies:

Decarbonizing construction

Alexandria targets LEED® Gold or Platinum certification for new ground-up developments. Through our sustainability goals for new developments, we are exploring opportunities for delivering energy- and resource-efficient buildings that will meet or exceed tenant, city, and state requirements for energy and water efficiency, material sourcing, biodiversity, and alternative transportation.

We are also revolutionizing building design through innovative low-carbon solutions. At 325 Binney Street, on our Alexandria Center at One Kendall Square mega campus in Cambridge, the building design is expected to yield a 95% reduction in fossil fuel consumption. The project is targeting LEED Platinum Core & Shell and LEED Zero Energy certifications. At 685 Gateway Boulevard in South San Francisco, we are targeting Zero Energy Certification through the International Living Future Institute by leveraging design strategies such as building envelope optimization, high-performance features, and on-site energy generation.

With several jurisdictions shifting (or with plans to shift soon) from fossil fuels for heating and requiring all electric buildings as a strategy to reduce carbon emissions associated with building operations, we have proactively incorporated electrification into building designs, with one project completed and two currently in progress.

Embodied carbon in building materials used for real estate construction purposes accounts for 11% of annual global GHG emissions, and Alexandria is taking a leadership role in the industry’s efforts to measure and ultimately reduce carbon associated with the construction process. In 2019, Alexandria became a sponsor and the first REIT to use the Carbon Leadership Forum’s Embodied Carbon in Construction Calculator tool. For new construction projects, Alexandria seeks to procure products with Environmental Product Declarations (“EPDs”), which provide information on product composition and environmental impact. Using such EPDs, Alexandria aims to reduce embodied carbon by 10% for new ground-up development projects. As of December 31, 2021, Alexandria has completed three embodied carbon assessments and others are in progress for 15 development projects.

PROXY STATEMENT SUMMARY (continued)

Leveraging renewable energy

We are pursuing opportunities to power our buildings with renewable energy as another means to reduce our carbon footprint. Properties such as 3215 Merryfield Row in San Diego are generating solar energy, and our development pipeline will scale our ability to source additional clean energy on-site. We also procure renewable energy generated off-site from local utilities and from power service providers for some of our operating assets.

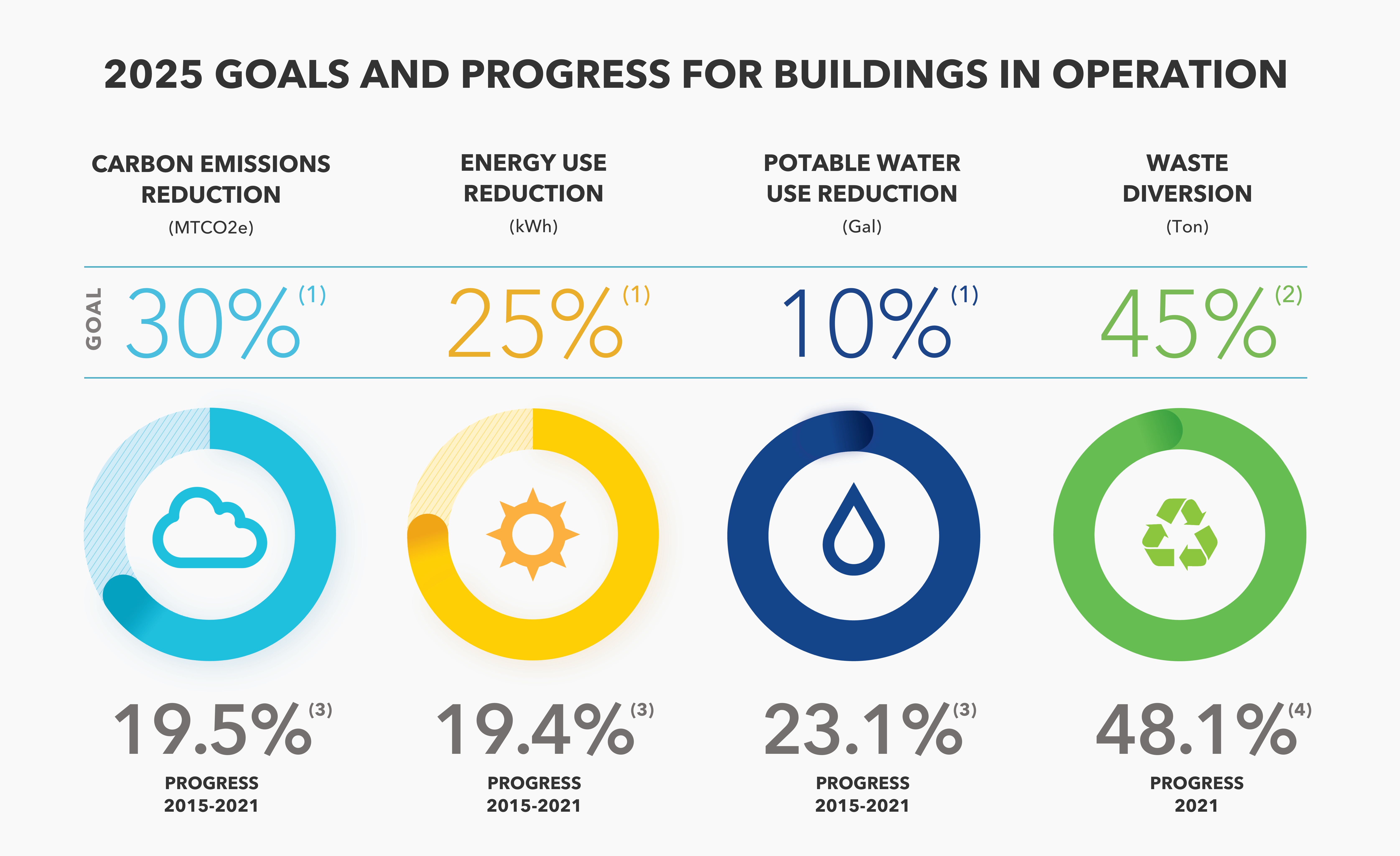

Reducing the environmental footprint of buildings in operation

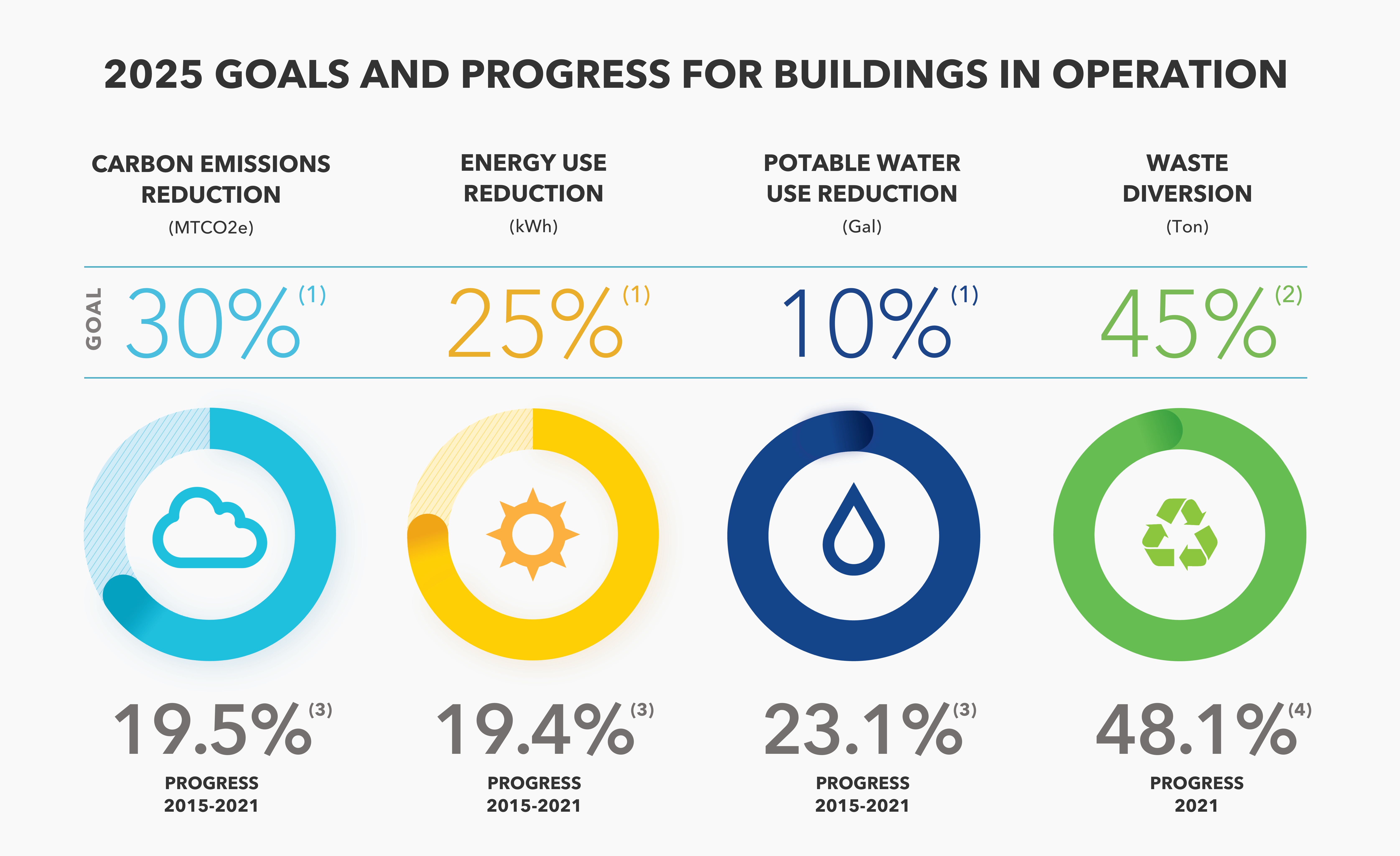

Our sustainability mission compels us toward industry-leading sustainability practices and performance that can help reduce operating expenses and result in higher occupancy levels, longer lease terms, higher rental income, higher returns, and greater long-term asset value, and thus enable us to capture climate-related opportunities. Our ongoing efforts to reduce consumption are driven by our commitment to operational excellence in sustainability, building efficiency, and service to our tenants. Alexandria’s 2025 sustainability goals for buildings in operation and new ground-up construction projects provide the framework, metrics, and targets that guide the Company’s focus on continuous, long-term improvement. For buildings in operation, we set goals to reduce carbon emissions, energy consumption, and potable water consumption and increase waste diversion by 2025. Our progress toward these goals is summarized in the chart below.

Environmental data for 2021 reflected in the chart above received independent limited assurance from DNV Business Assurance USA, Inc (“DNV”). The Independent Assurance Statement from DNV is available on our website at https://www.are.com/corporate-responsibility.html.

(1)Relative to a 2015 baseline for buildings in operation that Alexandria directly manages.

(2)For buildings in operation that Alexandria indirectly and directly manages.

(3)Reflects sum of annual like-for-like progress from 2015 through 2021.

(4)Reflects progress for all buildings in operation during 2021 that Alexandria indirectly and directly manages.

As we look to the future, we are creating our long-term strategy and plan for the net zero-carbon transition. We are developing an approach to set industry-leading science-based targets that will provide a pathway to reduce scope 1, 2, and 3 GHG emissions and continue our leadership in sustainability.

Refer to “Item 1A. Risk factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 for a discussion of the risks posed by climate change.

PROXY STATEMENT SUMMARY (continued)

(1)Source: Barron’s, “10 Real Estate Companies That Are Both Greener and More Profitable,” February 19, 2022.

PROXY STATEMENT SUMMARY (continued)

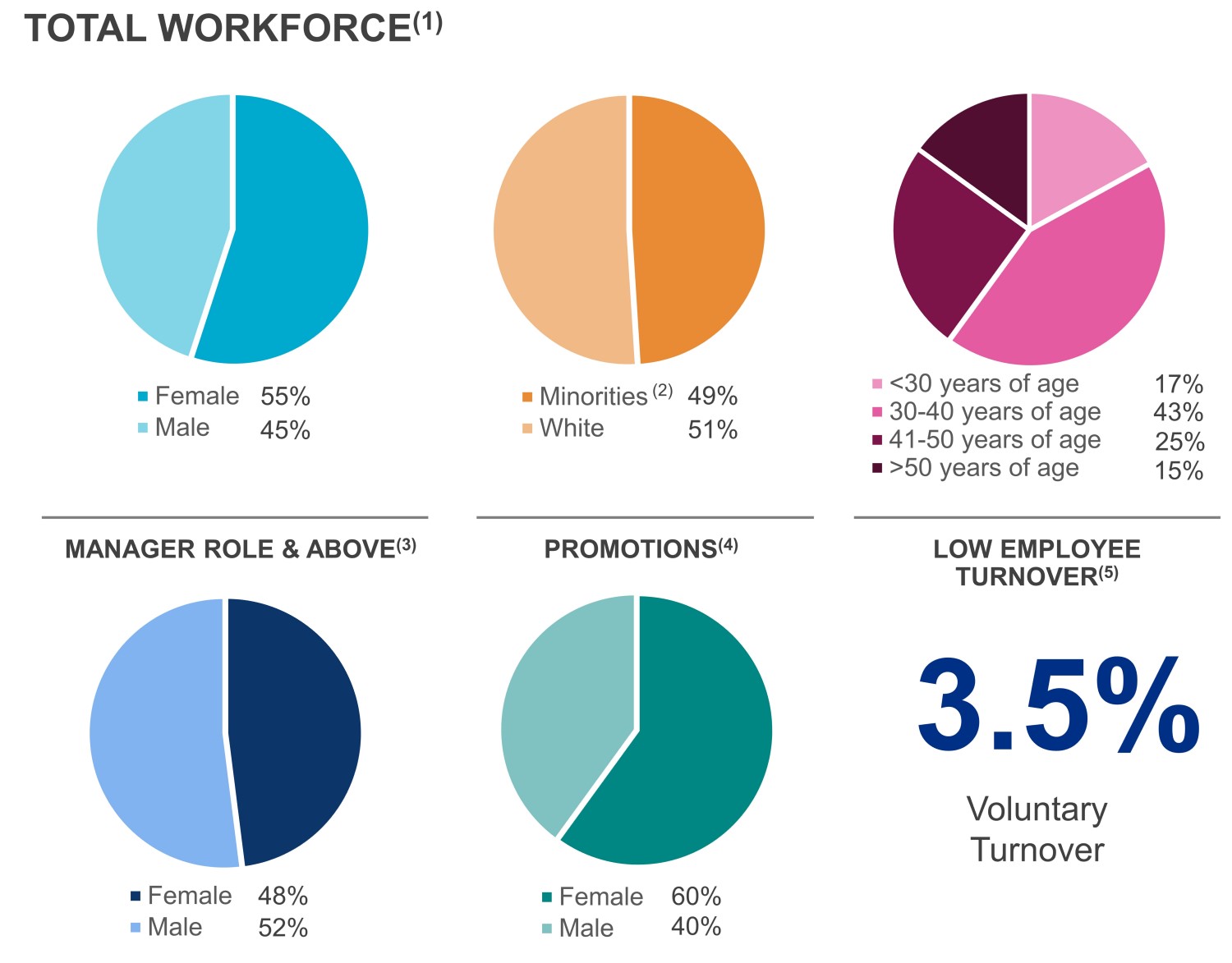

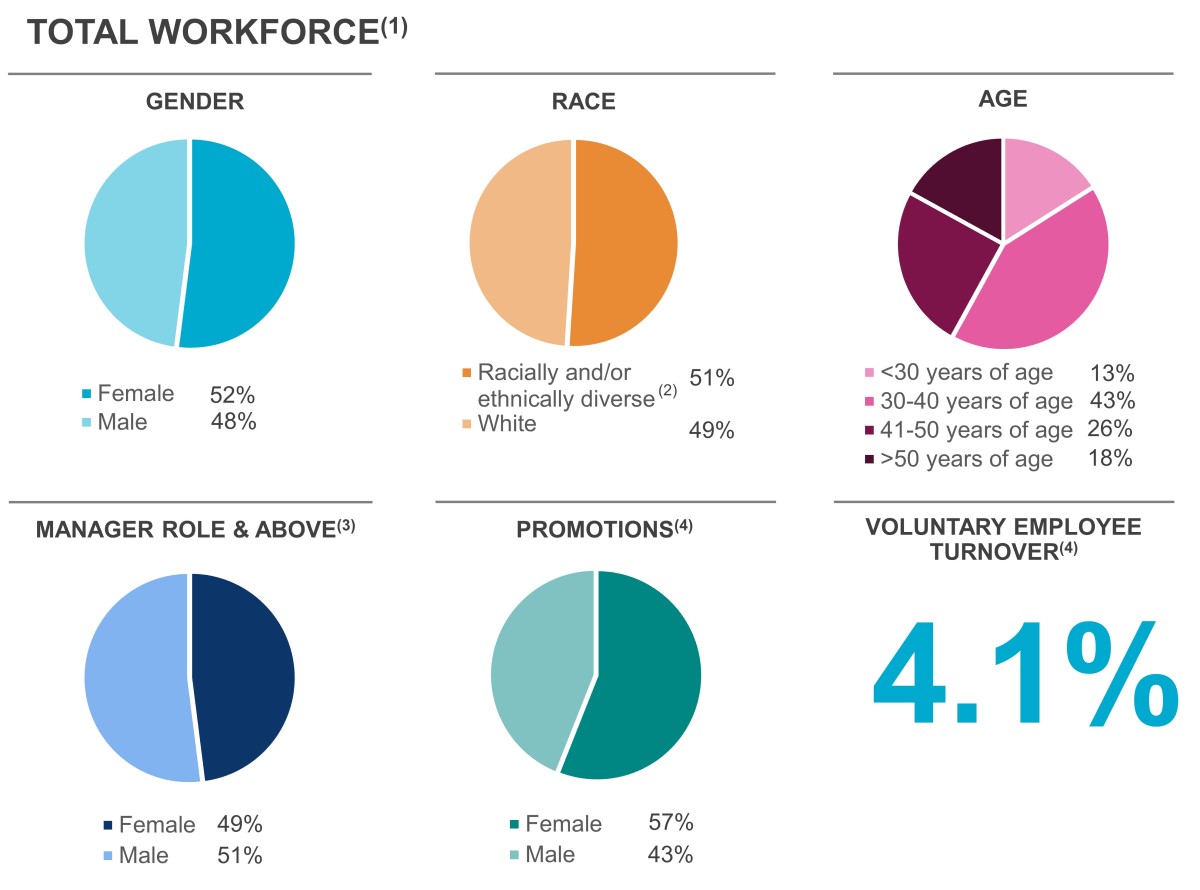

Social Responsibility

As COVID-19 persisted throughout 2021,We recognize that the fundamental strength of Alexandria results from the contributions of every team member within the organization and that our dedicationfuture growth is dependent upon the same. Alexandria devotes significant efforts to makinghiring, developing, and retaining a lasting positive impact on societydiverse workforce, and we understand firsthand that the health, happiness, and well-being of our best-in-class team are key factors to the success of our employees and to revitalizing and supporting the communities in which we work and live has only increased. The significance of our team’s shared purpose to fulfill our noble mission to advance human health has never been clearer and our steadfast commitment to developing, implementing, and expanding disruptive solutions to society’s most urgent challenges has never been more necessary.

Alexandria aligns our mission-driven business and visionary social responsibility efforts to advance human health and improve the quality of people’s lives. We are committed to creating long-term, scalable solutions to somethat of the most persistent societal challenges throughCompany. We continue to prioritize our bedrock social responsibility pillars, which include aiming to address diseaseemployees’ medical, mental, emotional, physical, and other threats to humanfinancial health, hunger and food insecurity, opioid addiction, deficienciesas described in support services for the military and their families, disparities in educational opportunities, and homelessness. In 2021, the Company established a new social responsibility pillar to address the growing mental health crisis, with a focus on helping children cope with the loss of a parent or family member to suicide. We also recently launched a pillar dedicated to supporting museums of compelling importancemore detail below. For additional information, refer to the United States as part of our deep commitment to commemorating and honoring our nation’s greatest heroes and those lost during the attacks of 9/11 and to inspiring and empowering future generations to come with lessons of service, selflessness, heroism, and resilience.Company’s website at www.are.com.

Alexandria has a longstanding track record at the leading edge of health, wellness, and safety. We are proud to be widely recognized for our industry leadership and innovative approaches to developing and operating sustainable and collaborative campus environments and healthier workplaces that enable our tenants to continue their development of diagnostics, testing, therapeutics, and vaccine programs related to COVID-19 and thousands of other diseases and disorders; enhance the ability of our tenants to recruit and retain world-class talent; promote health and well-being; and inspire productivity, efficiency, creativity, and success.

Our commitment to the success and growth of our tenants is well established in the life science agtech, and real estate industries.industry. Our focus inon owning, operating, and developing vibrant urbanmega campuses catalyzes high-quality job creation, economic activity, and sustainable urban infill development in the innovative and dynamic cities and states in which we operate. Furthermore, our role at the vanguard and heart of the life science and agtech ecosystems has a distinctive and lasting impact on the growth, stability, and diversity of the life science and agtech industries and on the economies and communities in which we operate. We also regularly convene, participate in, and provide resources to groups that help to nurture and grow the life science agtech, and technology industries.industry. We carry out this important aspect of our Company’s mission through our pioneering social responsibility initiatives, philanthropy, volunteerism, and thought leadership programming and by partnering with regional and national non-profits, life science and agtech companies and industry groups, local community planning and real estate groups, and organizations that help to advance sustainable building and investment.

Additionally, our commitment to our people has always been our primary focus, and we continue to devote extraordinary efforts to hire, develop, and retain a diverse workforce. We also strive to provide an environment for our workforce that will positively impact their overall health and well-being. Throughout the COVID-19 pandemic, we have prioritized our employees’ medical, mental, emotional, physical, and financial health, as described in more detail below.

Alexandria’s Pioneering and Highly Impactful Social Responsibility Pillars

The ongoing COVID-19 pandemic has laid bare the immense social needs across our nation and in our communities by exacerbating already devastating societal challenges to human health and well-being, including significant increases in opioid overdoses, food insecurity,and homelessness, and the exacerbation of the existing educational achievement gap due to school closures and barriers to remote learning for our most underserved youth.

By uniting the passionpassions and commitment of our team and our community partners and leveraging our unique leadership, knowledge,resources, and expertise, and resources, we have worked steadfastly to develop and implement long-term, scalable solutions to some of the most pressing societal issues. The key areas that represent Alexandria’s eight social responsibility pillars comprise the following, as further described below:

•

1.Accelerating groundbreaking medical researchinnovation to advance lifesaving treatments and curessave lives;

•2.Harnessing the agrifood ecosystemagtech to combat hunger and improve nutrition, and support human health at its most fundamental levelnutrition;

•Bolstering the resilience of3.Supporting our military, our veterans, and their familiesfamilies;

•Working to conquer the opioid epidemic and revolutionizing addiction treatment

•Empowering underserved students to achieve long-term success and reach their potential as leaders in the community through education

•Building a model for a comprehensive, sustainable solution to address homelessness

•Addressing4.Prioritizing the mental health crisiscrisis;

5.Revolutionizing addiction treatment;

6.Approaching homelessness as a healthcare problem, not a housing issue;

7.Building principled leaders through education; and

8.Inspiring future generations with a focus on helping children cope with suicide lossthe stories and values of our nation’s heroes.

•Supporting museums to preserve history and honor our greatest heroes

PROXY STATEMENT SUMMARY (continued)

Accelerating Groundbreaking Medical Researchmedical innovation to Advance Lifesaving Treatments and Curessave lives

Alexandria is an indispensableintegral driver of medical progress and provides transformative strategic funding to speedcatalyze advances for treatments and cures across a number of disease areas and disorders, including autism, Parkinson’s disease, heart disease, and cancer.

An example of our commitment to partnering on endeavors that aim to better manage disease is the most promising breakthrough biomedicalunique, long-term partnership we have formed with Curebound, a San Diego-based non-profit organization that raises and invests strategic funding in translational cancer research projects aimed at accelerating new discoveries from labs to patientsclinical application. Alexandria’s San Diego region regularly participates in need.

•As a supporter of the Parker Instituteand fundraises for Cancer Immunotherapy (“PICI”), Alexandria is supporting mission-critical work to accelerate the development of breakthrough immunotherapies that could turn all cancers into curable diseases. As a member of PICI’s board of directors, our Executive Chairman and Founder, Joel S. Marcus, with his visionary leadership, helped guide PICI toward many significant accomplishments in 2021,Curebound events, including the build-up and launch of its second multi-center platform trial, REVOLUTION, building on the discoveries from its PRINCE Trial in pancreatic cancer.

•As a supporter of The Michael J. Fox Foundation2023 Concert for Parkinson’s Research (“MJFF”) for nearly a decade, Alexandria has helped fundamentally alter the trajectory of progress toward a cure. In 2021 alone, MJFF issued more than $257Cures, which raised $5.5 million in new grant commitments and has funded more than $1.5 billion in research programs to date.

support cancer research.

Harnessing the Agrifood Ecosystemagtech to Combat Hunger, Improve Nutrition,combat hunger and Support Human Health at Its Most Fundamental Levelimprove nutrition

In 2020, nearly 11% of U.S. households and 15% of U.S. households with children experienced food insecurity. Driven by the understanding that food is a fundamental building block ofto human health and well-being, we areAlexandria is dedicated to helping Americans accessproviding the most vulnerable in our communities with the nutritious, healthy food they need to thrive. WeFor over two decades, Alexandria has been developing and operating state-of-the-art R&D and greenhouse infrastructure and investing in innovative agrifoodtech companies that are advancing novel approaches with great potential to address societal issues around sustainability, agriculture, food, and nutrition.

Additionally, we are proud to support organizations like Project AngelLittle Sisters of the Assumption Food (Los Angeles)Distribution (New York City), Nourish Now (Maryland), Los Angeles Regional Food Bank, Food for Free (Boston)Feeding San Diego (San Diego), and Feeding AmericaFood For Free (Boston) to help support critical hunger-relief efforts across the country.

Bolstering the Resilience of Our Military, Our Veterans, and Their Families

With profound appreciation for the immense sacrifices of our nation’s heroes, Alexandria is committed to providing the resources needed forSupporting our military, our veterans, and their families to live healthy, successful, and rewarding lives. We are deeply humbled and honored to pay tribute and lend assistance to the brave men and women of our elite forces in recognition of the courage, dedication, and sacrifice they demonstrate in defense of our country. We have

Alexandria has actively supported the Navy SEAL FoundationFoundation’s crucial efforts to address the unique needs of Naval Special Warfare warriors, veterans, and families since 2010, including through our record-breaking fundraising efforts as Chair of its New York City Benefit in 2017.

Motivated to continue to enhance our critical support of the U.S. military,2010. In an impactful partnership that began in 2017, Alexandria collaborated with the Navy SEAL Foundation and its founding partner, The Honor Foundation, embarked on a truly impactful partnership to create a mission-critical headquarters in San Diego for The Honor Foundation a unique career transition program for the Special Operations Forces community that effectively translates elite military experience to the private sector andin San Diego. The non-profit helps facilitate the next generation of corporate and community leaders.leaders through its career transition program, which effectively translates its clients’ elite military experience to the private sector. Alexandria conceived of, designed, fully built out, and donateddonates the use of an 8,000 SF state-of-the-art facility where our nation’s most elite service members can participate in a tuition-free,its three-month executive education program that provides tools and experiences to help them transition from the Special Operations Forces to the private-sector workforce.is funded entirely by private donations.

In 2021, The Honor Foundation served approximately 1,890 service members at its world-class headquarters, up from 1,356 in 2020, and graduated 400 of our nation’s heroes from the program, up from 296 in 2020. Program participants received executive education and coaching, industry mentorship, and job placement assistance with The Honor Foundation’s 592 employer partners.

| | |

The Honor Foundation Headquarters, 11055 Roselle Street, Sorrento Mesa, San Diego |

| | | | | | | | |

20222024 Proxy Statement

| 149 | |

PROXY STATEMENT SUMMARY (continued)

ConqueringPrioritizing the Opioid Epidemicmental health crisis

With a significant number of Americans living with a mental illness and over 50,000 lost to suicide in 2023, including over 6,000 veterans who die by suicide annually, the nation’s shared societal responsibility to drive forward treatments and solutions to this devastating public health challenge is immense.

Alexandria, in partnership with former congressman Patrick J. Kennedy and The Kennedy Forum, held its second Alexandria Summit® on Mental Health in Washington, DC in February 2024. Alexandria convened a diverse set of key decision makers, influential life science industry thought leaders, members of Congress, regulatory agency executives, and other key policymakers to advance the development of novel, effective psychiatric therapies to address vast unmet need.

We are proud of the continuing positive impact we have made through our key action and results-oriented initiatives, including our crucial long-term efforts to ensure the Navy SEAL Foundation’s vital work in addressing the unique physical and mental health needs of our nation’s elite warriors. Military personnel and veterans experience mental health and addiction issues at higher rates than the general U.S. population. Our partnership with the Navy SEAL Foundation enables it to address the increasing need for specialized mental health support of Naval Special Warfare personnel and veterans. Most recently, Alexandria played an instrumental role in the establishment and launch of the foundation’s Warrior Fitness Program West Coast facility in San Diego. The cutting-edge facility provides Navy SEAL warriors and veterans with evidence-based support, advanced technology, and expert personnel to help them physically and mentally recover and rebuild from injuries and trauma.

Revolutionizing Addiction Treatmentaddiction treatment

CentralDetermined to our mission, we are committed to partnering on endeavors that aim to better manage and cure disease, as well as reducereverse the economic burdentrajectory of disease on society, including addressingthe U.S. opioid epidemic, which remains one of the nation’s most pervasive public health issueschallenges, in our nation’s history — the opioid epidemic.

We2017 Alexandria partnered with Verily Life Sciences, LLC, an Alphabet company (“Verily”), to createpioneer OneFifteen, an innovativea personalized, non-profit data-driven healthcare system dedicated tocare model for treating addiction, in Dayton, Ohio — a city with one of the full and sustained recovery of people living with opioid addiction.highest per capita overdose death rates in the nation that year. Together with Verily, we pioneered and built a fully integrated campus in Dayton, Ohio to house a comprehensive care model encompassing a full continuum of care with dedicated facilities and services, for crisis stabilization,including medication-assisted treatment, residential housing, peer support, family reunification, workforce development, job placement, and community transition. As the strategic real estate partner in this mission-critical initiative, Alexandria catalyzed the vision for and led the design and development of the 4.3-acre 59,000 RSF OneFifteen campus, completing construction of the Outpatient Clinic; the Crisis Stabilization Unit; and OneFifteen Living, the residential housing component.

OneFifteen received an honorable mentionSince the campus’s opening in Fast Company’s prestigious 2021 Innovation by Design Awards in its new Impact category, which recognizes designs that have a major cultural or social impact. OneFifteen's distinction by Fast Company acknowledges Alexandria’s work to advance effective, scalable solutions to address the opioid crisis. Since opening to patients in the fall ofOctober 2019, OneFifteen has made a positive impact on the local communitytreated over 7,500 patients living with opioid addiction and the way addiction is treated, with over 4,000 patients seen and over 11,500 telehealth visits conducted as of December 31, 2021. Its campus, which celebrated its second anniversary in October 2021, represents a source of hope for the future in addressing the enormity and urgency of the opioid crisis that claimed more than 100,000 lives in the United States in the 12 months ended April 2021. Determined to reverse the devastation the opioid epidemic has caused to countless individuals, families, and communities across the country, itother substance use disorders. It is our hope that OneFifteen’s unique approach to treatment will serve as a blueprint for other communities to replicate.

| | |

OneFifteen campus in Dayton, Ohio |

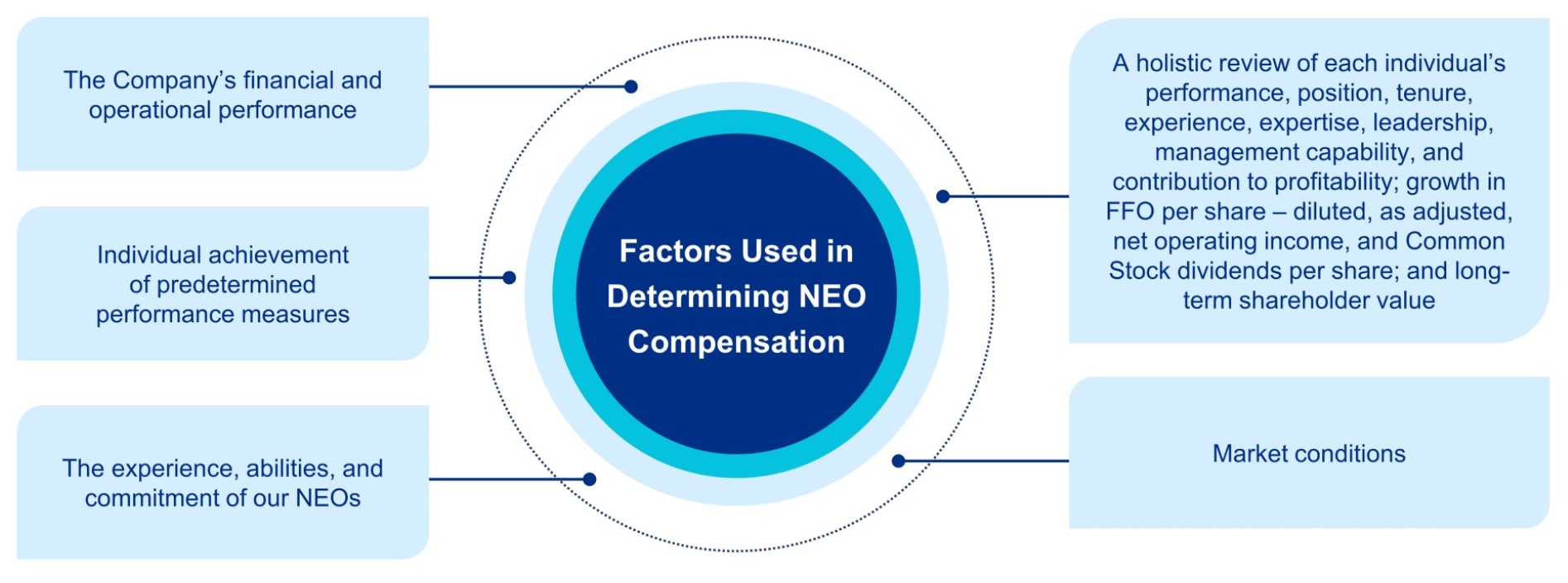

PROXY STATEMENT SUMMARY (continued)